Weekly Indicators for May 9 – 13 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. One measure of how the Russia-Ukraine war has been “normalized” globally, is that industrial commodity prices have declined sharply – on the order of 25% – in the past two weeks, taking back their entire sharp increase at the start of hostilities. Meanwhile, the Treasury yield curve has “normalized” somewhat more in...

Read More »The Passing Of Axel Leijonhufvud

The Passing Of Axel Leijonhufvud On May 5, Swedish economist Axel Leijonhufvud died at age 88. I only met him once when he attended a seminar I gave in Trento, Italy a decade ago. I always admired his work and felt lots of sympathy with it, and I think he liked what I had to say at least in my seminar that day. He was someone who stood outside of orthodoxy while not being clearly tied to any particular school of economic thought. However, he...

Read More »Nat Gas Up, SPR, Oil, Distillates, Product supply Low

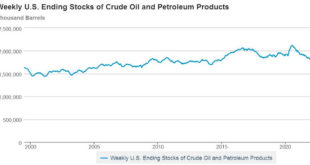

RJS, Focus on Fracking __________ Summary: Natural gas price hits 164 month high after doubling in 2 months; SPR at a 1058 week low, total US oil supplies at a 746 week low; distillates supplies at a 729 week low, total oil + products inventories at a 711 week low, gasoline imports at a 8 month high; natural gas rigs at a 31 month high.. ___________ Natural gas prices hit 164 month high after doubling in 2 months Oil prices rose for...

Read More »Can empire-sized Republics long survive, and the failure of judicial supremacy as a bulwark

On the self-government of prehistorical human settlements, whether empire-sized Republics can long survive, and the failure of judicial supremacy as a bulwark Can the Empire-sized Republic long survive? This was the issue I pondered after Donald Trump was elected President in 2016. Once a country gets big enough, do elected officials ultimately fail, and people inevitably turn to an autocrat to lead them? That led me on a journey reading the...

Read More »Trade Deficit Rose on Imports of Industrial Supplies, Materials and Consumer Goods

RJS, MarketWatch 666 Summary: Trade Deficit Rose 22.3% to Record High in March on Higher Imports of Industrial Supplies & Materials and Consumer Goods Our trade deficit was at another record high in March, 22.3% higher than February’s record, as both our imports and exports increased, but our imports increased by quite a bit more . . . the Commerce Department’s report on our international trade in goods and services for March indicated that...

Read More »Weekly Indicators for May 2 – 6 at Seeking Alpha

by New Deal democrat Weekly Indicators for May 2 – 6 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. Over the past few months, indicators across all timeframes have deteriorated. With increasing interest rates, and another Fed rate hike, that trend continued, and spread to credit conditions in a significant way. As usual, clicking over and reading will bring you up to the virtual moment, and will bring me some lunch...

Read More »SPR, oil, distillates, product Inventories low

RJS, Focus on Fracking, Summary: Strategic Petroleum Reserve at a 1058 week low, US oil supplies at a 746 week low; distillates supplies at a 729 week low, total oil + products inventories at a 711 week low, gasoline imports at a 8 month high The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending April 29th indicated that because of an increase in our oil...

Read More »Oil Buyback Replenishing SPR

RJS; Focus on Fracking Oil Prices Top $111 As Biden’s SPR Buyback Plan Leaks — The Biden Administration will purchase 60 million barrels of crude in Q3 (Yahoo) in an effort to replace volumes in the U.S. strategic petroleum for the first time in nearly 20 years, CNN reports, after authorizing a record release over six months. Citing an unnamed Energy Department official, CNN said what is referred to as a “long-term buyback plan” for oil...

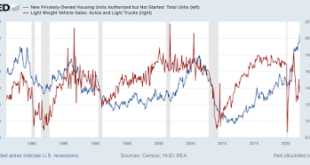

Read More »The impact of supply constraints on the US economy in 3 easy graphs

The impact of supply constraints on the US economy in 3 easy graphs The two most important purchases ever made by most consumers are (1) their houses, followed by (2) their motor vehicles. Indeed, according to Prof. Edward Leamer‘s forecasting model, ever since the end of World War 2 almost all American recessions have been preceded by, first of all, a decline in new home purchases about 6-7 quarters before, followed by a decline in the purchase...

Read More »Dow Jones plunges 1,100 points today . . .

In midday trading, the Dow Jones industrial average slumping 3.3 percent. The S&P 500 index sinking 165 points, or 3.8 percent. The tech-heavy Nasdaq was losing biggly, giving back 651 points, or 5 percent. I am not looking at investments today. The drop was wiping out the gains from the previous session’s massive rally. All reactions to the FED jumping the rates up 1/2 of 1%. What remains to be seen??? Nancy Davis, founder of asset...

Read More » Heterodox

Heterodox