By Thornton “Tip” Parker As NEP readers know, the economy consists of private, government, and foreign sectors. Financial flows among the sectors always add up to zero; that is, one sector’s deficits must be offset by surpluses in either or both of the others. If the private sector imports more than it exports, ignoring investment flows, it will run a financial deficit while the foreign sector runs a surplus and the economy will then slow down as money in the private sector becomes...

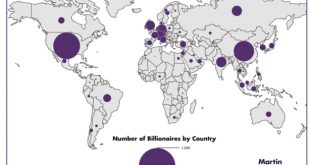

Read More »Map of the Billionairs – 1,826

from David Ruccio According to a new study, The Geography of the Global Super-Rich, by Richard Florida, Charlotta Mellander, and Isabel Ritchie, the United States is home to the world’s largest number of billionaires, with 541, 30 percent of the total. China is second with 223 or 12 percent. Next in line are India and Russia, with 82 billionaires (4.5 percent) each. Germany is fifth with 78 billionaires (4.3 percent). The United Kingdom is sixth with 71 (3.9 percent). Switzerland has 58...

Read More »Employment charts, Atlanta GDP forecast

Government hiring contributed 38,000 jobs last month and a total of almost 100,000 over the last three months: This is the jobs number before seasonal adjustments: The year over year number ‘takes out’ the seasonal factors: Note how many of the new employees were previously considered to be ‘outside the labor force’ for purposes of calculating the unemployment number: The duration of unemployment has come down but it’s still higher than it’s ever been before this cycle: So,...

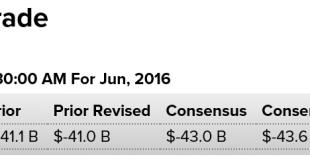

Read More »Trade, Jobs, SNB buying US stocks, German Factory Orders

Larger trade deficit than expected for June, lowering Q2 GDP calculations as previously discussed: Much better than expected and prior month total payrolls were revised up some with private payrolls revised down. The headline unemployment rate was unchanged, while U6 unemployment, the broader measure, moved up a tenth to 9.7, indicating an unexpectedly large increase in the available labor force. More details later today. Also, year over year job growth is still...

Read More »Voters aren’t buying what mainstream economists are selling

from David Ruccio Mainstream economists, such as Harvard’s Gregory Mankiw, celebrate international trade (including outsourcing, which they argue is just another form of international trade) at every opportunity. But right now, voters—especially in the United States and the United Kingdom—aren’t buying what mainstream economists are selling. They are (as I’ve argued here, here, and here) ignoring the so-called experts. That rejection clearly disturbs Mankiw, who just adds fuel to the fire...

Read More »Is the CORE e-Book – Part Two: The basic background ideology

from Mouvement des étudiants pour la réforme de l’enseignement en économie (MEPREE) France and RWER #75 The basic background ideology: free individuals, free markets and “invisible hand” The e-Book overtly proclaims that it adheres to “methodological individualism”. That is, individuals are society’s point of departure. They are “free to choose”, between consumption and leisure for “Angela the farmer” and “Mary the employee”, e-Book’s typical consumer, and between leisure and...

Read More »Real final domestic demand, Layoffs, Fed tax receipts, Factory orders

This was the component of GDP that was touted as a sign of underlying consumer strength, as per the last quarter over quarter move up: However, the same data looked as year over year change- call it a 12 month moving average- shows that looking past the data’s ‘volatility’ there was a move up during the last phase of the burst of oil related capital expenditures chasing $100 oil followed by a continuous deceleration that began when the oil related capital expenditures...

Read More »Is the CORE e-Book a possible solution to our problems? – Part One

from Mouvement des étudiants pour la réforme de l’enseignement en économie (MEPREE) France and RWER #75 “Students in economics all over the world were asking, just as I had asked a few years previously: why has the subject of economics become detached from our experience of real life?” (Camila Cea, Member of the CORE project, University of Chile.) AbstractThe CORE project is a response to students’ protests against teaching in economics. It wants “to make economics accessible and relevant...

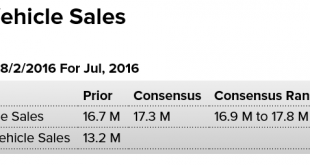

Read More »Auto sales, Mtg purchase applications, Secular stagnation, PMI services index ISM sesrvices

Lightweight cars and trucks better than expected, but heavy weight truck sales brought down the total: HighlightsJuly proved to be a very strong month for vehicle sales, pointing to accelerating strength for consumer spending. Vehicles sold at a 17.9 million annualized rate in the month which is far above June’s 16.7 million. Unit sales offer only a rough indication for the motor vehicle component of the retail sales report but July’s indication is unusually strong. Sales...

Read More »“On economics as a science” – Paul Spicker

Much of social science has come to rely on a set of analytical approaches intended to identify specific influences within a range of confounding factors. The object of analysis is to separate the strands, to distinguish different influences, to attribute influence to particular variables. This has to be done in the face of multiple, competing influences. As a discipline, economics goes about this in different ways. The traditional approach of classical economics is theoretical and...

Read More » Heterodox

Heterodox