December jobs report: good headlines, but deceleration continues – by New Deal democrat If the long leading indicators all last year, and the majority of the short leading indicators from the past few months are to be believed, a recession is near. And if that is the case, we ought to see the leading elements of the jobs report begin to roll over. One of them, the average manufacturing workweek, clearly has. Arguably so has temporary...

Read More »New Mfg orders both decline further, to readings even more on the cusp of recession

December manufacturing, new orders both decline further, to readings even more on the cusp of recession – by New Deal democrat I described last month’s ISM manufacturing reading as being one “on the cusp of recession.” Well, this month’s reading was even cusp-ier. To recapitulate, this index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession....

Read More »New jobless claims will end 2022 on a positive note

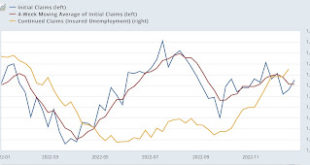

New jobless claims end 2022 on a positive note; preview of tomorrow’s jobs report – by New Deal democrat Initial claims started off the year – or ended last year if you are technical about it – on a positive note, declining 19,000 to a 3-month low of 204,000. The more important 4 week moving average declined 6,750 to 213,750, a two-month low. Continuing claims for the prior week also declined by 24,000 to 1,694,000 (due to either a software or...

Read More »Growth, GDP, and Faith

“This Pioneering Economist Says Our Obsession With Growth Must End,” NYT. Portions are (or much) taken from David Marchese’s interview with Herman Daly in 2022. Economist Herman Daly passed on, October 28 in Richmond, Virginia. at the age of 84. What made Herman Daly unique was his embracing of “the counterintuitive possibility our current pursuit of growth, rabid as it is causing such great ecological harm. In turn, the pursuit might be incurring...

Read More »November JOLTS report consistent with a continued “hot” labor market

November JOLTS report consistent with a continued “hot” labor market – by New Deal democrat The JOLTS report for November showed both continuing decelerating trends in some series, but overall a picture of a labor market that continued “hot.” Here’s the graph I ran one month ago of job openings, hires, quits, and total separations: Now here is an update for the past 2 years of all four series: Three of the four series – openings,...

Read More »The remedy for high prices is – high prices

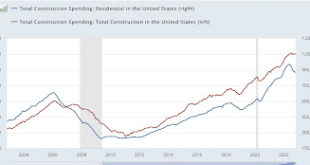

2023 data begins with another lesson: the remedy for high prices is – high prices – by New Deal democrat And so, another year begins. And kicks off with a look at the leading housing sector. And furthermore, there is even some good news. Total construction spending in November rose 0.2% for the month, while the more leading residential construction spending declined -0.5%. While total construction spending is only down 0.6% from its recent...

Read More »Earnings inequality continuing growth in the pandemic labor market

“Inequality in annual earnings worsens in 2021.” This report is a couple of weeks old. Still relevant and supports what NDd has been saying as well as others here at Angry Bear. This is taken from EPI. Partial read of a larger report. Details from year twenty-one finds annual wages rising the fastest for the top 1% of earners (up 9.4%) and top 0.1% (up 18.5%) Those in the bottom 90% saw their real earnings fall 0.2% between 2020 and 2021. Workers...

Read More »Weekly Indicators for December 26 – 30

– by New Deal democrat My Weekly Indicators post is also up at Seeking Alpha. The volatile coincident consumer numbers bounced higher this week, while another recession indicating system flashed red, suggesting a recession is most likely to start during the 2nd Quarter of 2023. As usual, clicking over and reading my commentary at Seeking Alpha will not only bring you up to the virtual moment as to the economy, but it will bring me a little...

Read More »Nous sommes dans le changement

Indeed we are. Tout les mond sommes dans le changement. Change comes sometimes fast, sometimes slow; but always, inexorably. Still and yet, some would deny, attempt to slow down or even stop change. Too few recognize it when they see it. Throughout history, blood has flowed like rivers resultant efforts to slow down or stop change. Our own Civil War, ‘The Great War’, … . Then, they couldn’t, didn’t want to see the changes that were taking place....

Read More »Initial claims close out the year still positive

Initial claims close out the year still positive – by New Deal democrat This morning we got the final economic news of the year, as initial claims for the week rose 9,000 to 225,000. The 4-week moving average declined 250 to 221,000. Continuing claims rose 41,000 to 1,710,000, a 10-month high: The weekly number was actually 14,000 higher than one year ago, but that is not significant. The 4-week average and the continuing claims numbers...

Read More » Heterodox

Heterodox