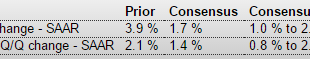

A weak number and Q4 not looking so good either. Domestic spending decelerating as incomes fade from reduced capex. Slowing investment, weak exports, and inventory reductions should also continue into Q4 as top line growth continues to fade. And lower prices speak to lower demand. Vehicle sales also looking to slow into Q4 as per recent vehicle loan stats and industry forecasts. GDPHighlightsSteady domestic spending helped to prop up GDP growth in the third-quarter which came in at an...

Read More »US Trade

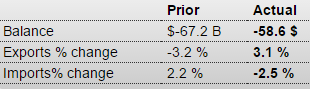

This is just for ‘goods’ but seems to be counter to all other releases reporting weak exports, but it has been zig zagging it’s way lower and August was particularly weak. And note the weakness in car imports: International trade in goodsHighlightsSeptember reversed August’s outsized goods trade gap, coming in at $58.6 billion vs $67.2 billion. Exports jumped 3.1 percent following August’s 3.2 percent decline with wide gains in consumer goods, autos, industrial supplies and capital goods....

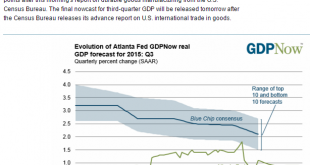

Read More »Atlanta Fed, Oil inventory, Chemical Index, Mtg Purchase Apps

Down to .8: Crude inventory that used to pile up from high cost shale production is coming down as drilling is way down and existing well output declines some 70% in its first two years. Meanwhile, US imports increase as domestic production decreases: Crude stocks at the Cushing delivery hub fell by 748,000 barrels, data from the industry group, the American Petroleum Institute, showed late on Tuesday.Iraq’s southern oil exports have reached 3.10 million barrels so far this month,...

Read More »Confidence, Richmond, PMI Services

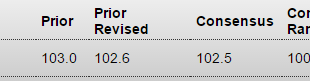

A lot less than expected based on jobs assessment, and note the drop in car buying plans: United States : Consumer ConfidenceHighlightsA decline in the assessment of the current jobs market pulled down the consumer confidence index to a lower-than-expected 97.6 in October. This is about 2.4 points below Econoday’s low-end forecast and 5.0 points below a revised September.Consumers are saying there are fewer jobs available then there were in September and more say jobs are hard to get. But...

Read More »Healthcare Premiums, UK Gap, EU Credit Growth, Durable Goods, Redbook Retail Sales, Oil

Last I checked this ‘counts’ as ‘personal consumption expenditure’: Premiums for Health Insurance Bought on Exchanges to Climb in 2016 Oct 26 (WSJ) — The Obama administration said many consumers will see noticeable premium increases when buying health coverage on insurance exchanges in 2016. Federal officials said Monday that the price of the second-lowest-cost midrange “silver plan”—a key metric for premiums around the country—will increase by 7.5% on average across the three-dozen states...

Read More »Truck tonnage, Philly Fed Coincident Index, ECB policy, Credit Check

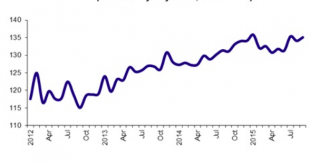

Signs of stabilizing: So the ECB threatened more negative rates and QE, both placebos at best, analogous to spraying the crowd with a barrage of blanks, which nonetheless dispersed the crowd. However, with the record and growing euro area 31 billion trade surplus last month and a growing US trade deficit augmented by increased petro imports as domestic production falls, I expect those fundamentals to dominate: Interesting how growth that supported GDP in 2014 peaked as oil price broke...

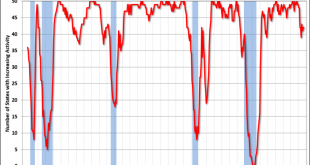

Read More »Philly Fed State Index, ECRI, Rail cars

ECRI’s WLI Growth Index Declines Again and Remains In Contraction ECRI’s WLI Growth Index which forecasts economic growth six months forward – declined and remains in negative territory. This index had spent 28 weeks in negative territory, then 15 weeks in positive territory – and now is in its tenth week in negative territory. Also discussed below is the coincident and lagging index which is in decline. Rail Week Ending 17 October 2015: Contraction Continues Week 41 of 2015 shows same...

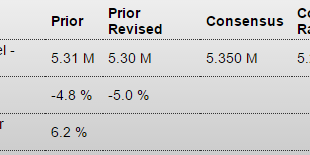

Read More »Existing Home Sales, Chicago Fed, Leading Indicators, KC Fed

Higher than expected, not directly a contributor to GDP or a measure of output.The change in fed mtg regs that caused the blip and mtgs and subsequent reversalneeds to play out here as well: Existing Home SalesHighlightsExisting home sales bounced back very strongly in September, up 4.7 percent to nearly reverse the prior month’s revised decline of 5.0 percent, a decline that now looks like an outlier on a steadily rising slope. The month’s annual sales rate, at 5.55 million, is just beyond...

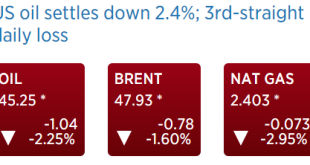

Read More »Oil Prices, RT Interview, Revenue Misses

No letup yet as Saudi discounts continue: My RT interview on the price of oil here. Seems suddenly everyone is missing on revenues? Total sales (less inventory draw down)= GDP AT&T warns of revenue miss in Q3

Read More »Mtg Purchase Apps, Arch. Billings, Japan Exports, Bernie Article

After the up and down in front of the change in regulations new purchase apps are, so far, lower than before: Fits with the permit spike/decline story, and there was also this note: The multi-family residential market was negative for the eighth consecutive month – and this might be indicating a slowdown for apartments – or at least less growth. Japan export growth slows sharply, raising fears of recession By Tetsushi KajimotoOct 21 (Reuters) — Japan’s annual export growth slowed for the...

Read More » Mosler Economics

Mosler Economics