Unemployment benefits are harder to get, as previously discussed: The Next Recession Is Gonna Really Suck As a result, the rate at which unemployed Americans receive layoff compensation overall has fallen from about 36 percent in 2007 to about 28 percent in 2017, according to data from The Department of Labor. Wayne Vroman, an associate with the Urban Institute, said a big reason for the decline is that states are finding ways to kick unemployed people off benefits after...

Read More »Spending bill, Rail traffic, Rig count, Saudi pricing

This alone could add maybe 2% to nominal GDP.How much real output it adds is another question, of course: Trump signs massive spending deal into law and ends year’s second government shutdown Self-professed fiscal hawks in the House also opposed the bill. The nonpartisan Congressional Budget Office estimated Thursday that it would cost about $320 billion. Most of that would come in the first year.The deal includes: A $165 billion increase in military spending; A $131 billion...

Read More »Spending bill, Rail traffic, Bank loans

This alone could add maybe 2% to nominal GDP. How much real output it adds is another question, of course: Trump signs massive spending deal into law and ends year’s second government shutdown Self-professed fiscal hawks in the House also opposed the bill. The nonpartisan Congressional Budget Office estimated Thursday that it would cost about $320 billion. Most of that would come in the first year.The deal includes: A $165 billion increase in military spending; A $131...

Read More »Consumer credit, Mania comment, Fed on rates and inflation

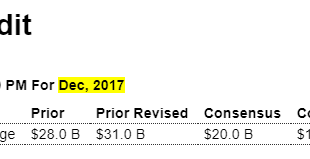

It’s been decelerating all year with a year end move up that’s likely to be reversed as personal income growth continues to be very low: Highlights Consumer borrowing increased in December, up $18.4 billion vs an upwardly revised $31.0 billion in November which is the largest monthly increase since a break in the series 7 years ago. Revolving credit, a component that tracks credit-card debt, rose a sizable $5.1 billion following a November spike of $11.0 billion. On an...

Read More »US service sector surveys

Seems the two US service sector surveys are a bit at odds with each other:

Read More »Employment, Factory orders, Bank loans

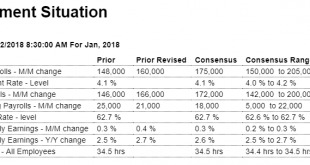

Note how the year over year growth rate continues it’s 3 year decline, and is in ‘stall speed’ with no sign of reversal. And last I heard a .1 change in the work week hours is equal to about 100,000 jobs, so the .2 drop last month offsets the 200,000 new jobs: Highlights A very solid employment report for January, one however tinged with a hint of weakness, is led by a 200,000 gain in nonfarm payrolls. This is 25,000 above Econoday’s consensus and near the high estimate....

Read More »ADP employment forecast, Pending home sales, Income and spending

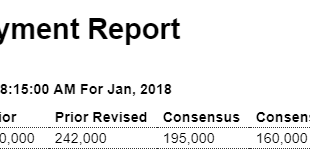

This is now a forecast for Friday’s payroll number, and note from the chart that it’s been diverging all year. Seems there’s some kind of error in their forecasting methodology? Highlights ADP sees a very strong employment report coming out on Friday, estimating a 234,000 rise in private payrolls. ADP has been running above actual government data which is reflected in the difference in Econoday’s consensus calls for each, at 195,000 for today’s ADP report and 172,000 for...

Read More »Spending and savings, Apartment market tightness, Vehicle sales

Seems to me this divergence has been stretched to the limit: And this chart from Daniele Della Bona shows how dipping into savings via borrowing adds to interest expense that further reduces savings when other personal income is lagging: And this shows the gap: And from a different angle: And this was also part of the consumer’s year end credit card binge that contributed to GDP? And would that be consumption or investment? ;) From WardsAuto: U.S. Forecast: January Sets...

Read More »Personal income and outlays, GDP, PMI’s, Philly Fed index, Bank loans, Rail traffic

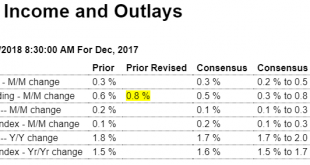

Pretty much in line with expectations, but last month’s spending increase means what I think was an unsustainably low savings rate is now even lower. Highlights Personal income rose 0.4 percent in December with wages and salaries up a solid 0.5 percent. Spending also rose 0.4 percent in December with November revised 2 tenths higher to a very strong 0.8 percent gain. Giving a boost to spending but hinting at trouble for the consumer is a 1 tenth dip in the savings rate to a...

Read More »New home sales

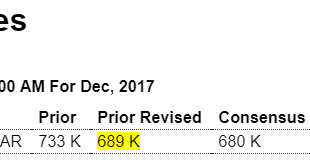

Much lower than expected, and last month’s number, which was touted as the turning point for housing, was revised lower as well. And note from the chart we’re still below the levels of the 1970’s when the population was about 40% lower: Highlights The headline 9.3 percent decline in new home sales for December masks what is actually a solid new home sales report. December’s 625,000 annualized rate is the fourth best of the expansion and follows November’s revised 689,000...

Read More » Heterodox

Heterodox