Real Earnings News Release All employees Real average hourly earnings for all employees were unchanged from January to February, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from a 0.1-percent increase in average hourly earnings offset by a 0.2-percent increase in the Consumer Price Index for All Urban Consumers (CPI-U). Saudis set price and then pump all the market wants to buy at their prices. The first chart shows that...

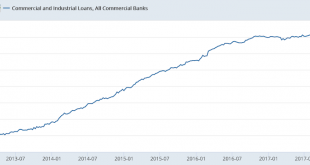

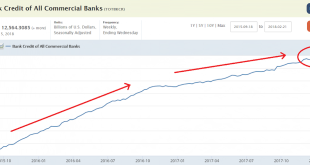

Read More »Bank loans, Cell phone sales

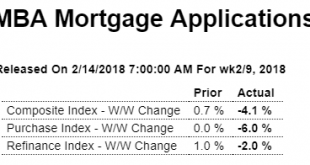

Actually dropped a bit last week:

Read More »Employment

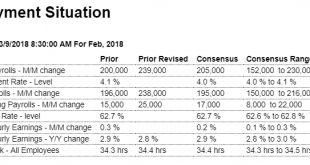

Nice surprise on the upside, though there’s discussion it’s weather-related, as highlighted below. The growth rate moved up some as per the chart shows, but remains in a multi-year downtrend, with the low growth in hourly earnings an indication that demand remains very weak; Highlights There’s still no wage inflation underway but the flashpoint may be sooner than later based on unusual strength in the February employment report. Nonfarm payrolls rose an outsized 313,000...

Read More »Trade with China, Bank loans, Chain store sales

Killing the goose that’s laying the golden eggs: Trump says China has been asked for plan to cut trade imbalance with U.S. Mar 7 (Reuters) — U.S. President Donald Trump said on Wednesday that China has been asked to develop a plan to reduce its trade surplus with the United States. Trump is pressing to implement campaign promises of hardening the U.S. stance on trade. Last week, he announced that he planned to impose heavy tariffs on imported steel and aluminum. “China has...

Read More »Factory orders, Trade, Consumer credit, Fed beige book, Las Vegas real estate sales

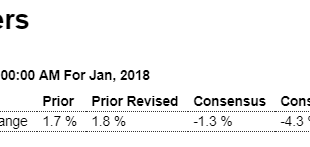

Highlights Today’s factory orders report, down 1.4 percent at the headline level but showing life underneath, closes the book on what was a mixed to soft month of January for manufacturing. Aircraft has been a bright spot for the factory sector and mitigates what is a 28 percent downswing in January. Excluding transportation equipment, where aircraft and also motor vehicles are tracked and which were also weak with a 0.5 percent decline, factory orders fell 0.3 percent but...

Read More »Light vehicle sales, Trump tariffs

Blaming interest rates for a decline that started about two years ago: U.S. Car Sales Fall as Credit Terms, Higher Payments Squeeze Buyers (WSJ) Overall U.S. vehicle sales dropped 2.4% in February, to 1.3 million, according to Autodata Corp. J.D. Power estimates incentive spending in February—averaging $3,850 per vehicle—was down slightly from the same month in 2017. The seasonally adjusted sales pace for the market slipped to 17.1 million on an annualized basis, from 17.5...

Read More »Personal income and expenditures, Construction spending

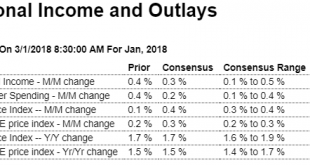

About as expected, with a relatively small increase from the tax cuts, which are a one time event. And the weakness in consumption hints at those receiving the cuts having a low propensity to spend. Also, the still too low personal savings rate suggests continuing weakness: Highlights Core inflation did noticeably rise but not more than expected, at 0.3 percent in January but not enough to lift the year-on-year rate which holds at an as-expected 1.5 percent. Total prices,...

Read More »MMT article, Mtg purchase apps, Pending home sales

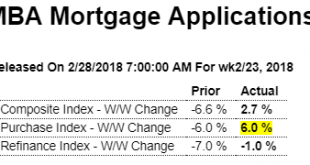

Very friendly article! Modern Money Theory Explained (Vice) Nice increase but year over year remains weak: Highlights With the rise in mortgage rates taking a pause, purchase applications for home mortgages rose by a seasonally adjusted 6.0 percent in the February 23 week. But unadjusted, purchase applications were down 1.0 percent from the prior week, putting the year-on-year gain in the Purchase Index at a rather slim 3.0 percent, while applications for refinancing, which...

Read More »Mtg purchase apps, Existing home sales, Euro current account, Bank lending, Cycle chart

Deteriorating rapidly now? Not good: This is, fundamentally, seriously strong euro stuff: No improvement here as, most recently, growth has gone to 0:

Read More »Mtg purchase apps, CPI, Retail sales

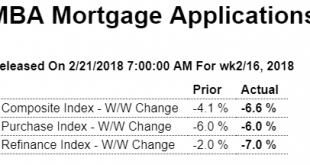

Still depressed and going nowhere: Highlights Amid rising interest rates, purchase applications for home mortgages fell by a seasonally adjusted 6.0 percent in the February 9 week. Unadjusted, the year-on-year gain in the volume of purchase applications fell 4.0 percentage points to 4.0 percent. Applications for refinancing fell just 2.0 percent in the week, putting the refinancing share of mortgage applications up 0.1 percentage points to 46.5 percent. Mortgages rates rose...

Read More » Heterodox

Heterodox