Initial and continuing claims edge closer to signaling recession – by New Deal democrat There’s a blizzard of data this morning. I’ll report on retail sales and Industrial production later. But let’s start with initial jobless claims, which were unchanged this week at 262,000, the highest level in over 18 months. The 4 week average increased 9,250 to 246,750. Continuing claims, with a one week lag, increased 20,000 to 1.775 million:...

Read More »Here’s what Republicans get Wrong about the Student Loan Debt crisis

What is exciting about this op-ed is not just the topic but the writer Lisa Ansell. Ms. Ansell is the Associate Director at the Casden Institute for the Study of the Jewish Role in American Life. She definitely has the band width in adding to the fight for student loan relief for the 46 million students having no-way-out from predatory loans. Lisa is writing articles in support of Student Loan Justice Org. “I’m an independent. Here’s what...

Read More »In the aggregate, in real terms, average American households are bringing home more income

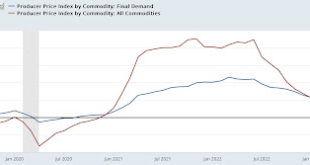

Producer prices continue sharp deceleration; real average and aggregate nonsupervisory pay continues to increase – by New Deal democrat Historically producer prices were more upstream of consumer prices, but since the 1990s and the employment of “just-in-time” inventories, that has been less the case. So I normally don’t pay too much attention to the monthly PPI. But for the record, PPI continues to confirm, and amplify, what we’ve seen in...

Read More »Properly measured Inflation is no longer a significant issue . . .

CPI less shelter up only 0.7% in last 11 months (0.8% annualized rate) – by New Deal democrat Let me cut to the chase right from the outset: except for the very lagging measures of shelter; motor vehicle parts, repairs and insurance; and to a lesser and waning extent, food; consumer inflation is now well-contained and close to the Fed’s target rate. First, let’s look at the headlines, with the monthly and YoY rates of change: Total CPI...

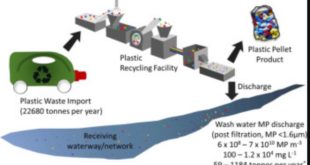

Read More »Recycling Plastics releases Microplastic pollution in the Water and Air

Having purchased healthcare, automotive, etc. components from various molding manufacturers, I can definitely testify to the amount of scrap created from each part. There is no way of avoiding the scrap left from a molded component. Much of this ends up in regrind and what ever is sorted may go into other uses. The story touches on micro particles occurring during the regrinding of the scrap. Some so small, it is difficult to see. The little-known...

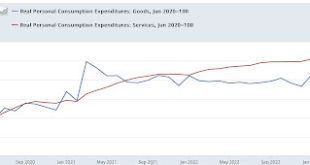

Read More »Are personal consumption expenditures a helpful forecasting (or even nowcasting) metric? An overview

Are personal consumption expenditures a helpful forecasting (or even nowcasting) metric? An overview – by New Deal democrat As I’ve noted a number of times recently, in addition to payrolls the other positive datapoint keeping the economy growing is real personal spending. Here is what it looks like in total, plus broken down by goods and services for the past several years: The trend in both, at least since last June, is definitely higher....

Read More »Corporations Changing their Minds on Remote Work

I can not tell you I worked remotely. It was always required I be in the building governing the operations of the facility. One of those 7AM to 7PM positions which also entailed calls from the other side of the globe at night. And then a trip back to the facility. The fun part were the trips globally to check out our associate facilities. I can understand the reasoning for working remotely. More gets done with less interruption. Google has...

Read More »A Few Sunday Morning Reads

Niagara Falls: Some things never change, Carbon Upfront, Lloyd Alter. In 1882 Oscar Wilde noted that “Niagara will survive any criticism of mine. I must say this, however, that it is the first disappointment in the married life of many Americans who spend their honeymoon there.” (Calling it the second disappointment is a misquote) I recently visited with my daughter Emma’s family, and not much has changed since 1882, or at least since my kids were...

Read More »Replenishing the Strategic Petroleum Reserve

“This success can translate to a more transformative and permanent paradigm shift for US energy policy, but the DOE’s success paves a clear path to future successes.” The SPR strategy being, “how long can the US hold out against a hostile Middle East?” The Saudis appear to favor trump over other US politicians. Maybe appeasing trump is easier than satisfying a real president focused on the nation they represent rather than himself and ego. In any...

Read More »Real business sales estimate: up 0.3% in April, but still below January peak

Real business sales estimate: up 0.3% in April, but still below January peak – by New Deal democrat Let me start today by re-upping this graph of the current state of the coincident indicators mentioned by the NBER as data that they track: As I wrote earlier this week, the two positives keeping the economy in expansion are real spending on services, and jobs. The other indicators are either flat or down from their peaks. In fact I’ve...

Read More » Heterodox

Heterodox