UE is the United Electrical, Radio & Machine Workers of America issuing a statement by its Executive Board. In case you are wondering, UE is responsible for transporting train crews. The membership is approximately 2,000. It is interesting to note, their claiming of pricing issues with the transportation of goods across the US. Typically, we see these costs passed along in the form of shortages and/or higher prices. UE is also calling...

Read More »On student loans’, “Letters To The Editor” Waxahachie Sun

Besides fishing for various in district Federal Judges to sponsor Paxton’s lawsuits against the Federal Government, there is Che Ted Cruz – a want-to-be. Student Loan Justice member Jacque Abron calling Ted Cruz out. ‘On student loans’, Letters To Editor, waxahachiesun.com, Jacque Abron at Student Loan Justice The fact that Texas legislators like Ted Cruz are opposing student loan cancellation makes no sense. The state is crushed under $141...

Read More »New Deal democrat’s Weekly Indicators February 20 – 24

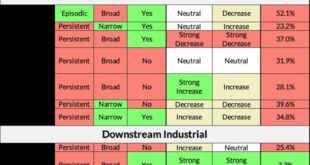

Weekly Indicators for February 20 – 24 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. While several of the important coincident indicators continue to hover just above neutrality, importantly neither long term Treasury yields nor corporate bond yields nor mortgage rates have made a new high in the past 4 months, and historically that has been significant. As usual, clicking over and reading will...

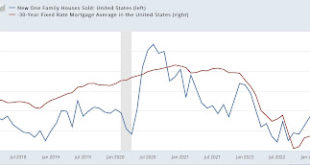

Read More »New home sales: a bright spot in the housing indicators

New home sales: a bright spot in the housing indicators – by New Deal democrat New home sales are very noisy, and are heavily revised, which is why I pay more attention to single family housing permits. But they do have one important value: they are frequently the first housing indicator to turn at both tops and bottoms. And it increasingly looks like new home sales have already made their bottom for this cycle. In January they rose a...

Read More »Interesting Stuff from My In-Box

I am late in posting “In-Box” due to other things going on at home. Talk of Healthcare? I fractured a tooth. It now has to be replaced with a bridge. I did not like the idea of a Sears Best drilling a hole in my jaw-bone for a stud to mount a tooth. Next up an eye operation which Medicare will cover. Then down to the VA to make contact again. This week there were a lot of interesting subjects to read. So many of them, I could double the length of...

Read More »Does Being Balanced at the New York Times Mean Giving the Right Space to Lie?

Perfect follow-up to Dean’s earlier commentary “Declining population and diminished national power is bad news?” which I also posted at Angry Bear. In Dean’s earlier commentary, he makes a point of declining population not being a big issue. Decreasing productivity would be a far bigger issue except it is not an issue in the US. The numbers of older people are increasing in the US. As Dean points out, “If wage growth moves in step with productivity...

Read More »Strong upward revisions push real personal income to new highs

Strong upward revisions push real personal income to new highs, put 2 important coincident indicators firmly in expansion territory – by New Deal democrat Almost all of the news in this morning’s release for personal income and spending for January was positive. Nominally, personal income rose +0.6% and personal spending rose 1.8%. The deflator also rose +0.6%, making real personal income close to unchanged, and real spending (after...

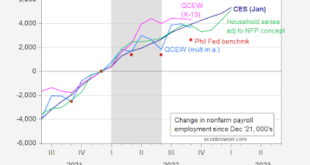

Read More »The “gold standard” of jobs data shows a strong rebound in Q3 2022

The “gold standard” of jobs data shows a strong rebound in Q3 2022 – by New Deal democrat The preliminary estimate for the Q3 2022 QCEW was released yesterday. Although the monthly nonfarm payrolls report gets all the glory, it is only a survey. The QCEW is an actual census of the roughly 95% of all businesses paying unemployment insurance. It is reported with about a 6 month delay, and is not seasonally adjusted. The bottom line is while...

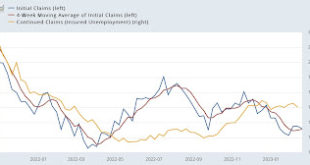

Read More »Initial Jobless Claims continue recent excellent streak

Initial claims continue recent excellent streak – by New Deal democrat Initial jobless claims continued their recent excellent reports, as there were only 192,000 new claims, down -3,000 from the week before, and close to their 50+ year lows of last March and April. The 4 week average increased 1,500 to 191,250, still an excellent number. Continuing claims, with a one week delay, declined -37,000 to 1,654,000, still in their slightly elevated...

Read More »Considering the Inconvenient Truth About Electric Vehicles

There are two good articles to be read here. Most is drawn from The Atlantic article and the other from The Detroit News. Some of the information is pulled from other articles to which the links are in the article. EVs may be the wave of the future. I think we will need better technology to power the electric vehicles and also lessen the energy pollution needed to make them. “Electric Vehicles Are a Status Symbol Now,” The Atlantic, Andrew...

Read More » Heterodox

Heterodox