rom David Ruccio U.S. Olympic rower Megan Kalmoe doesn’t want to talk about water quality anymore. As she explained on her blog, journalists are ruining the 2016 Olympic games by being “fixated on shit in the water.” We are American, and we are going to Rio to represent you in this potentially flawed and imperfect setting that you are trying so desperately to get the public to love to hate. We are going to compete for medals to bring them home to you, and for you so that the US...

Read More »Italian banks, Campaign finance, NY ISM, July vehicle sales

Even this shows deceleration since the oil capex collapse: Early preview, not looking good: U.S. July auto sales miss estimates as pent-up demand slackens By Bernie Woodall August 2 (Reuters) — DETROIT: Four major automakers in the U.S. market on Tuesday reported July vehicle sales slightly below expectations as the pent-up demand that has helped drive sales since 2009 plays itself out. In a continuing trend, consumers shunned passenger cars in favor of SUVs and pickup...

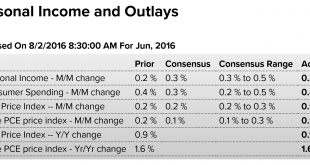

Read More »Personal income and outlays, Redbook retail sales, Saudi price setting

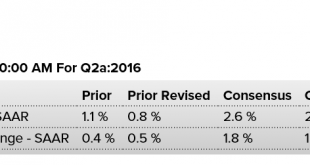

Income a tenth lower than expected and remains depressed, spending was a tenth better than expected and up on higher energy prices. So looks to me like a mini ‘dip into savings’ that works against retail sales, etc. but just a guess. Prices a touch softer than expected and remain well below Fed’s target. And note the deceleration of the annual growth of real disposable personal income as per the chart, which is down to stall speed: HighlightsThe consumer continues to spend...

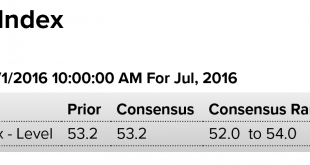

Read More »ISM manufacturing index, PMI manufacturing, Construction spending

Manufacturing is showing signs of bottoming at the lower levels, as the lack of aggregate demand does it’s thing with the service sector: HighlightsEmployment fell slightly and delays in delivery times eased, two factors that held down the July ISM index to 52.6 vs June’s 53.2. But that’s not the important news. The important news is the new orders index which remains extremely solid, at 56.9 and pointing to future strength for employment as well perhaps as slowing for...

Read More »What next for the EU?

from Jayati Ghosh Even before the results of the UK referendum, the European Union was facing a crisis of popular legitimacy. The result, especially in England and Wales, was certainly driven by the fear of more immigration, irresponsibly whipped up by xenophobic right-wing leaders who now appear uncertain themselves of what to do with the outcome. But it was as much a cry of pain and protest from working communities that have been damaged and hollowed out by three decades of neoliberal...

Read More »Commodification of science and technology

from Maria Alejandra Madi At the beginning of XX century, Joseph Schumpeter developed the concept of creative destruction to characterize the waves of development based on clusters of innovations -both technical and institutional. In the last decades, these waves have included petrochemical products, automobiles, information technologies and biotechnologies, especially genetic modification. Looking back, throughout the postwar era in advanced Western societies, scientific research and...

Read More »Bank lending, Restaurant index, More on GDP

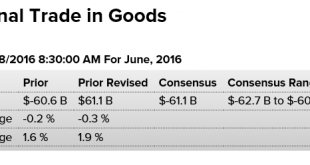

The deceleration that began with the peak in oil capex continues: Trending lower ever since oil capex collapsed. But remember the hype for the one spike up it took early this year before reversing? Wouldn’t surprise me if net trade, which worked in favor of Q2 GDP, reverses gets revised down for Q2 with the June data coming out on Tuesday, with growing oil imports, stronger non oil imports, and weaker exports as per the latest monthly data:

Read More »GDP, Chicago pmi, Consumer sentiment

Worse than expected, Q1 revised lower, and note the year over year deceleration in the chart. The inventory correction previously discussed looks to be well underway and has much further to go to bring inventories into balance with sales. Problem is, sales growth is declining, and the downward spiral will continue until ‘borrowing to spend’ steps up to support the negative effects of what I call unspent income, aka savings desires. And the historical drivers of private...

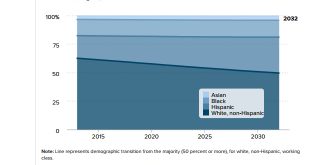

Read More »Class struggles in America (6 graphs)

from David Ruccio Almost five years ago, I suggested we start calling things by their correct names. Take the working-class—people who are forced to have the freedom to sell their labor power for a wage. We refer to them as members of the middle-class (which needs to be “rebuilt“) and working families (who need to be helped) or, now as workers’ wages stagnate and the real value of the minimum wage declines, as the “feral underclass” (especially in theUK, in the aftermath of the...

Read More »Trade, KC manufacturing index, Atlanta Fed, Ford

Higher than expected, and last month revised higher as well. And oil imports are increasing as output falls and consumption remains firm: More bad news doesn’t stop the KC Fed from calling for a rate hike: HighlightsThe good news didn’t last long for the Kansas City manufacturing index which, after popping to plus 2 in June for the first positive score since January last year, is back in the negative column at minus 6 in July. New orders are at minus 5 with backlog orders at...

Read More » Heterodox

Heterodox