Still looks to me like the vote will have no material financial consequences? “The UK will have to renegotiate 80,000 pages of EU agreements, deciding those to be kept in UK law and those to jettison. British officials have said privately that nobody knows how long this would take, but some ministers say it would clog up parliament for years.” As previously discussed, the drop in oil prices led to increased consumer imports and reduced exports, both of which fundamentally...

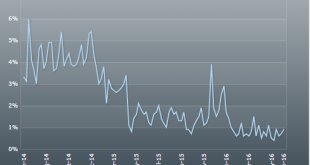

Read More »Credit check, Comments on the great moderation

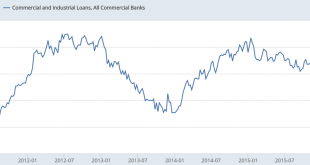

Gradual deceleration looks to be continuing:Growth here had been increasing, helping to offset the decline in govt. deficit spending, but after the oil capex collapse this measure of credit growth leveled off:Real estate as well as consumer loan growth have also leveled off:This story is all about income here as well. The consumer has been hit hard twice due to the recession and then tax hikes and it’s all ratcheted down a notch each time. Even in the prior recession personal...

Read More »June car sales forecasts, Philly Fed recession indicator

Looks like another small decrease as the deceleration continues: Vehicle Sales Forecasts: Sales to be Over 17 Million SAAR again in June By Bill McBride June 24 (Calculated Risk Blog) — The automakers will report June vehicle sales on Friday, July 1st. Note: There were 26 selling days in June, up from 25 in June 2015.From WardsAuto: Forecast: June Sales to Reach 11-Year High A WardsAuto forecast calls for U.S. automakers to deliver 1.57 million light vehicles this month....

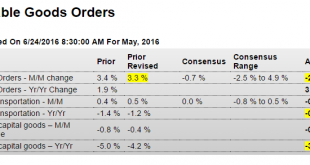

Read More »Durable goods orders, Consumer sentiment, UK comments

Weaker than expected, and turns out it was up in April followed by down in May as previously discussed: HighlightsMay proved to be a generally weak month for the factory sector. Minus signs spread across the durable goods report with total new orders down a very sizable 2.2 percent and ex-transportation orders, which exclude aircraft and vehicles, down 0.3 percent. The worst news comes from capital goods, a sector where weakness points to weakness in business investment and...

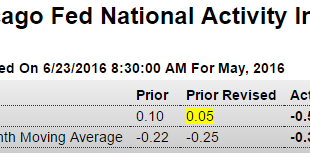

Read More »Chicago Fed, New home sales, Architecture Billings Index

Remember the enthusiasm around last month’s move up? As suspected, it’s reversed and the 3 month average remains negative: HighlightsMay was a weak month based on the minus 0.51 result for the national activity index, one that drives the 3-month average to a minus 0.36 level consistent with below average growth. Production, not employment, is by far the weakest component in May, at minus 0.32 and reflecting contraction in industrial production and factory utilization....

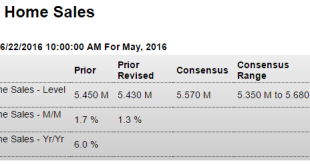

Read More »Mtg purchase apps, Existing home sales

HighlightsDespite another fall in rates, the purchase index is not pointing to acceleration for home sales, down 2.0 percent in the June 17 week with year-on-year growth slowing 4 percentage points to 12 percent. Low rates, however, are an immediate plus for refinancing where the index rose 7.0 percent. And rates are indeed low, at an average 3.76 percent for conforming loans ($417,000 or less) which is down 3 basis points in the week and at its lowest since May 2013. Not...

Read More »Chemical activity barometer, Fed Atlanta job tracker, Recession article

Looks to me like it’s still decelerating? From the American Chemistry Council: Chemical Activity Barometer Continues Solid Growth in June; Signals Higher U.S. Business Activity Through End Of The YearRead more at http://www.calculatedriskblog.com/#fcgmQuzJH31oFHbc.99 Wage ‘pressures’ indicators, after all this time, are finally moving up towards what would have been considered historically very low levels, so time to slam on the brakes? (Not that rate hikes are slamming on...

Read More »Redbook retail sales, Help wanted index, Job openings, Port traffic

Still nothing happening here:More imports, fewer exports:

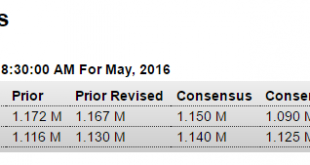

Read More »Housing starts, Beijing bans iPhone 6

Not good. Note from the chart how growth has stalled, and housing is not likely to add as much to GDP this year as it did last year: HighlightsHousing starts are solid but not permits. Starts did slip 0.3 percent to a 1.164 million annualized rate in May but the trend is positive with the year-on-year gain at a very strong 9.5 percent. Permits, in contrast, popped 0.7 percent higher in the month to a 1.138 million rate but here the year-on-year rate remains deep in the...

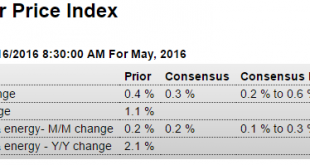

Read More »CPI, US current account, Philly Fed, Housing market index, Wage data

Continues well below the Fed’s target: HighlightsWhatever pressure may be building in import & export prices or even producer prices, it has yet to give much of a boost to consumer prices which rose only 0.2 percent in May. Core prices, that is prices excluding food and energy, also came in at plus 0.2 percent.Year-on-year rates aren’t going anywhere, at only plus 1.0 percent for total prices and plus 2.2 percent core prices. Though the 2.2 percent rate does exceed the...

Read More » Mosler Economics

Mosler Economics