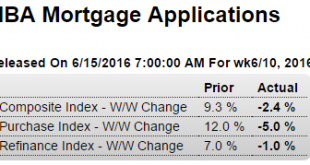

Purchase applications backed off but have been moving higher for several months, though still very depressed:A nice move up but as per the chart it’s hovering around 0:Worse than expected, and continues at recession levels, and note the decline in autos:HighlightsA steep drop in vehicle production pulled industrial production lower in May, down 0.4 percent. Vehicle production had been leading this report but fell 4.2 percent in the month excluding which the headline loss...

Read More »Saudi output, Fed Atlanta, NY Fed GDP forecast, Credit card company sell off

Saudi output hasn’t materially changed. The previous strategy was to set the price low enough for output to increase. So seems the new oil minister has changed course is now setting price as high as he thinks he can set it without triggering development of higher priced oil.Let me suggest this GDP ‘forecast’ is about as high as it gets before substantially falling back, as it did last quarter. This is because it is an account of what’s happened in April and May based on...

Read More »NFIB Small Business Optimism Index, Retail sales, Redbook retail sales, Business inventories

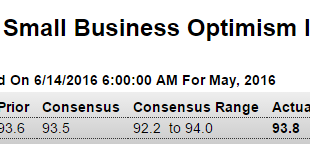

The charts of all the components look just as bad.And note the collapse after oil capex collapsed:HighlightsThe small business optimism index rose 0.2 points in May to 93.8, slightly extending April’s 1 point bounce back from 2-year lows but remaining well below the 42-year average of 98. Four of the 10 components of the index showed gains in May, two were unchanged and four declined. Expectations that the economy will improve posted the largest gain, rising 5 points but...

Read More »Rail traffic, Employment agency chart, growth vs cost cutting chart

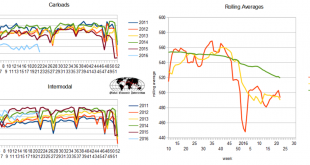

Rail Week Ending 04 June 2016: Rail Contraction Accelerates By Steven HansenJune 10 (Econintersect) — Week 22 of 2016 shows same week total rail traffic (from same week one year ago) contracted according to the Association of American Railroads (AAR) traffic data. The improvement seen last week evaporated, and was likely due to the a holiday falling into different weeks between years. And this indicator: Cost cutting likewise reduces income:

Read More »JOLTS, Unemployment claims, Wholesale inventories and Sales

The deceleration in jobs openings released yesterday leads the deceleration in employment. Downward job revisions also mean lower income estimates, so watch for personal income and savings to be revised down as well. And it all started decelerating after oil capex collapsed at the end of 2014. Job Openings Hit Record High, But Hiring Fades In JOLTS Survey By Ed CarsonJune 8 (IBD) — Job openings matched a record high in April but hiring activity sank to the lowest since last...

Read More »Tax receipts

Mtg purchase apps, Productivity, Unemployment survey, Article submitted

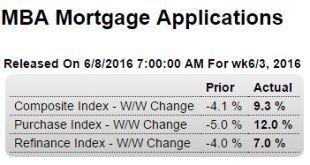

From the MBA: The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 12 percent from one week earlier. The unadjusted Purchase Index decreased 12 percent compared with the previous week and was 6 percent lower than the same week one year ago. HighlightsPurchase applications for home mortgages rose strongly in the June 3 week and were up 12 percent from the prior week when seasonally adjusted to account for the...

Read More »Saudi pricing, Consumer credit, Redbook retail sales, Fed discussion

Lower than expected as last month’s higher print reverses. Remember all the hoopla over last month’s number? And how the consumer was finally spending? I suspect you’ll hear nothing about how that’s not the case after all, and note how the chart shows it’s been decelerating since the collapse of oil capex: Consumer Credit Released On 6/7/2016 3:00:00 PM For Apr, 2016 HighlightsApril was a strong month for retail sales but it wasn’t an especially strong one for consumer...

Read More »Fed’s labor market index, Saudi price hikes

This went from bad to worse but they don’t seem to pay much attention to it: Labor Market Conditions IndexHighlightsLast week’s employment report was very weak and is reflected in May’s labor market conditions index which came in at minus 4.8 for the fifth straight negative reading and the lowest of the economic cycle, since May 2009. April is revised 2.5 points lower to minus 3.4 which, next to May, is the second lowest of the cycle. These readings point to a fundamental...

Read More »Employment report, PMI services, ISM non manufacturing, Factory orders

Continuing to decelerate. As previously discussed, I see no chance of a reversal until deficit spending- public or private- picks up to offset the unspent income/savings desires: Employment SituationHighlightsThe assessment of the labor market, not to mention the outlook for consumer spending, just came down as nonfarm payrolls proved much weaker than expected in May, up only 38,000 with the two prior months revised a total of 59,000 lower. The Verizon strike is a negative in the data but...

Read More » Mosler Economics

Mosler Economics