from Peter Radford We hear it all the time. It is a relentless drum beat on the left. Capitalism, we are told, is in crisis. This crisis is manifested in all sorts of ways. We – meaning those of us on the left – need to prepare. We need to counter attack. We need to seize this moment and retrieve from the mess whatever we can. Democracy, in various forms depending on who is writing, is our way forward. Only through democracy can we save society from the crisis in capitalism. Really?...

Read More »The Irish and Eurostat national accounts statisticians do have something to explain…

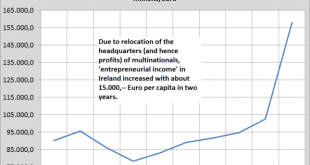

I read the rule book – and am not that sure anymore if the Irish GDP figures were calculated ‘according to the rules’. Due to the relocation of headquarters of the headquarters of some large multinational corporations the Irish statisticians mapped an increase of, especially, profit income of the Irish economy of 60 billion euro in two years. Which is a lot, for a country of 4 million people. Eurostat agrees, as it was, according to Eurostat, calculated according to the Eurostat rules....

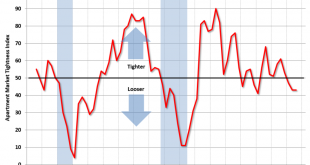

Read More »Apartment market tightness, Chicago diffusion index, Equity flows, UK PMI and public sector deficit, Union Pacific

Looks like a bit of oversupply from new construction, and it didn’t take much of that, either, as construction has been well below prior cycles: “Apartment markets remain strong, but the surge of new apartment construction is starting to shift the supply-demand balance, particularly in the market for upscale apartments,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Given that most new supply is class A, we’re not seeing the same shift in...

Read More »“How Individualist Economics Are Causing Planetary Eco-Collapse”

A selection from the cover of Green Capitalism: The God That Failed. (Image: WEA Books) For some in the environmental movement, it has been tempting to believe that “innovation” and free market solutions could address the challenge of climate disruption. In his provocative and robustly argued book Green Capitalism: The God That Failed, Richard Smith shows why that idea is a myth. Click here to order this important book today with a donation to Truthout! Click here for an abridged...

Read More »Irish growth: what happened?

There has recently been a fuzz about the 26% Irish 2015 GDP growth rate. For more timely discussion of this phenomenon,look here and here on this blog (though I have to admit that I was flabbergasted too by the upward revision of Irish growth from about 9% to about 26%: beyond imagination). What to make of this? The Irish Central Statistical Office is not happy about it, too, and states: “the CSO intends to convene a high-level cross-sector consultative group” to address this situation....

Read More »The top ten economics books of the last 100 years

RWER Poll 2016 The top ten economics books of the last 100 years Subscribers to this journal were asked: “What are the top ten economics books of the past 100 years?” The poll was open for two weeks in May and over 3,000 economists voted. They could vote for up to ten of the books on the short list of 50 which had been compiled from the nominations submitted by Real-World Economics Review readers. People on average voted for five books. Here are the results. Number of...

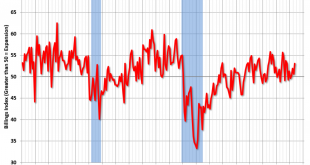

Read More »Architecture Billings Index, Teen employment

Going nowhere: Key June ABI highlights: Regional averages: South (55.5), West (54.1), Northeast (51.8), Midwest (48.2) Sector index breakdown: multi-family residential (57.9), institutional (52.7), mixed practice (51.0), commercial / industrial (50.3) Project inquiries index: 58.6 Design contracts index: 49.7 From the AIA: Architecture Billings Index remains on solid footing Buoyed by increasing levels of demand across all project types, the Architecture Billings Index...

Read More »Philly Fed, Chicago Fed, Existing home sales, NY state revenue report, Hamptons real estate sales

The setbacks continue: As is the general case, this indicator rose with the oil capex boom then peaked with the collapse in oil capex, and remains in negative territory: Same here. Peaked when the oil capex boom ended and the 3 month average is still in negative territory: A bit better than expected for the month, but the year over year rate declined: This NY state revenue report is few weeks old:...

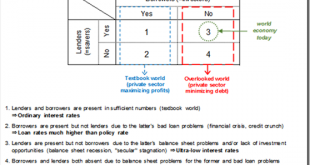

Read More »The other half of macroeconomics – Richard Koo

Four possible states of borrowers and lenders The discussion above suggests an economy is always in one of four possible states depending on the presence or absence of lenders (savers) and borrowers (investors). They are as follows: (1) both lenders and borrowers are present in sufficient numbers, (2) there are borrowers but not enough lenders even at high interest rates, (3) there are lenders but not enough borrowers even at low interest rates, and (4) both lenders and borrowers are...

Read More »The World Bank on the way back to the Washington Consensus – with Chicago Boy Paul Romer

from Norbert Häring On Monday the World Bank made it official that Paul Romer will be the new chief economist. This nomination can be seen as a big step back toward the infamous Washington Consensus, which World Bank and IMF seemed to have left behind. This is true, even though Paul Romer has learned quite well to hide the market fundamentalist and anti-democratic nature of his pet idea – charter cities – behind a veil of compassionate wording. Romer won significant academic merits with...

Read More » Heterodox

Heterodox