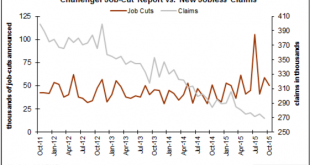

Down a bit but still trending higher since the oil price collapse: Seems she still doesn’t realize negative rates are just another tax: FED’S YELLEN: IF ECONOMY SIGNIFICANTLY DETERIORATED, NEGATIVE RATES AND OTHER TOOLS WOULD BE ON THE TABLE This implies the rest of Saudi pricing remains the same from November, when discounts to benchmarks were substantially increased. In general, discounts have been increased over the last few months: Saudi Arabia, the world’s largest oil exporter,...

Read More »Saudi Output, Mtg Purchase Apps, NY ISM, ADP, International Trade, PMI services, ISM Non-manufacturing, Motor Vehicle Sales

If the Saudis are looking to pump more seems they have to continue to lower prices:Sure looks like housing still can’t get out of its own way: MBA Mortgage ApplicationsHighlightsMortgage applications are settling down after spiking and dipping sharply in volatility tied to new disclosure rules put in place last month. Both the purchase and refinance indexes fell an incremental 1.0 percent in the October 30 week with the purchase index up a very solid 20 percent year-on-year. Rates were...

Read More »Crude Oil, Euro, Opec Spending Cuts

So when the Saudis widened their discounts on October 5 it looked to me like they were inducing a downward price spiral that would continue until either they altered pricing or their output increased to full capacity so they couldn’t sell any more at those discounts. So far neither has happened: Fundamentally the euro also looks very strong to me, with a large and rising trade surplus vs a rising trade deficit for the US, and negative rates and QE ultimately further remove euro income from...

Read More »Atlanta Fed, German Engineering Orders, Misc News, Redbook retail sales, North Dakota, Factory orders

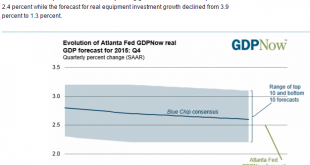

Down to 1.9 for Q4, after being very close for Q1, Q2 and Q3: German Engineering Orders Hit by Lower Demand From China By Nina AdamNov 2 (WSJ) — Germany’s VDMA engineering federation said Monday that its “plant and machinery makers are battling against global markets’ adversities.” German mechanical engineering orders slumped 13% year-over-year in September, hit by a 18% drop in foreign demand. Foreign orders from outside the eurozone were down 7% in the nine months through September from...

Read More »Draghi Comments, Global Comments

ECB will do what is needed to keep inflation target on track: Draghi By Stephen JewkesOct 31 (Reuters) — “If we are convinced that our medium-term inflation target is at risk, we will take the necessary actions,” ECB president Draghi told Il Sole 24 Ore. “We will see whether a further stimulus is necessary. This is an open question,” he said, adding it would take longer than was foreseen in March to return to price stability. Draghi said inflation in the euro zone was expected to remain...

Read More »Health Care Expenditures, ISM Manufacturing, Construction Spending

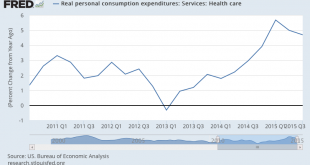

My understanding is that this series includes premiums paid for health insurance and so GDP has gotten a one time boost from from the newly insured who are now paying insurance premiums via the affordable care act. So Q4 should see another reduction and growth and a lower contribution to GDP growth:This kind of personal consumption collapsed with the collapse in oil prices and oil capex: This is for September, and is slowing as previously discussed after permits peaked in June with the...

Read More »The scrap heap of capitalism

Capitalism has always been characterized by a massive scrap heap of failures. Not to say the ‘winners’ don’t make it all worthwhile!;) Why technology spending isn’t all its cracked up to be: Study By Javier E. DavidOct 31 (CNBC) — Large companies often spend a good deal of money on cultivating their technology, but a new study suggests nearly 70 percent of what they spend may be misallocated.In a study, Genpact Research Institute recently found that, of nearly $600 billion spent on digital...

Read More »Brent Spot Chart, China, Atlanta Fed

Looks a lot more negative since the October 5 Saudi price cuts than the futures markets. These price are more indicative of prices of physical oil vs financial portfolio activities:Note the lack of results of ‘monetary policy’: China’s October factory, services surveys show economy still wobbly Nov 1 (Reuters) — Activity in China’s manufacturing sector unexpectedly contracted in October for a third straight month, an official survey showed on Sunday, fuelling fears the economy may still be...

Read More »Rail traffic, Personal Income, Credit Check

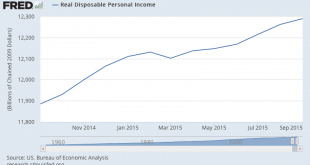

Rail Week Ending 24 October 2015: A Worse Week Among Bad Weeks Week 42 of 2015 shows same week total rail traffic (from same week one year ago) and monthly total rail traffic (from same month one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic contracted year-over-year, which accounts for approximately half of movements. and weekly railcar counts continued in contraction. See how the growth rate slowed down just before year...

Read More »Personal Income and Outlays, ECI, Chicago PMI, Consumer Sentiment, GDP related

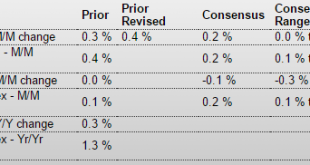

Income and spending and pricing low and lower than expected: Personal Income and OutlaysHighlightsInflation is not building based on the Fed’s favorite reading, the core PCE price index which inched a lower-than-expected 0.1 percent higher in September with the year-on-year rate steady and flat at only plus 1.3 percent. These results will not lift the odds for a December hike at the next FOMC.Income and spending data also came in below expectations, at plus 0.1 percent each vs expectations...

Read More » Mosler Economics

Mosler Economics