The setbacks continue: As is the general case, this indicator rose with the oil capex boom then peaked with the collapse in oil capex, and remains in negative territory: Same here. Peaked when the oil capex boom ended and the 3 month average is still in negative territory: A bit better than expected for the month, but the year over year rate declined: This NY state revenue report is few weeks old:...

Read More »Mtg purchase apps, Gallup index, Euro area current account

Down again, and you can see from the chart that it’s most recently gone flat after ramping up a bit: Just another index that headed south after the collapse in oil capex: The euro area current account surplus continues to trend higher: Euro Area Current Account The current account surplus in the Eurozone came in at €15.4 billion in May of 2016 compared to an €8.4 billion surplus a year earlier. The goods surplus widened 16 percent to €31.1 billion while the services one...

Read More »Housing starts, Redbook retail sales, Comments on low rates

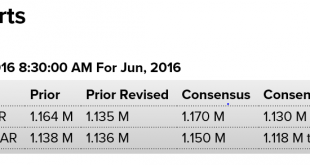

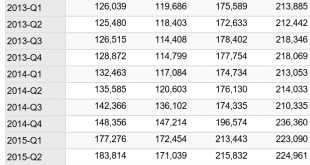

Last month’s downward revision and the drop in permits make this report particularly negative. Again, looks like housing will be a drag on growth this year vs last year: Still trending from bad to worse: With the govt a net payer of interest, rate cuts reduce total interest income for the economy by that amount. But some of the effects are lagged, as indicated below, and are therefore still ongoing, as lower pension returns often result in higher contributions and lower...

Read More »SNB, Homebuilder optimism, Corporate profits, Morgan Stanley cartoon

It looks like the SNB (Swiss National Bank- the central bank) has been building $ reserves faster than euro reserves, which has worked to support the $ vs the euro. That is, when they were buying euro to keep their currency down they were selling quite a few of those euro for $ to keep their portfolio ‘balanced’. And for the last two quarters reported below, $ holdings went up about 12.5 billion while euro holding fell by about 4 billion, which means the shifting is...

Read More »CPI, retail sales, Empire State Mfg, Industrial production, Business inventories, Consumer sentiment, JPM earnings, UK comment, China comment

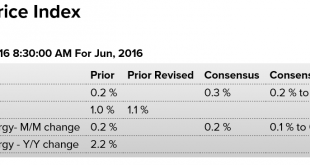

A bit less than expected- nothing to cause the Fed to be alarmed. You’d think that by now they’d realize that all that rate cutting and so called ‘money printing’ has nothing to do with the price level or ‘accommodation’…: Highlights Price pressures evident the last two months down the supply chain are not yet appearing in consumer prices where the CPI rose only 0.2 percent in June for a weak year-on-year rate that is not going in the right direction, at plus 1.0 percent vs...

Read More »Treasury budget, Air freight index, Atlanta Fed

It was previously noted that Treasury revenue was down, which now is confirmed in this report. This is the beginning of the automatic fiscal stabilizers at work, where weakness translates intoa larger federal deficit, and persists until deficit spending is sufficient to more than offset unspent income, as is necessary for growth. Private sector deficit spending would also restore growth. However I see only private sector credit growth deceleration, which is generally the...

Read More »Oil prices, Regional feds, Long term deficit forecasts, China trade

A few weeks ago I posted the announcement of Saudi price cuts, suggesting this could be meant to bring down prices, which now seems to be happening: Again, with no loan demand, they are calling for higher rates, presumably to slow down lending: Six Fed banks called for discount rate hike: minutes By Lindsay Dunsmuir July 12 (Reuters) — The number of regional Federal Reserve banks pushing the central bank to raise the rate it charges commercial banks for emergency loans rose...

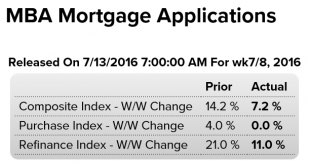

Read More »Mtg purchase apps, EU deficit limits, Wholesale sales, New home sales per capita

Unchanged from last week as modest growth from very low levels continues: The seasonally adjusted Purchase Index was unchanged from one week earlier. The unadjusted Purchase Index decreased 20 percent compared with the previous week and was 5 percent lower than the same week one year ago. Last year, the Fourth of July fell on the prior week.Read more at http://www.calculatedriskblog.com/#sQ3JkrmqGOvif9t3.99 So now that they know larger deficits are better for an economy, why...

Read More »Small business index, Redbook retail sales, Wholesale trade, Jolts

Up a bit, but still weak and in a downtrend, and employment declining: HighlightsThe small business optimism index rose 0.7 points in June to 94.5, the third monthly increase since falling to a 2-year low in March. The improvement in small business optimism slightly exceeded expectations, though the index remains in the downtrend in place since the 100.4 recovery peak set in December 2013 and below the 42-year average of 98. Four of the 10 components of the index posted...

Read More »Fed’s labor market conditions index, Tax revenues

Not good: Not a good sign when tax revenue growth decelerates like this:

Read More » Mosler Economics

Mosler Economics