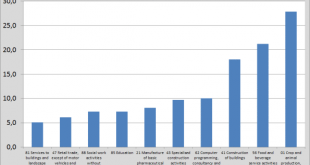

According to the Irish Statistical Office, economic growth in 2015 was an unbelievable 26%. At the same time, employment increased with 2,4% or 151.000 jobs. A brisk but not exceptional pace and totally at odds with the 26% economic growth estimate. Subsectoral data underscore this anomaly: job growth was located in agriculture, tourism (food and beverage service activities) and construction. And to a much smaller extent in the computer, pharmaceutical and leasing sectors which showed,...

Read More »Capital links. Nature, France and a Marxist DSGE model

1) What is capital? The national accounts define capital as a monetary variable. Many people however also talk about ‘natural capital’, ‘The stock of living and non-living components of the earth that provide a flow of valuable ecosystem goods or services‘. That’s from the Australian Bureau of Meteorology, which has issued a very good report ‘The environmental accounts landscape‘. They may underestimate the extent to which laws and regulations shape ‘capital’. But here’s an interesting...

Read More »Mtg apps, Durable goods orders, Pending home sales, Apple and Cat comments

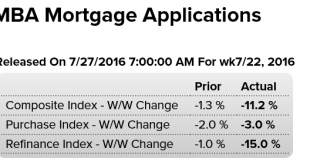

HighlightsPurchase applications for home mortgages were down 3.0 percent in the July 22 week following the previous week’s 2.0 percent decline, while refinancing applications, which tend to be even more sensitive to interest rates, fell a sharp 15.0 percent. The decrease brought the Purchase Index down to the lowest level since February, and the year-on-year gain in purchase applications was pared down to 12 percent from the prior week’s 16 percent gain. Mortgage rates...

Read More »Children’s economics

from David Ruccio As I have argued many times on this blog, representations of the economy are produced and disseminated in many different spaces (in addition to academic economics departments) and through many different media (in addition to the usual, mostly mainstream economics textbooks). One example of this proliferation of economic representations is children’s literature. Children are the targets of educators and writers, most of whom (at least these days) are determined to make...

Read More »PMC, Oil prices

PMC ride August 5th and 6th coming up fast! First, thanks to all of you who’ve donated this year! For the rest, hoping you’ll dig deep and donate this year, which also means you stay on my otherwise free email list! ;) 100% of donations got to cancer research at Dana Farber- all overhead is sponsored. The 2 day ride raised $45 million last year, $500 million since inception! For me this is a ‘must give’, and just saying I personally donate a whole lot more than shows on my...

Read More »Redbook retail sales, Home price index, PMI services, New home sales, Consumer confidence, Richmond manufacturing index

Still down and out: NYC condo price index: Good report here for June, and may revised higher as well. However, no home is built without a permit, so new home sales end up at the same place as permits, and total permits aren’t looking so good. And note the level is still well below all prior cycles, and the charts are not population adjusted: Total permits- single and multi family: Single family permits doing a bit better than multi family: Better than expected but still...

Read More »Is the Trans-Pacific Partnership President Obama’s Vietnam?

from Dean Baker The prospects for the Trans-Pacific Partnership (TPP) are not looking very good right now. Both parties’ presidential candidates have come out against the deal. Donald Trump has placed it at the top of his list of bad trade deals that he wants to stop or reverse. Hillary Clinton had been a supporter as secretary of state, but has since joined the opposition in response to overwhelming pressure from the Democratic base. As a concession to President Obama, the Democratic...

Read More »Escape from Freedom

from Robert Locke Erich Fromm’s 1941 book, with this title, came to mind while watching Donald Trump and his followers in the Cleveland arena. In his book “Fromm distinguishes between ‘freedom from’ (negative freedom) and ‘freedom to’ (positive freedom). The former refers to emancipation from restrictions such as social conventions placed on individuals by other people or institutions. This is the kind of freedom typified by the Existentialism of Sartre, and has often been fought for...

Read More »Don’t believe Wall Street’s scare stories about a financial transactions tax

from Dean Baker Thanks in large part to Sen. Bernie Sanders, the Democratic Party recently added a financial transactions tax to its platform. In his run for the presidential nomination, Sanders had promoted the idea of an FTT — a small sales tax on the purchase of stocks, bonds or other financial assets — as a way to finance free college for everyone, with money left over for infrastructure and other important needs. The idea has currency beyond the platform, too: Rep. Peter A. DeFazio...

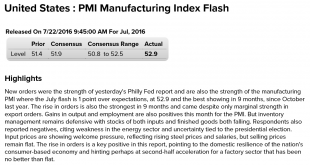

Read More »PMI, Commercial and Industrial loan growth, Japan trade

A bit better than expected, and the narrative sounds hopeful, but the chart still looking like there’s a long way to go to get back to where we were before the collapse of oil capex. And no sign of emergence of deficit spending- private or public- to drive top line growth: Looks to me like this measure of bank loan growth has been going downhill ever since the collapse in oil capex: Japan is rebuilding it’s trade surplus that made the yen the strongest currency in the...

Read More » Heterodox

Heterodox