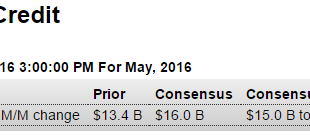

Still decelerating on a year over year basis: United States Consumer Credit ChangeConsumer credit in the United States increased by $18.56 billion in May 2016 following a downwardly revised $13.4 billion rise in April and above market expectations of a $16 billion gain. This was decelerating and below stall speed when the boom in oil capex reversed that trend early in 2014. Then in late 2014 oil capex collapsed and bank lending growth reversed and resumed its deceleration:...

Read More »Employment, Bank losses, German Banks

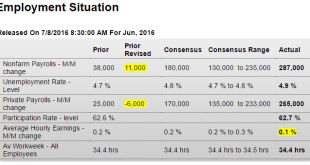

Nice rebound as Verizon workers return to work, but the year over year deceleration continues and, of course, this number will be revised next month. And the lower average hourly earnings gains could put off fears of the US turning into Zimbabwe and Weimar for several hours: The payroll gain in June is what is striking in this report. Yet smoothing the big ups and downs, second-quarter payroll growth averaged a monthly 147,300 vs a more substantial 195,700 in the first...

Read More »Unemployment claims, Online help wanted ads, Italian bank comment

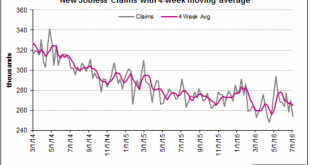

Record lows, particularly population adjusted, for record periods of time, and no one even suggests it might be because they’ve become that much harder to get? Meanwhile, the consequence is less govt. spending than otherwise potentially making this recession that much worse: Note the peak was just after oil capital expenditures collapsed: The Italian bank crisis isn’t going away. There is no way under current policy to recapitalize. The EU considers any funds from the...

Read More »Trade, PMI services, ISM non manufacturing, Atlanta Fed

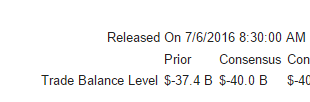

More weakness: HighlightsThere is some weakness in the May trade report as the nation’s trade deficit widened sharply to $41.1 billion from April’s $37.4 billion. The net deficit for goods widened to $62.2 billion from April’s $58.6 billion while the net surplus for services narrowed slightly to $21.1 billion. In a negative indication on global demand, exports of both goods and services fell slightly in the month. But in a positive indication on domestic demand, imports rose...

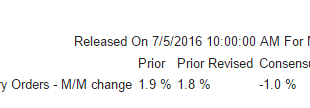

Read More »Factory orders, Small business borrowing, NY business conditions, Shadow lending, US jobs diffusion index

Worse than expected as another April gain reverts in May: US Factory Orders Fall More Than Expected New orders for manufactured goods shrank 1% mom in May, compared to a downwardly revised 1.8% gain in April. Figures came slightly worse than market expectations of a 0.9% drop. Meanwhile, orders for non-defense capital goods excluding aircraft fell 0.4%, lower than a 0.7% drop in April and excluding transportation, factory orders edged up 0.1%.HighlightsMay was a weak month...

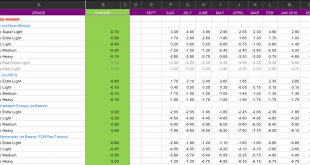

Read More »Saudi pricing, UK construction

Looks like prices a bit higher for Europe and lower for the rest? Market price action over the next few weeks will tell us if this works to lower prices:This was before the Brexit vote:

Read More »PMI manufacturing, ISM manufacturing, Construction spending, China PMI, Manhattan apartment sales

Manufacturing historically just chugs along at maybe a 3% growth rate or so. However as oil capital expenditures collapsed, manufacturing ratcheted down accordingly. And now it looks like it may be resuming it’s traditional modest growth rate from a much lower base than otherwise. This is not to say that the reduction in spending on capex is being replaced, as the spending deficiency now continues after having spread to the (much larger) service sector. Still on the low...

Read More »Chicago PMI, Restaurant performance index, Brexit comment

Nice move higher in this highly volatile series. Employment however, moved lower as it has in most surveys: HighlightsVolatility is the name of the game when it comes to the Chicago PMI which surged in June to a 56.8 level that is far beyond expectations and follows a sub-50 contractionary reading of 49.3 in the May report. And there was no indication in the May report of the strength to come as both new orders and backlog orders were in outright contraction. But that was for...

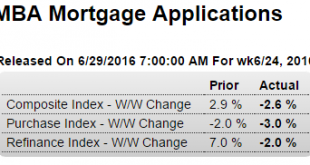

Read More »Mtg purchase apps, Personal income and spending, Pending home sales, US oil production, Atlanta Fed

Continues to decline and now down for the month: HighlightsThe lowest mortgage rates in three years are not causing much of a stir in purchase applications for home mortgages, down 3 percent in the June 24 week for the third weekly decline straight. The year-on-year increase in purchase applications volume is a still very strong 13 percent, though far below the 30 percent gains seen in March. Even mortgage refinancing activity abated, down 2.0 percent after rising 7 percent...

Read More »Redbook retail sales, Q1 corporate profits revision, Q1 GDP revision, Brexit chart, Richmond Fed, Consumer confidence

Still at recession levels: HighlightsCorporate profits sank in the first quarter, revised to minus 2.3 percent year-on-year vs the initial estimate of minus 3.6 percent. Profits are after tax without inventory valuation or capital consumption adjustments. Revised up mainly due to residential investment, which isn’t looking so good in q2. And the downward revision to personal consumption weakens the ‘resilient consumer’ narrative, especially with employment softening in q2....

Read More » Mosler Economics

Mosler Economics