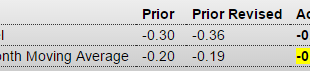

Still negative: Chicago Fed National Activity IndexHighlightsDecember was a weak month for the U.S. economy but a little less weak than November, based on the national activity index which improved to minus 0.22 from minus 0.36 (revised lower from minus 0.30). The improvement is centered in the production component as contraction in industrial production eased to minus 0.4 percent from November’s very deep minus 0.9 percent. Other components were steady with sales/orders/inventories and...

Read More »Claims, Philly Fed

Possible bottom and now moving higher:This month’s negative reading doesn’t look so bad because the revised last month’s down so much…;) Philadelphia Fed Business Outlook SurveyHighlightsThe factory sector continues to slow this month though, in good news, the rate of contraction is flattening out. The Philly Fed’s general business conditions index for January is minus 3.5, a little better than the Econoday consensus for minus 4.0 and the best reading since all the back in August. The new...

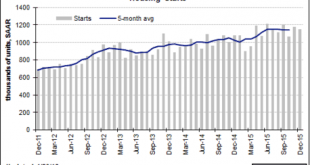

Read More »Housing starts, Mtg purch apps

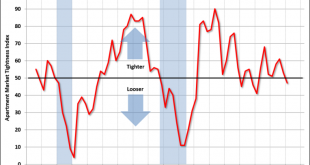

Looks to have stopped growing about 10 months ago:Remains seriously depressed: MBA Mortgage Applications

Read More »Holiday sales, Atlanta Fed, Freight transport index

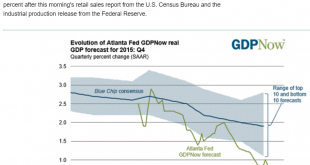

Not long ago they blamed cold weather, now it was the warm weather. And this time not a word about the consumer not spending his gas savings…;) Holiday sales fall short of forecasts: NRF Jan 15 (CNBC) — The National Retail Federation said Friday that holiday sales increased 3 percent to $626.1 billion in November and December, falling short of the trade group’s forecast for 3.7 percent growth, as unseasonably warm weather and low prices weighed on results.The news came shortly after the...

Read More »Fed comment, Retail sales, Empire State Manufacturing, Industrial production, Business inventories, Consumer sentiment

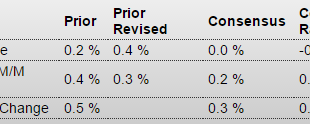

Looks like the Fed hiked during a recession. Should make for interesting Congressional testimony… Maybe the hundreds of $ millions they spend on economic research isn’t enough???;) Sales remain at recession levels: Retail SalesHighlightsRetail sales proved disappointing in December, down 0.1 percent in a headline that is not skewed by vehicles or even that much by gasoline. Ex-auto sales also fell 0.1 percent while the core ex-auto ex-gas reading came in unchanged which is well below both...

Read More »Apartment market tightness, Euro area trade surplus, Spain

This just keeps going up, which fundamentally tends to drive up the euro which tends to continue to be subject to said upward pressure until the trade picture reverses: Euro Area Balance of TradeThe Eurozone trade surplus increased to €23.6 billion in November of 2015 compared to a €20.2 billion surplus a year earlier. Exports recorded the highest annual gain in four months and imports rebounded. Potential showdown that could drive up Spanish rates: Guindos Ditches Pledge on Spain...

Read More »ECB, Fed, Rail traffic

Looks like they are again making hawkish noises, taking the lead of the Fed: ECB wary of further action despite uncertain future By: Balazs Koranyi and John O’DonnellJan 14 (Reuters)* Many governors sceptical of need for further action in near term* Governors urge countries to act instead with reform* Oil price and inflation expectations:Many European Central Bank policy makers are sceptical about the need for further policy action in the near term, conversations with five of them indicate,...

Read More »Mtg purchase apps, China trade

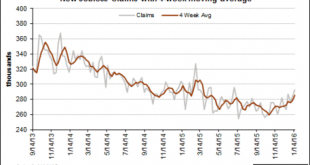

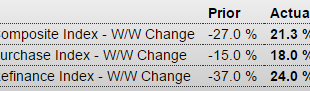

Lots of up and down right now. The chart indicates purchase apps may be up a bit but still depressed historically. MBA Mortgage ApplicationsHighlightsThe new year is seeing a surge in mortgage activity reflecting a strong jobs market and low rates, according to the Mortgage Bankers Association’s weekly report. Purchase applications surged 18 percent in the January 8 week with refinancing applications up 24 percent. These gains, however, also reflect volatility in weekly measures and largely...

Read More »Weather comment, oil capex reductions, NFIB small business index

This time the warm weather is cited for the weakness as utility spending fell. Yes, capitalism is about sales, and unspent income reduces sales, unless other agents spend more than their income, etc. etc. And with the private sector in general necessarily pro cyclical, unspent income stories beg fiscal adjustments, which at the moment are universally out of style. U.K. Industrial Output Plunges Most in Almost Three Years By Jill WardJan 12 (Bloomberg) — UK industrial production fell the...

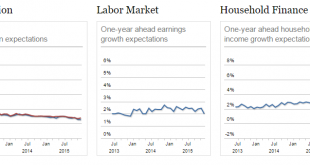

Read More »EU growth, NY Fed consumer survey

A bit of growth in the EU supported by the low euro from the CB euro selling and consequent trade/current account surplus. However, without ECB euro selling the fundamentals will inevitably firm the euro until that growth component ceases. But meanwhile, watch for signs of ECB hawkishness: Ever so slowly, the euro zone economy awakes By Jeremy GauntJan 10 (Reuters) — Economic growth was running at an annual rate of 1.6 percent in the third quarter, roughly twice the average annual growth...

Read More » Mosler Economics

Mosler Economics