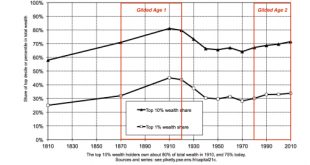

from David Ruccio [modified from the original source (pdf)] We’ve been learning a great deal about the conditions and consequences of the obscene levels of inequality in the United States—now, in the past, and it seems for the foreseeable future. Right now, inequality is escalating within public higher education, especially in research universities that are chasing both tuition revenues and rankings. Thus, the editorial board of the Badger Herald, the student newspaper at the University...

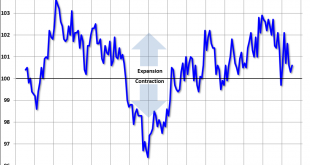

Read More »Restaurant performance index, PMI manufacturing, ISM manufacturing, Construction spending

The downtrend looks intact, and on the edge of contraction: Highlights Markit’s U.S. manufacturing sample continues to report month-to-month growth but slow growth. The PMI for August came in at 52.0 which is only modestly above the 50 level that divides monthly growth from monthly contraction. Growth in new orders slowed which is a key negative in the report, along with slowing in employment. The sample is also cutting its inventories which points to lack of confidence in...

Read More »Mtg Purchase apps, Chicago PMI, ADP employment forecast, Pending home sales, Tax receipts

Mortgage purchase applications are now down to only 5% higher than a year ago: A lot worse than expected: Highlights Business growth has slowed in Chicago this month based on the city’s PMI which fell more than 4 points but, at 51.5, is still over breakeven 50. New orders slowed while backlogs fell sharply and into sub-50 contraction. Production also slowed while inventories were drawn down. Employment posted a gain and is the strength of the August report, strength however...

Read More »Valuing Education?

from Peter Radford Ben Casselman at fivethirtyeight.com throws us some back to school numbers. They make for depressing reading. America is not committed to education, far from it. Priorities seem to be elsewhere. And short term thinking dominates. Here are a few key highlights: The US had roughly 8.4 million teachers back in 2008. Now it has 8.2 million This is despite adding about 1 million new students So student/teacher ratios have risen back to levels last seen in the 1990’s School...

Read More »Will the IMF become irrelevant before it changes?

from Mark Weisbrot The neoliberal reforms it has imposed on countries around the world have been disastrous. The UK’s vote in June to leave the European Union, combined with an extraordinary backlash against trade agreements as manifested in the US presidential election, has set off an unprecedented public debate about globalization and even some of the neoliberal principles that it embodies in its current form. It is therefore of great relevance to look at what is happening to one...

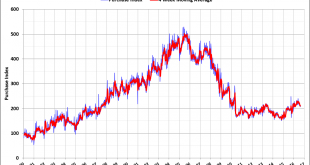

Read More »Personal income and spending, Dallas Fed

In line with expectations as real disposable income growth remains at or below ‘stall speed’, as per the charts. And the total growth of that measure of income since the 2008 peak remains very low. On the consumption side, the mini jump in auto sales provided the (small) boost for the month, though down year over year, and auto sales forecasts for August are all pointing to a resumption of weakness: Highlights Income picked up slightly in July and consumption slowed...

Read More »Re-Introducing Ethics in Education

from Asad Zaman A driving spirit of the modern age is the desire to banish all speculation about things beyond the physical and observable realms of our existence. This spirit was well expressed by one of the leading Enlightenment philosophers, David Hume, who called for burning all books which did not deal with the observable and quantifiable phenomena: “If we take in our hand any volume; of divinity or school metaphysics, for instance; let us ask, Does it contain any abstract reasoning...

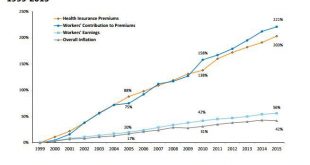

Read More »Unhealthy healthcare: workers pay

from David Ruccio On Tuesday, I began a series on the unhealthy state of the U.S. healthcare system—starting with the fact that the United States spends far more on health than any other country, yet the life expectancy of the American population is actually shorter than in other countries that spend far less. Today, I want to look at what U.S. workers are forced to pay to get access to the healthcare system.According to the Kaiser Family Foundation, about half of the non-elderly...

Read More »Car sales, Bank loans

More evidence the wheels are coming off, not that there have been any doubts… From WardsAuto: Forecast: U.S. Light Vehicles Sales Weaken in August A WardsAuto forecast calls for August U.S. light-vehicle sales to reach a 17.4 million-unit seasonally adjusted annual rate, less than like-2015’s 17.7 million and July’s 17.8 million, but ahead of the 17.2 million recorded over the first seven months of this year. From J.D. Power: August Decline in New-Vehicle Sales Fourth in...

Read More »From 1998, Q2 GDP revision, Corporate profits, Trade, Consumer sentiment

Something I wrote that got published in 1998: Revised down, note how the year over year growth has been continuously decelerating ever since the collapse of oil capex, and the strength in consumer spending looks like it could be about healthcare premiumus, which portends cutbacks elsewhere, hence the weaker q3 retail sales, etc. And with inventories still looking way too high, proactive inventory building doesn’t seem likely. Nor does the most recent housing data bode well...

Read More » Heterodox

Heterodox