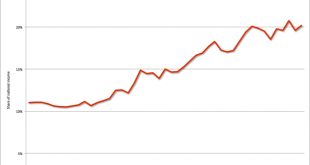

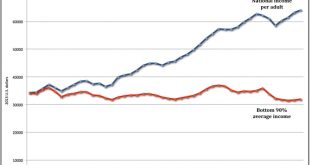

from David Ruccio Where does all the surplus in the U.S. economy go? Well, a large chunk of it is captured by the top 1 percent, whose share of national income almost doubled between 1970 and 2014—from 11 percent to 20.2 percent. Equally interesting is the composition of that growing share of national income, which we can decompose thanks to new data from Thomas Piketty, Emmanuel Saez, and Gabriel Zucman. One way of making sense of the way the top 1 percent manages to capture a...

Read More »PMI services, Oil capex

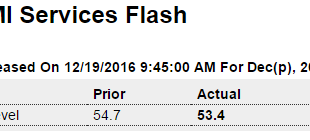

Less than the expected 55.2 as weakness in the services sector continues, and as post election hopes fade: Highlights Growth in new orders, though still near a 12-month high, has slowed so far this month, pulling down the flash services PMI for December by more than 1 point to 53.4. But, given the comparison with November’s unusual strength in new orders, the slowing is deceptive. Other readings in the report are clearly favorable including a gain in backlogs that has...

Read More »Some problems of the neoclassical concepts of employment and unemployment

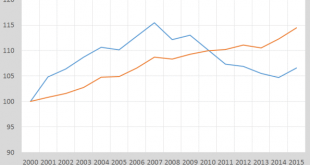

Are neoclassical macro models post-truth? It might very well be. The ‘workhorse’ neoclassical macro ‘DSGE’ models used by for instance central banks state that lower real wages will solve unemployment, largely because these lower wages will entice ‘marginal’ workers, like the elderly and women to leave the labor force (read this, by Lawrence Christiano, Mathias Trabandt and Karl Walentin (2011). Less workers, unemployment solved! But does this also happen? Ehhmmm…no (graph2). After...

Read More »You want to replace the pay working-class Americans have lost?

from David Ruccio Neil Irwin is right: “Poor and working-class Americans have fallen behind over the last generation, receiving few of the gains of an expanding economy.” So, he wants to devise a tax plan to change that. The problem is, Irwin only looks at raising the income of the bottom 20 percent of families to where they would be if they shared equally in the gains since 1979. So what would it all cost? The Tax Policy Center crunched the numbers: The policy would deplete federal...

Read More »The Federal Reserve Raising Interest Rates is Unwelcome and Unnecessary

Wednesday’s decision by the Federal Reserve to raise interest rates is unwelcome and unnecessary. As admitted in its statement, investment remains soft, growth is only moderate, and inflation expectations are little changed. Moreover, the economy confronts financial headwinds from the recent jump in long term interest rates and an even stronger dollar. The Federal Reserve seems [...]

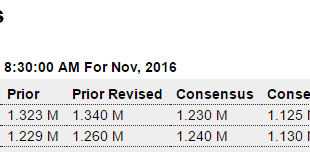

Read More »Housing starts, Euro trade, State budget shortfalls, Iowa farmland

Housing remains depressed, and not the driver of US growth that had been forecast by most analysts: Highlights Housing starts are being hit by huge swings. November starts fell 18.7 percent in November to a much lower-than-expected 1.090 million annualized rate following an upward revised gain of 27.4 percent to 1.340 million in October. There’s less volatility on the permits side where a roughly 30,000 undershoot in November, at 1.201 million vs the Econoday consensus for...

Read More »A new orientation away from neoliberalism

According to Polanyi: [T]he victory of fascism was made practically unavoidable by the liberals’ obstruction of any reform involving planning, regulation, or control. (Polanyi 1944, p. 257) The direction and content of socioeconomic development in the EU have been essentially determined by market laissez-faire, ultimately dictated by the financial markets’ irrational, manic-depressive psychology. The institutions and the economics of the orthodoxy, which form the constitutional...

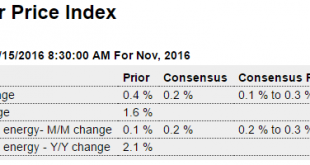

Read More »CPI, Various surveys, Current account

Fed still failing to hit its 2% target after years of trying, and after years of forecasting that it would hit its 2% target: Highlights Inflation at the consumer level remains low. The CPI rose 0.2 percent in November with the year-on-year rate up 1 tenth to plus 1.7 percent. The core rate, which excludes food and energy, also rose 0.2 percent with this year-on-year unchanged at 2.1 percent. Food prices were unchanged in November though energy did move sharply, up 1.2...

Read More »Retail hiring, Yellen on fiscal, Rep Williams on Fed hike, Fx chart

November 2016 Retail Hiring Falls To 6-Year Low Dec 13 (Econintersect) — Retailers added fewer workers through the first two-thirds of the typical holiday hiring period – and is down nearly 10% from a year ago. The latest data from the Bureau of Labor Statistics (BLS) showed that employment in retail grew by 371,500 in November. That was down 9.3 percent from a year ago, when jobs in the sector increased by 409,500. It was the lowest November employment increase since 2010....

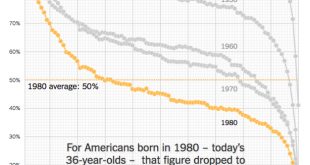

Read More »The American Dream is quickly disappearing

from David Ruccio My students are worried—many of them obsessed by the possibility—they’re not going to be better off than their parents. As it turns out, they’re right. According to new research by Raj Chetty et al. (pdf), the rates of “absolute income mobility” (the fraction of children who earn more than their parents) have fallen from approximately 90 percent for children born in 1940 to 50 percent for children born in the 1980s. And the likelihood is, that rate is going to fall...

Read More » Heterodox

Heterodox