– by New Deal democrat The Bonddad Blog My “Weekly Indicators” post is up at Seeking Alpha. Not much churn in the short leading or coincident timeframes this week. But one of the long leading indicators joined the “less bad” parade. This is what I would expect to see coming out of a recession, before growth in the shorter term improves. Just one week, but still . . . As usual, clicking over and reading will bring you up to the virtual...

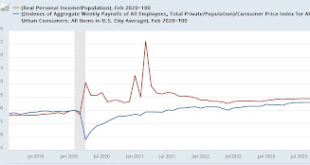

Read More »Another strong personal income and spending report, but beware the uptick in inflation

– by New Deal democrat The Bonddad Blog Personal income and spending has become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen. Because real personal spending on services...

Read More »Leading indicators in the Q1 GDP report are mixed

– by New Deal democrat The Bonddad Blog Most of the commentary you will read about Q1 GDP that was released this morning will be about the core coincident components. For that I will simply outsource to Harvard’s Prof. Jason Furman: “much of the slowdown was in non-inertial items like inventories (-0.35pp) and net exports (-0.86pp). The better signal of final sales to private domestic purchasers was 3.1%.” I agree. With that out of...

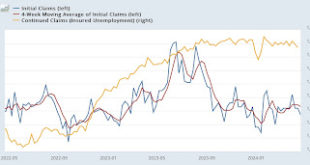

Read More »Jobless claims continue their snooze-fest

– by New Deal democrat The Bonddad Blog [Note: I’ll put up a post discussing Q1 GDP later today.] Initial and continuing claims continued their snooze-fest this week. Initial claims declined -5,000 to 207,000, continuing their nearly 3 month long range of between 200-220,000 per week. The four week average declined 1,250 to 213,250. This average has remained in the 200-225,000 range for over half a year! Finally, with the typical one...

Read More »In addition to housing, manufacturing is range-bound as well

– by New Deal democrat The Bonddad Blog First off, let me reiterate that my focus this year is on manufacturing and construction. That’s because these are the two sectors the waxing and waning of which have almost always determined if the US economy is growing or not. By contrast, for the past half century or more the production and consumption of services has tended to increase even right through most recessions. With that framework in...

Read More »It’s a start

In many capitalist European countries, college students do not have to pay tuition fees out of their own pockets. Here in America, most students have to fund their own college costs, which for many students means student loans. Whether or not they complete the degree, student loan borrowers can’t discharge these loans through bankruptcy.Of course, college isn’t free in Europe, it’s paid for by taxpayers. Presumably, those countries believe the...

Read More »The range-bound new home sales market continues

– by New Deal democrat The Bonddad Blog As per my usual caveat, while new home sales are the most leading of the housing construction metrics, they are noisy and heavily revised. That was true again this month, as sales (blue in the graph below) increased almost 9% m/m to 693,000 annualized, after February was revised downward by -25,000 to 637,000. As the five year graph below shows, after the initial Boom powered by 3% mortgage rates,...

Read More »Real median wage and income growth through March continued the recent increasing trend

– by New Deal democrat The Bonddad Blog This is an update of some information I last posted several months ago. Real median household income is one of the best measures of average Americans’ well-being. However, the official measure is only reported once a year, in September of the following year. So right now the most recent official measure is for calendar year 2022 (when you might remember gas prices surged to $5/gallon). In other...

Read More »New Deal democrats Weekly Indicators for April 15 – 19 2024

– by New Deal democrat The Bonddad Blog I neglected to put this up Saturday, so here it is now. My “Weekly Indicators” post is up at Seeking Alpha. There continues to be a fair amount of churn and noise in the short leading and coincident time range. Nevertheless, the underlying theme is one of positivity. Aside from the swoon in the stock market this past week, the other big move was in industrial commodities, which spike higher late in...

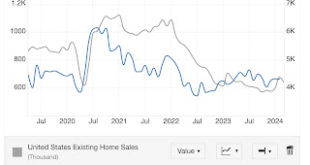

Read More »The bifurcation of the new vs. existing home markets continues

– by New Deal democrat The Bonddad Blog The bifurcation of the new vs. existing home markets continued in March, per the report on existing home sales and prices yesterday. Remember that, unlike existing homeowners, house builders can vary square footage, amenities, lot sizes, and offer price and/or mortgage incentives to counteract the effect of interest rate hikes.On a seasonally adjusted basis, existing home sales declined from 438,000 to...

Read More » Heterodox

Heterodox