by Joseph Joyce (Joseph P. Joyce is a Professor of Economics at Wellesley College, where he holds the M. Margaret Ball Chair of International Relations. He served as the first Faculty Director of the Madeleine Korbel Albright Institute for Global Affairs.) The Change in the U.S. Direct Investment Position The U.S. has long held an external balance sheet that is comprised of foreign equity assets, mainly in the form of direct investment (DI), and...

Read More »On Yglesias on the Dramatic 0.25% Rate Cut

Monetary policy is roughly the only issue on which I regularly disagree with Matt Yglesias. So it is boring to note that I agree with almost everything he wrote in his Vox article on the recently announced 0.25% Federal Funds target rate cut. His main assertions are: – it is a very reasonable move even though Trump advocated it and it will help Trump’s 2020 campaign. – The previous stance of normalizing interest rates because normal interest rates are...

Read More »Interest Rates and the Hack Gap.

Kevin Drum notes conservative hackitude. I’m just going to fair use the whole post (please click the link so I don’t feel guilty) I would like to offer a comment on the hack gap this morning: It’s remarkable the number of liberal economists who continue to favor an interest rate cut from the Fed. They are displaying intellectually honesty here: with inflation low, there’s no reason not to take out an insurance policy that could keep the current economic...

Read More »Degeneration of Bipartisan Blog Sites: Econbrowser

Degeneration of Bipartisan Blog Sites: Econbrowser This is probably just a whiny complaint of well-known and long running issues. Indeed for a long time most blog sites (not to mention most twitterspheres and Instogram Idiotspheres) have been mono-partisan in those who participate in their discussions/debates. This has been true for a long time for most sites in the Econoblogosphere, including this site, which clearly tilts “left,” even though we have...

Read More »Pledging Zero Carbon Emissions by 2030 or 2050: Does it Matter?

Pledging Zero Carbon Emissions by 2030 or 2050: Does it Matter? We now have two responses to the climate emergency battling it out among House Democrats, the “aggressive” 2030 target for net zero emissions folded into the Green New Deal and a more “moderate” 2050 target for the same, just announced by a group of mainstream legislators. How significant is this difference? Does where you stand on climate policy depend on whether your policy has a 2030...

Read More »Both long leading components of Q2 GDP declined UPDATED with revisions and further comments

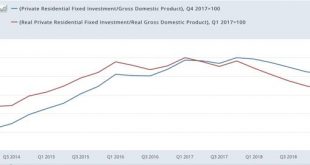

Both long leading components of Q2 GDP declined UPDATED with revisions and further comments The headline number for the first estimate of real GDP in Q2 2019 was 2.1%, as I’m sure you’ve read elsewhere. As is usual, I’m not so interested in what is, after all, what the view in the rear view mirror is, as what the leading components can tell us about what lays ahead. In that regard, both leading components of GDP declined. – Real private fixed...

Read More »Climate Chaos?

Dan here. You will be reading more of him soon…David Zetland has contributed here on water issues via Aguanomics. He now publishes his blog The one-handed economist. He is a native Californian who moved to Amsterdam several years ago. David is an assistant professor of political economy at Leiden University College, a liberal arts school located in The Hague. He teaches courses in social and business entrepreneurship, cooperation in the commons, and...

Read More »The Strange Anti Inflation Coalition

Why is the 2% inflation target sacred ? A very strong case can be made that a higher target would be better, because it would mean normal nominal interest rates are further from the (near) zero lower bound. DeLong and Summers made this point in the 90s . AEA President and former IMF head economist OJ Blanchard made it in 2010. Yet it gets nowhere. The 2% target is the gold standard of the 21st century. There is no historical or theoretical basis for...

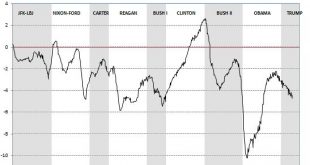

Read More »The Federal Deficit by Presidential Terms

Under Trump the federal deficit has rebounded to some 4.4 % of GDP — it is the same whether you look at it quarterly or monthly data as this chart does. The monthly estimate is calculated by Haver Analytics. So much for the tax cut paying for itself. The shaded areas are by Presidential term, not of recessions as is usually the case. Typically, Republicans leave office with a larger deficit than they inherited while Democrats leave with a smaller one,...

Read More »Housing has bottomed

Housing has bottomed With the release of new home sales this morning, and existing home sales yesterday, it is increasingly apparent that housing has bottomed – just as I said a number of months ago that it would sometime this spring. To the graphs! New home sales (blue in the graph below) bottomed last October, at 557,000 units annualized. As of June, they were at 646,000: This isn’t as good as earlier this spring, but is better than every other...

Read More » Heterodox

Heterodox