from Grazia Ietto-Gillies The business media is awash with news about transnational companies (TNCs) be they in the services or manufacturing or agriculture sector. The news may refer to performance or strategies or plans for real investment (or the lack of them) or takeovers. There is currently also considerable interest in their tax minimization strategies. Yet economics textbooks and courses are still shying away from this most relevant part of our contemporary economies. This is true...

Read More »PMI services, Durable goods orders, KC Fed

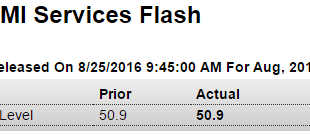

Weakness now includes the service sector: United States Services PMIThe Markit Flash US Services PMI came in at 50.9 in August of 2016, down from 51.4 in the previous month and below market expectations of 52. It is the lowest reading since February with business activity, new orders and employment all slowing due to subdued demand conditions and uncertainty ahead of the presidential election. Up a bit more than expected for the month, but remains in contraction year over...

Read More »A schocker for Sumner

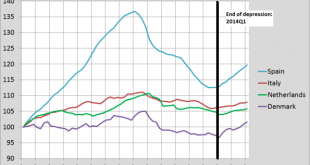

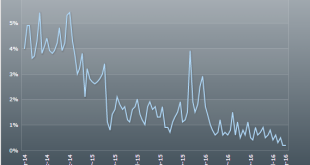

Why did the crisis last so long in Italy, the Netherlands, Spain and Denmark (graph 1) and much shorter (four years!) in the UK, Poland and Sweden (graph 2, at the end)? Lack of Aggregate Demand in the former countries? Not according to Scott Sumner. This post will however show, point by point, some counterexamples to the ideas of Scott Sumner about what he calls ‘AD voodoo‘- and especially his claim that “there is almost no theoretical or empirical support for the new voodoo claims, and...

Read More »Mtg purchase apps, House prices, Existing home sales

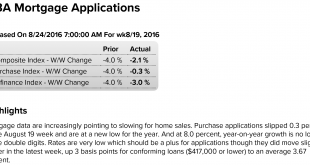

Bad news for housing today- mtg purchase apps at the lows of the year, prices moderate, and existing home sales weak, so, as previously discussed, not looking like housing will be contributing to growth this year:

Read More »Unhealthy healthcare

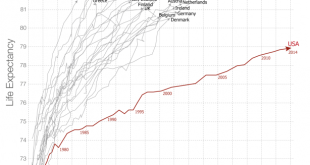

from David Ruccio While I was finishing up the latest right-wing libertarian dystopian finance novel, I was also trying to figure out the dystopia that the U.S. healthcare system has become. Clearly, for most Americans, the combination of private healthcare and private health insurance (and, now with Obamacare, public subsidies) is a nightmare. There is a glaring contradiction between healthy profits and the health of the U.S. population. Over the course of the next couple of weeks,...

Read More »Euro consumer confidence, Military accounting, ECB thought…

The beatings will continue until morale improves… The Collapse of Rome: Washington’s $6.5 trillion Black Hole The Defense Finance and Accounting Service, the agency that provides finance and accounting services for the Pentagon’s civilian and military members, has just revealed that it cannot provide adequate documentation for $6.5 trillion worth of “adjustments” to Army general fund transactions and data. According to a report released July 26 by the by the Inspector General...

Read More »Redbook retail sales, PMI, Richmond Fed, New home sales

Still extremely depressed:Down and well below expectations: HighlightsWeakness in orders and employment were unfortunate themes of last week’s Empire State and Philly Fed reports and likewise headline the manufacturing PMI report. The PMI, which is based on a nationwide sample of manufacturers, slowed by 8 tenths in the August flash to 52.1, a reading only modestly above breakeven 50 to indicate no more than limited expansion in composite activity. Output is the month’s best...

Read More »Open Ended [A note to myself]

from Peter Radford One of the major reasons, perhaps the major reason, economics is oftentimes irrelevant to our understanding of economies is that it fails to notice a rather salient fact: economies have no end. They have no beginning either. Or, rather, the choice of an ending or a beginning are merely arbitrary selections by an analyst needing to close up the system for analytical purposes. But this act of closure destroys the validity of any results from the subsequent analysis. Why?...

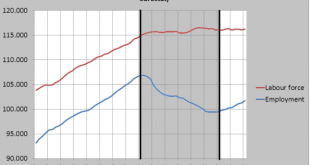

Read More »Employment and the labour force in the EU, 1992 (2000) – 2016. 4 graphs.

How are the EU and the Euro Area doing? some graphs about the labour force. Main points: Very fast employment and labour force growth in Germany during the last year (‘despite’ the new the minimum wage in many sectors). The labour force is increase is not just about refugees but to quite an extent about non-German inhabitants of the EU. Mind the employment decline after the Harz reform’ around 2001. I’m not sure if the fast increase also shows in the data of the Statistisches Bundesamt.A...

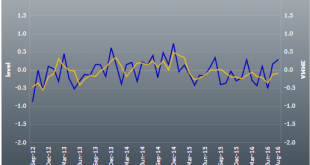

Read More »MMT in the news, Chicago Fed, Dividends

Stephanie Kelton #1, Pavlina Tcherneva #4!http://theweek.com/articles/643874/hillary-clintons-economic-dream-team Up a bit for the month, but the 3 month moving average remains negative:

Read More » Heterodox

Heterodox