I was catching up with what is going on in the courts. Went to my favorite reference point which involves the ABA and what Lawyer Erwin Chemerinsky thinks. Some commentary on Student Loan forgiveness. SCOTUS will decide if states are suffering from forgiveness of loans. If they collect nothing, which will be the issue, then what is the problem? ~~~~~~~~ The State of Texas filed suit in their favorite pick-of-the-day federal court. Filing in...

Read More »Declining population and diminished national power is bad news?

My Thoughts I am not sure what Prof. Dean means by elites. Was looking for an explanation. It may have zoomed by me if it is not obviously called out. In the beginning of his commentary, we read of declining population in China. The makeup of the population is older. Been there numerous times going from plant to plant and working with my counterparts there. Marvelous country to explore with the assistance of my associates there. Making the leap...

Read More »Despite sharp rebounds in retail sales and manufacturing production, both metrics are on the cusp of being recessionary

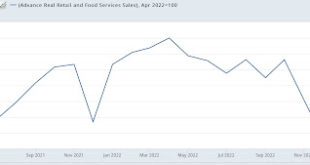

Despite sharp rebounds in retail sales and manufacturing production, both metrics are on the cusp of being recessionary – by New Deal democrat Retail sales for January rose strongly in January,up 30% in nominal terms and up 2.4% after accounting for inflation. While that looks great, it only reverses the two downward readings of November and December, and is similar to the reversal last January. This makes me think that there is unresolved...

Read More »Ford’s Old and New Manufacturing Troubles Deepen Fast

I believe Ford reported $2.2 billion in losses in 2022 writing down the value of two big investments, struggling with high costs, and also supply chain problems. In 2023, there is still going to be volatility on chips, On the older chips used in the auto industry, there is still capacity constraint.” I also can’t image funding two different teams, one for EVs and the other for gasoline vehicles is helping either. Ford’s Troubles Deepen Fast,...

Read More »Inflation is decelerating substantially towards the Fed target ADDENDUM: the huge impact of shelter

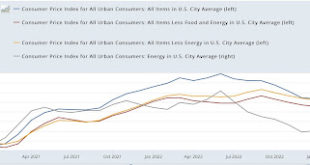

Measured by actual rather than fictitious prices, inflation is decelerating substantially towards the Fed target ADDENDUM: the huge impact of shelter – by New Deal democrat For the last year, consumer prices have mainly been about two things: (1) the huge rise, and then fall, in gas prices; and (2) the phantom menace of owner’s equivalent rent (OER) dragging shelter prices higher, even as actual house prices peaked, and new rental...

Read More »CSX agrees to Sick Leave for BMWED, BRC, IAM, NCFO Unions

I saw the announcement up at Infidel753 Blog in his Link Roundup for February 12th. I am using Railway Age for the news of the settlement between CSX and the Brotherhood of Maintenance of Way Employes Division (BMWED) and the Brotherhood of Railway Carmen (BRC) on February 7. On February 10, the International Association of Machinists and Aerospace Workers (IAM), and the National Conference of Firemen and Oilers (NCFO) also reached agreement with...

Read More »The #1 likely reason I suspect the economy has not gone into recession yet

The #1 likely reason I suspect the economy has not gone into recession yet – by New Deal democrat I’ve been reading increasing talk about the fabled “soft landing,” or alternatively, “rolling recession.” For example, over the weekend Liz Ann Sonders of Schwab told “Wall Street Week” that housing is already in a recession, but the larger services side of the economy was still in good shape. Let me start out by noting that the goods side of...

Read More »New Deal democrat’s weekly indicators

Weekly Indicators for February 6 – 10 at Seeking Alpha I neglected to post the link to this yesterday, so let me do it today. My Weekly Indicators post is up at Seeking Alpha. We continue to see a slow drip, drip, drip of ever so slightly more negative coincident data, without it crossing over into firm recessionary territory. I have a feeling I know what the crucial reason why is, and that metric will be updated this coming week (that’s...

Read More »Unionization increased by 200,000 and More Wanted to Join

In the Private Sector? The Protecting the Right to Organize Act is a historic proposal restoring fairness to the economy by strengthening the federal laws protecting workers’ right to unionize and bargain for higher wages and better benefits. In the Public Sector? There is no federal law protecting the freedom of state and local public service workers to join a union and collectively bargain. Numerous states have passed free rider so-called...

Read More »Interesting Stuff from My In-Box, Maybe?

More Economic and Government topics the time. Much of it due to the pandemic caused economic issue. It is interesting as to how the news varies from week to week and what becomes important. I did add reports on Ukraine’s economy for 2022. You will see percentages from ~31% to ~38% cited depending on who you read. The Housing economy in in Arizona has come to a near standstill. At an AZ State House Committee meeting, the representatives were...

Read More » Heterodox

Heterodox