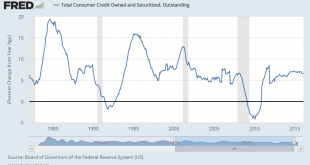

There are a few slots still open: Audience with Warren Mosler Not much happening here. Certainly no signs of any kind of a consumer spending boom,and it’s been decelerating some for the last year or so:

Read More »Purchase apps, Jobless claims

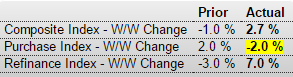

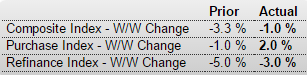

Reversed last weeks gain, and year over year gain down to 11% and falling rapidly towards 0: MBA Mortgage Applications Claims remain depressed, but it’s becoming more clear that the reason is difficulty in obtaining them, rather than an indication of a ‘healthy jobs market’:

Read More »US Gasoline demand, Non manufacturing and Employment index, Bank loans

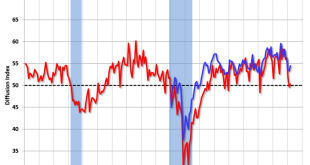

U.S. gasoline demand, one of the strongest pillars supporting oil consumption, fell in January for the first time in 14 months, U.S. Energy Information Administration data showed. Below growth rates that marked prior recessions:

Read More »ECB footnote, Trade, Fed Atlanta, Redbook retail sales, ISM non manufacturing

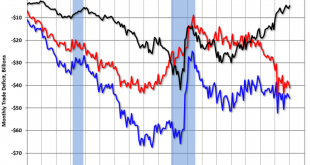

Who would’ve thought?;) The ECB makes this point in a footnote on page 10: The ECB Explains Why Central Banks Can’t Go Bankrupt in a Footnote “Central banks are protected from insolvency due to their ability to create money and can therefore operate with negative equity.” Trade deficit higher than expected. GDP estimates being revised down: International Trade And note the general downturn in trade which has always been associated with recessions in the past:GDP growth forecast down to...

Read More »Core capital goods, Euro

How bad does this look? If it was adjusted for inflation it would look even worse:QE, negative rates, easing bias vs the Fed in hiking mode, and the euro is going up anyway? Seems the ECB and euro area exporters might be getting concerned?

Read More »Labor market index, Factory orders, Durable goods

The Fed’s labor market index is showing some slack: Labor Market Conditions IndexHighlightsEmployment has been strong, especially the participation rate, but isn’t being reflected in the Federal Reserve’s labor market conditions index which came in at minus 2.1 in March vs a downwardly revised 2.5 percent decline in February. The index, experimental in nature, is a broad composite of 19 separate indicators and is rarely cited by policy makers. Another bad one, on the heels of very weak...

Read More »Car sales, Employment, Construction spending, Earnings, ISM manufacturing, Consumer sentiment

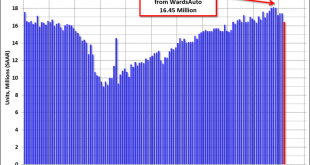

This is the big news today, and there’s nothing good about it. It’s way below expectations and continues the declilne from last year’s peak: U.S. Light Vehicle Sales decline to 16.45 million annual rate in Marchby Bill McBrideBased on an estimate from WardsAuto, light vehicle sales were at a 16.45 million SAAR in March.That is down about 4% from March 2015, and down about 6% from the 17.43 million annual sales rate last month. A bit better than expected, and, again, the growth rate (though...

Read More »Mtg purchase apps, ADP, Fed comment

Sorry, wrote this up yesterday and never sent it. Purchase apps remain depressed, though a bit off the bottom, and depressed housing sales reports indicate the growth in mtg purchase apps is more about how purchases are financed rather than an indicator of total home purchases: MBA Mortgage ApplicationsHighlightsPurchase applications for home mortgages rose by 2 percent in the March 25 week, with the year-on-year increase continuing very strong at 21 percent. Refinance applications declined...

Read More »Jobless claims, Job cut report, Chicago PMI, S&P earnings, High yield issuance

While claims are historically at record lows on a per capita basis, because they are now so hard to get the fact that they are rising some might mean something, but maybe not:Job cuts also look like they are trending a bit higher as well:Note how the chart shows this indicator has been zig zagging lower, so we’ll have to wait until next month to see if it zigs back down again: Chicago PMIHighlightsExpansion is March’s score for the often volatile Chicago PMI which surged 6 full points to a...

Read More »$ story

So well over a year ago the dollar started going up based on falling oil prices, which I suggested was a mistake. That was because it seemed to me that this time around the falling price of oil was not likely to lower the US current account deficit the way lower oil prices have lowered it in the past. I suggested two reasons. First, US production was likely to go down and therefore oil imports would rise, offsetting much of the price drop. Second, US exports to oil producers were likely to...

Read More » Mosler Economics

Mosler Economics