from James K. Galbraith and RWER no. 78 Could the economic program of President Donald Trump, if enacted, overcome secular stagnation? This essay addresses part of that question, focusing on the effects of a changing macroeconomic policy mix and thrust in the present US national and global context. A separate essay will address considerations on the supply side. The phrase “secular stagnation” is usually attributed to the early post-war Harvard economist Alvin Hansen, one of the first...

Read More »Deaths of Despair. The Case/Deaton paper about mortality of White Americans. Some remarks.

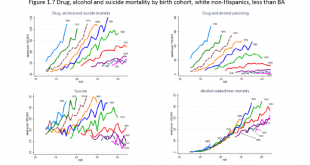

Anne Case and her husband Angus Deaton have published a new paper about the deteriorating health of non-hispanic Whites in the USA. The use of more refined and more granular data as well as another year of data again shows a grim picture of ever rising ‘Deaths of Despair’. For those familiar with ‘Decline of the USA’, a book written by the editor of this blog Edward Fullbrook, their findings won’t come as a total surprise. But the situation stays abhorrent. Death rates of those white...

Read More »Flipped economics classroom

from Maria Alejandra Madi and the WEA Pedagogy Blog Recent active learning experiences have been associated with “flipped” or “inverted” classroom (Norman and Wills, 2015). Indeed, this method has been receiving increasing attention by professors that search for alternatives to traditional lectures so as to cover some topics of the course content. By adopting the flipped classroom in economics instruction, professors out to enhance a larger pre-class involvement of the students not only...

Read More »Services and manufacturing PMI, Durable goods orders, Atlanta Fed

Trumped up expectations fading, as weakness in the service sector continues, And if Trump loses today’s health care vote, I expect those expectations to fade that much faster: Highlights All in the mid-to-low 50s and at 6-month lows, a significant moderation in growth is the signal from Markit Economics’ U.S. diffusion indexes. The composite flash for March is 53.2 which is more than 1 point below the consensus. The manufacturing flash, at 53.4, is also about 1 point below...

Read More »Open thread March 24, 2017

The man who crushed the mathematical dream

from Lars Syll Gödel’s incompleteness theorems raise important questions about the foundations of mathematics. The most important concerns the question of how to select the specific systems of axioms that mathematics are supposed to be founded on. Gödel’s theorems irrevocably show that no matter what system is chosen, there will always have to be other axioms to prove previously unproved truths. This, of course, ought to be of paramount interest for those mainstream economists who still...

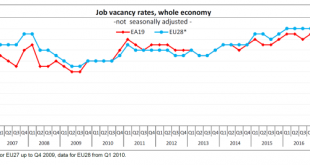

Read More »Graphs of the day: vacancies and wages.

Via Eurostat (look here and here) information about the labour market: vacancy rates and wages. Vacancies are up, wages are rising at a very moderate rate (and in many countries, like Spain, not at all). These are wage costs and not wages, but at this moment the difference is small, notice that wages increase less than the 2$ inflation target of the ECB. Vacancies have developed favorably. About this: during the last year there have been tailwinds: (much) lower prices for energy,...

Read More »Competition from China reduced Innovation in the US

Via Tyler Cowen, here is a piece by David Autor, David Dorn, Gordon Hanson, Gary P. Pisano and Pian Shu. Cowen quoted the most important part, so let me follow his lead: The central finding of our regression analysis is that firms whose industries were exposed to a greater surge of Chinese import competition from 1991 to 2007 experienced a significant decline in their patent output. A one standard deviation larger increase in import penetration decreased a...

Read More »The capital-mobilising deal maker

from Jamie Morgan and RWER no. 78 As a brand, Trump is also a particular kind of contemporary businessman. He positions himself as a maker of “deals” rather than a maker of things, though his wealth is rooted in construction and property. He is an owner of portfolio assets, who uses these to leverage new ventures where he is able to conjure personal gain from situations where material benefits to the many may be lacking. His skill set is one of concentration and extraction of returns, and...

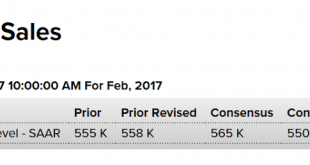

Read More »New home sales

More than expected but as per the chart it looks like they’ve peaked and are working their way lower. And as no house is built without a permit, and permits are also soft, I don’t see anything good happening. Also, bank lending for real estate has been decelerating and mortgage applications are going sideways: The longer term chart shows that recent weakness might just be part of the ‘pattern’ of the longer term uptrend, albeit from very depressed levels and at a slower...

Read More » Heterodox

Heterodox