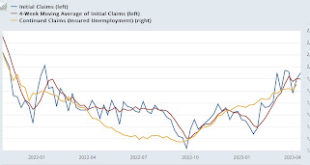

Jobless claims continue to warrant yellow caution flag, while continuing claims shade closer to crimson – by New Deal democrat Initial claims (blue in the graph below) continued their recent track into recession caution territory this week, as they rose 5,000 to 245,000, 12.9% higher YoY and the 5th time in the last 7 weeks that claims have been 240,000 or above. The last time they were at this level was in January 2022. The more important...

Read More »Blog Archives

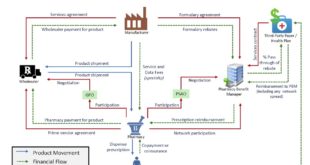

FTC and Congress Put PBMs on Notice

FTC and Congress Put PBMs on Notice – AAF (americanactionforum.org) The conclusion of the Congressional Plan Much of this post in a copy and past. However, the conclusion is mostly mine. I am starting out with the conclusions and actions of Congress to which the author claims could result in fewer PBMs and increasing prices. If you look at Figure Two, it becomes rather obvious where the fallout is going to be. The smaller PBMs will not be...

Read More »The importance of not equating science with statistical calculations

The importance of not equating science with statistical calculations All science entails human judgment, and using statistical models doesn’t relieve us of that necessity. Working with misspecified models, the scientific value of statistics is actually zero — even though you’re making valid statistical inferences! Statistical models are no substitutes for doing real science. Or as a famous German philosopher famously wrote 150 years ago: There is no royal...

Read More »Triple Header!

With the release of the Labor government’s Electric Vehicle policy and the Reserve Bank Review, as well as my semi-regular column for Independent Australia, I’ve been pretty busy this week. I haven’t got time to summarise them now, so I will just provide links. Quiggin, J. (2023) Electric vehicles: Time to get out of the slow lane. Inside Story 20 April, Quiggin, J. (2023) The RBA review ignores the global failure of inflation management to prevent financial chaos. The Guardian...

Read More »Potential of government money creation

Potential of government money creation

Read More »Links — 20 April 2023

Sixth Tone (China)AI Is Starting to Replace Humans in China’s Creative SectorYe ZhanhangSixth Tone (China)Can Work Survive the ChatGPT Era?Yu Mingfeng, associate professor of philosophy at Tongji University in ShanghaiCaitlinJohnstone.com (Australia)Tech Would Be Fine If We Weren’t Ruled By Monsters: Notes From The Edge Of The Narrative MatrixCaitlin Johnstone Southfront (sanctioned by the US Treasury Department)How Can I Use The Digital Yuan With Ease?Katehon (Russia)Limits To Supply Chain...

Read More »$255 bln tax drain so far this month.

I still think the market is holding up well in spite. Looks like early to mid-May as the beginning of a rebound. But there's still the debt ceiling to worry about.

Read More »The Keynesian revolution and the monetarist counter-revolution

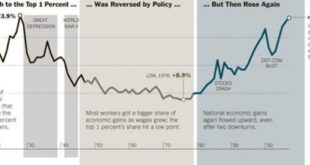

from Asad Zaman and RWER current issue The intimate connection between economic theory and political power is clearly illustrated by the rise and fall of Keynesian Economics in the 20th Century. Confidence generated by theories glorifying the workings of a market economy led leading economists to predict permanent prosperity, just prior to the Great Depression of 1929. After the crash, Keynes set out to resolve the most glaring contradiction between economic theory and reality. While...

Read More »Distributive Conflict and the “New” Inflation

[embedded content]Franklin Serrano on inflation (in Portuguese). More or less what I have been saying on the issue, with some interesting discussions on the changes in the New Consensus Model, and the changing views of some of the key authors like Larry Summers.

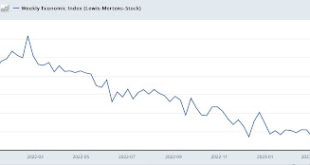

Read More »Coincident indicators hold on, mainly due to improvement in gas prices YoY

Coincident indicators hold on, mainly due to improvement in gas prices YoY – by New Deal democrat I’ve been paying particular attention lately to the coincident indicators, because the leading indicators have telegraphed a recession for about half a year – so why isn’t it here yet??? A good representation of coincident indicators remaining positive is the Weekly Economic Index of the NY Fed: It looked on track to turn negative at the...

Read More » Heterodox

Heterodox