The housing depression continues: Existing Home SalesHighlightsHousing demand continues to soften with existing home sales down a surprising 7.1 percent in February to a 5.080 million annualized rate. This is much lower than expected and well below Econoday’s low estimate for 5.200 million and is the second lowest rate since February last year. The report is weak throughout with single-family sales down 7.2 percent, at 4.510 million, and condos down 6.6 percent at 570,000. All regions show...

Read More »My WRKO interview today, Consumer Sentiment, Rail traffic, Fed’s Bullard on rates

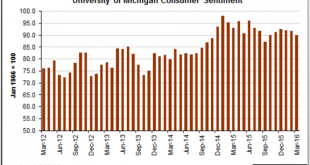

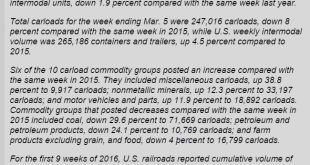

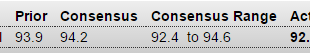

WRKO Interview Still drifting lower: US Consumer Sentiment at 5-Month LowThe University of Michigan’s consumer sentiment for the United States came in at 90 in March of 2016 from 91.7 in the previous month and hitting its lowest reading since October 2015, as both future expectations and current conditions deteriorated sharply. Markets were expecting the index to rise to 92.2. Rail Week Ending 12 March 2016: Rail Returns To Its Slide Into The Abyss Week 10 of 2016 shows same week total...

Read More »Philly Fed, Norway, Current account, JOLTS, Euro

A nice positive print that hopefully signals a turn around, but I need to see at least one more before taking it seriously, as volatility is common with this series:More negative than expected means a downward adjustment for GDP, as do downward revisions of prior prints: Current AccountHighlightsThe nation’s current account deficit narrowed in the fourth quarter to $125.3 billion from a revised third-quarter deficit of $129.9 billion. The improvement reflects a smaller trade deficit for...

Read More »Mtg prch apps, CPI, Housing starts, Industrial production

Working their way a bit higher but still seriously depressed:With the year over year CPI increase now only 1% the Fed can only wait and see if headline will catch up to core and ‘justify’ their tightening bias. Consumer Price IndexHighlightsThe CPI core is showing pressure for a second month, up a higher-than-expected 0.3 percent in February with the year-on-year rate up 1 tenth to plus 2.3 percent and further above the Federal Reserve’s 2 percent line.Gains are once again led by health...

Read More »Retail sales, Redbook retail sales, Housing index, Business inventories and sales, Empire manufacturing, MEW, Atlanta Fed

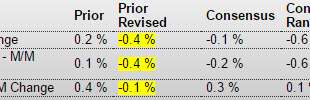

Just plain bad. Including last month’s downward revision. And, again, sales = income, and lower income means less to spend in the next period: Retail SalesHighlightsConsumer spending did not get off to a good start after all in 2016 as big downward revisions to January retail sales badly upstage respectable strength in February. January retail sales are now at minus 0.4 percent vs an initial gain of 0.2 percent. The two major sub-readings also show major downward revisions with ex-auto...

Read More »Rail traffic, Restaurant index, Import and export prices

Rail Week Ending 06 March 2016: Worse Than Last Week Week 9 of 2016 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic continued to improve year-over-year, which accounts for approximately half of movements but the weekly railcar counts remained in contraction. Relatively speaking, this week was worse than last week, and the improvement seen last week is fading. Up a bit in...

Read More »Commercial real estate, Restaurant index

U.S. Commercial Property Prices Drop for First Time in Six Years By Kara WetzelMarch 7 (Bloomberg)Values fell 0.3% in January from prior month, Moody’s says.Decline is `significant milestone’ showing shift in sentimentU.S. commercial real estate prices dropped in January for the first time since 2010, a sign of weakening demand by investors after a six-year rally that pushed values to records.The Moody/RCA Commercial Property Price Index slipped 0.3 percent from December, Moody’s Investors...

Read More »Wholesale trade

As previously discussed, GDP was only as high as it was due to increases in unsold inventory- not good! Wholesale TradeHighlightsWholesalers had been keeping their inventories down as sales have slowed but they got behind in January. Inventories rose 0.3 percent in the month which isn’t alarming in itself but relative to sales, which fell 1.3 percent, inventories look heavy. The stock-to-sales ratio rose two notches to 1.35 from 1.33 for the highest reading of the recovery, since April...

Read More »NFIB index, Redbook retail sales

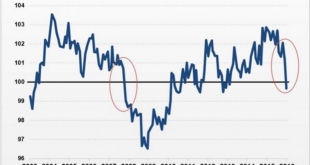

Tough to give this a positive spin… And note the downward slope of the chart, as weakness continues to spread from oil capex to the rest of the economy: NFIB Small Business Optimism IndexHighlightsThe small business optimism index slipped 1 point in February to 92.9, a 2-year low that reflects incremental declines across six of 10 components. The report’s two employment components both inched 1 point lower with plans to increase employment still at a positive reading of 10 and job openings...

Read More »Consumer Credit, Lumber prices, Inventories

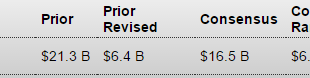

Another weak number, and the series was revised as well. And for GDP to grow the same as last year, all the ‘pieces’ have to grow the same, and this one isn’t keeping up: Consumer CreditHighlightsBreaks in the consumer credit series, due to changes in source data or methodology, are not uncommon, leading to sudden swings such as in mid-2011. Such a break is responsible for a big revision to December, now at a revised increase of $6.4 billion from an initial $21.3 billion. The revision is...

Read More » Mosler Economics

Mosler Economics