From: Erwan Mahé ‘Mr Draghi may have laid a fairly sophisticated trap to ensnare his most reticent colleagues.’. In a happy coincidence, the Fed and BoJ will hold their monetary policy meetings on exactly the same days, the 20th and 21st of September, with enough uncertainty in their decisions to reignite implied volatility in the preceding days! But we should, above all, focus on the ECB meeting, tomorrow, with speculation rampant about the possible changes Mr Draghi may announce in the...

Read More »Inequality in the US and mainstream macroeconomics

from David Ruccio I have argued many times over the years that mainstream economists, especially mainstream macroeconomists, largely ignore the issue of inequality. And when they do see it, they tend to misunderstand both its causes (often attributing it to exogenous events, such as globalization and technical change) and its consequences (often failing to connect it, other than through “political capture,” to events like the crash of 2007-08). In my view, mainstream economists overlook...

Read More »Saudi Pricing, Rail traffic, ISM non manufacturing index

Looks like the Saudis want prices to be a bit firmer: http://www.bloomberg.com/news/articles/2016-09-04/saudi-arabia-raises-pricing-for-october-crude-to-asia-on-demand Rail Week Ending 27 August 2016: All Rolling Averages Worsen And Remain In Contraction Sept 2 (Econointerest) — Week 34 of 2016 shows same week total rail traffic (from same week one year ago) contracted according to the Association of American Railroads (AAR) traffic data. This week, all rolling averages’...

Read More »IMF backs away from neoliberalism?

from Asad Zaman The IMF has been among the principal architects, executors and enforcers of the neoliberal agenda all over the globe for several decades. This is why an IMF publication with an article entitled “Neoliberalism: Oversold?” is as surprising as an ISIS article entitled “Violence: Oversold?” would be. Has neoliberalism become so unpopular that even the IMF does not want to be associated with it? In this essay, we study the lessons that the IMF claims to have learnt from...

Read More »Incorporating energy into production functions

from Steve Keen In my last post on my Debtwatch blog, I finished by saying that the Physiocrats were the only School of economics to properly consider the role of energy in production. They ascribed it solely to agriculture exploiting the free energy of the Sun, and specifically to land, which absorbed this free energy and stored it in agricultural products. As Richard Cantillon put it in 1730: The Land is the Source or Matter from whence all Wealth is produced. The Labour of man is the...

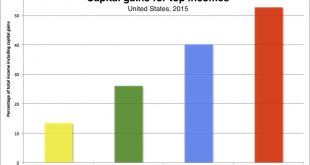

Read More »Beyond the carried interest tax loophole

from David Ruccio Everyone (from President Obama to venture capitalist Alan Patricof) agrees the carried tax loophole—which allows investment fund managers to treat much of their income as capital gains (taxed at a top rate of 23.8 percent) rather than as income (for which the top rate is 39.6 percent)—should be closed. But, as Michael Hiltzik reminds us, it’s a tax break the super rich are willing to give up in order to keep the loophole they really value: the capital gains tax...

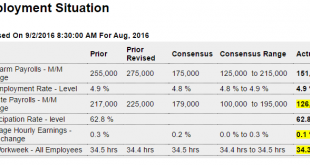

Read More »Jobs, Factory orders

The deceleration of job growth continues since the collapse in oil capex: Highlights The labor market is solid but maybe isn’t overheating, at least yet. Nonfarm payrolls rose a lower-than-expected 151,000 in August with revisions to July and June at a net minus 1,000. The unemployment rate holds at 4.9 percent with modest increases on both the employment and unemployment side of this reading. Earnings are very soft in this report, up only 0.1 percent in the month for a...

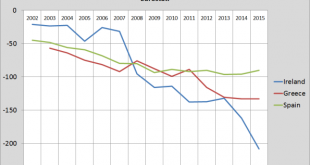

Read More »Will Ireland go bankrupt?

Ireland (the government plus the private sector) has by far the largest net international debt of all EU countries (measured as a % of GDP). To an extent this is caused because the Irish state was pressured, by its EU friends, to borrow money from other countries to bail out (the creditors of) Irish banks. The large and fast deterioration of the Irish position in 2014 and 2015 might be caused because large international companies finance their Irish headquarters with inter company...

Read More »Basics

from Peter Radford For a variety of reasons I pulled Olivier Blanchard’s macroeconomics textbook off my shelf yesterday — I have the fifth edition which dates back to 2007. Or at least that’s how he begins his opening paragraph, he says he’s writing in mid-2007. So it would be easy to plunge into the book and start to look for evidence that Blanchard’s version of economics led us all to expect or predict the crisis that unfolded only a year later. But that’s no what caught my eye. No I...

Read More »An ECB article on credit, house prices and the flow economy

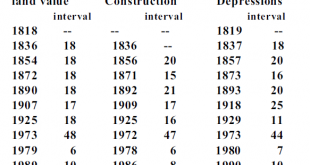

In the latest Research Bulletin of the ECB Gerhard Rünstler rightly states that ‘historical evidence suggests that many financial crises have been preceded by credit and housing booms‘ and ‘the emerging stylised facts have by no means been digested by the scientific economics community‘. But his implicit suggestion that these findings about credit, housing booms and economic downturns are new is wrong. According to Fred Foldvary (in 2007), ‘In the United States there has been a real...

Read More » Heterodox

Heterodox