Our daughter only applied to two colleges, Washington University in St. Louis and Colorado State University in Ft. Collins. Tuition wasn’t an issue, since her mom was an employee of Wash U, and the university pays full tuition at Wash U or half of Wash U’s tuition at any other college or university for all its employees. Half of Wash U’s tuition would cover most or all out-of-state tuition at any state university. Some of our St. Louis friends asked...

Read More »Prices for new single family homes down YoY,, while sales fluctuate; apartment rent changes YoY are zero

Prices for new single family homes down YoY,, while sales fluctuate; apartment rent changes YoY are zero – by New Deal democrat June’s new home sales, and Apartment List’s Rent Report, this morning rounded out our view of this important leading sector through June. New single family home sales are the most leading of all the government housing reports, but they are very noisy and heavily revised. That was on full display this morning, as...

Read More »On inheritance, college tuition and college loans

My parents died as paupers, so there wasn’t anything for me and my four siblings to “inherit” upon their deaths. No matter. I figure I got my inheritance on the front end, because my folks paid for my college education: tuition, room and board. Even correcting for inflation, tuition* at the University of Tennessee was cheap: ca. $160/quarter for a full load. I was fortunate that my parents had the money; even though I also carried a work-study job...

Read More »House prices stabilize (or even increase!) for existing homes, while prices have been slashed for new homes. What’s going on?

House prices stabilize (or even increase!) for existing homes, while prices have been slashed for new homes. What’s going on? – by New Deal democrat Both the Case Shiller and FHFA housing price indexes were reported this morning through May. To quote each in turn: “The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a -0.5% annual decrease in May, down from a loss of...

Read More »A little-known federal contractor is a big player in privatizing government services

We are again discussing people on Medicaid who may not know they have to reenroll. The largest unknowing segment of that population are those over 65 years of age. This is a combination of several different articles on the Medicaid Disenrollment occurring today. Private business again taking advantage of the lack of knowledge of people and the situation. The Company Salivating Over The Medicaid Disaster (levernews.com), Matthew Cunningham-Cook...

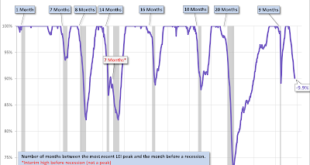

Read More »A “Big Picture” summary of why a recession still looks likely, even if it hasn’t occurred yet

A “Big Picture” summary of why a recession still looks likely, even if it hasn’t occurred yet – by New Deal democrat The below started out as a comment somewhere else, but it is too good a “big picture” summary of where the economy is today and not to post it here. I still intend also to take a more detailed look at the housing market, but since the below lays the groundwork for that, I’ll post it later (maybe later today, maybe not). What...

Read More »Where did you go to college?

One of the most famous graduates of my high school is Charlie Ergen. He was two years ahead of me, so we were in the same building for a year. I knew his name and would have recognized him (student council prez, captain of the B-ball team), but we never met. There were about 1800 students in our high school.Charlie went on to get a BA from UT-Knoxville and an MBA from Wake Forest. Eventually, he became co-founder and chairman of Dish Network and...

Read More »Social Security on Brink of Collapse, Dramatic Changes Coming – Some With ‘Bipartisan Support’

Dale Coberly: This is part 2 of a comment I began July 18 on Angry Bear. It is a reply to an article appearing on the internet by Andrew Herrig at wealthynickel.com under the title. “With Social Security on Brink of Collapse, Dramatic Changes Coming – Some With ‘Bipartisan Support,’” WEALTHY NICKEL, written by Andrew Herrig. The first part of my commentary noted that Herrig ignores that Social Security can fix itself simply by raising the...

Read More »New Deal democrats Weekly Indicators for July 17 – 21

Weekly Indicators for July 17 – 21 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. At least when it comes to weekly measures of consumer spending, the “waiting for godot” recession seems to have finally arrived. Meanwhile other metrics have been picking up steam as to the near future. This suggests a period of wobbling ahead. As usual, clicking over and reading will bring you up to the virtual...

Read More »Letters from an American, July 21, 2023, a Friday

July 21, 2023 (Friday), Letters from an American, Prof. Heather Cox-Richardson Defying SCOTUS, redistricting, and the border. On June 8 the Supreme Court affirmed the decision of a lower court blocking the congressional districting map Alabama put into place after the 2020 census, agreeing that the map likely violated the 1965 Voting Rights Act and ordering Alabama to redraw the map to include two majority-Black congressional districts. ...

Read More » Heterodox

Heterodox