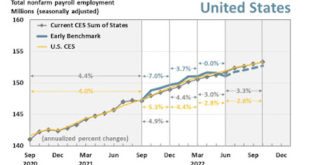

Job growth beginning in Q2 looks to be substantially revised downward – by New Deal democrat Last week the Philadelphia Fed published a working paper suggesting that in the second quarter of this year only 10,500 jobs were actually added, rather than the 1,047,000 as indicated by the monthly Establishment survey. Here’s their graph: Here’s what you need to know about the QCEW (Quarterly Census of Employment and Wages): The late...

Read More »A Look at Drug Pricing 2020, Costs, and Why – “Redux”

Commenter Arne asked how we would transition from today’s healthcare system to a Single Payer format. I do not have the answer immediately at hand. I have to look for it. I do want to review what we have learned to date and stated on Angry Bear already. I do have a number of posts of the costs of healthcare. This one I like as it is simple and gets the point across on Drug Costs. I recently did a post of Pharma pricing which I will conclude with...

Read More »New Deal democrat’s Weekly Indicators for December 12 – 16

Weekly Indicators for December 12 – 16 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. The coincident indicators, especially employment, are hanging on by the proverbial skin of their teeth. I don’t think they roll over until gas prices stop declining. In any event, clicking over and reading will bring you up to the moment on the status of the carnage, and bring me a little reward for the...

Read More »Nancy Altman wants to Turn Social Security into Welfare for All

AB writer, commenter and Social Security expert, Dale Coberly provides a different take on whether “President Biden Should Direct the Social Security Administration to Stop Penalizing Marriage.” ~~~~~~~~ Nancy Altman wrote the following piece, which appeared in PROGRESS AMERICA, on December 16, 2022 as well as Common Dreams. I thought it needed a response because I regard it as dangerous to Social Security. I have inserted my responses...

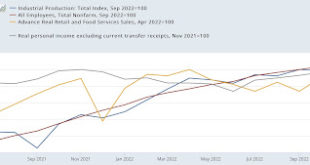

Read More »The status of the coincident indicators

The status of the coincident indicators – by New Deal democrat In addition to real GDP, which is only updated quarterly and with a lag, the NBER has indicated that it relies upon four other datapoints in determining the onset month of a recession: payrolls, industrial production, real income less transfer payments, and real manufacturing, wholesale, and retail sales. The below shows all four, with the exception that, because real...

Read More »November real retail sales turn down, return to negative YoY

November real retail sales turn down, return to negative YoY – by New Deal democrat Real retail sales is one of my favorite indicators for both the current economy and the jobs situation 3 to 6 months ahead. This morning nominal retail sales for November were reported down -0.6%, which only takes back about 1/2 of October’s strong +1.3% increase. Since consumer inflation rose +0.1% for the month, real retail sales decreased by -0.5%. Here...

Read More »Consumption taxes and inflation

In a recent post, Matt Yglesias argues for using fiscal policy – tax increases or benefits cuts – to control inflation, rather than relying on interest rate hikes. There is certainly an argument to be made here, but his suggestions for reducing consumption seem less than ideal. Yglesias floats the idea of limiting Social Security inflation adjustments for retirees with higher incomes. He also mentions capping deductions, and cutting Medicare...

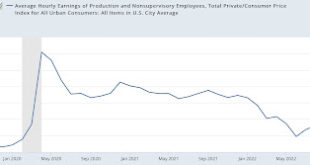

Read More »Real average and aggregate non-managerial wages for November

Real average and aggregate non-managerial wages for November – by New Deal democrat With November’s consumer inflation report in the books, let’s update two of my favorite measures of how the working/middle class is doing – real average non-supervisory wages, and real aggregate payrolls. Nominal average wages for non-supervisory workers rose a strong 0.7% in November. Inflation fell sharply to 0.1%. So real average wages rose 0.6% last...

Read More »Inflation is Falling Faster Than People Know; Fed’s Response to Inflation Poses a Bigger Threat

Mark Weisbrot of CEPR had an article up in the November LA Times addressing Inflation and the Fed. It appears it may be reprinted in December’s LA Times. “Weisbrot (LA Times): Inflation is Falling Much Faster Than Most People Know; and The Fed’s Response to Inflation May Pose a Bigger Threat than the Inflation Itself.” An essay arrived in my Hotmail account just today. An interesting email which I will repeat many portions of it here. Inflation...

Read More »More Railroad Workers Information

I am not the only one who sees issues with the way railroad workers are on call 24/7 with any time off being canceled or workers being subject to penalization if missing the call. Biden could have pushed harder to resolve this labor issue. Just like siding with financial issues, Jow Biden sided with Railroad corporate interests. ~~~~~~~~ Infidel753: Tell Biden to do the right thing, Infidel753 Blog, 06 December 2022. Since Congress voted...

Read More » Heterodox

Heterodox