Rail Week Ending 03 August 2019: July Down 6.1% Oil related capex never recovered to prior levels and is now in decline: Down some more:

Read More »Bankruptcy cuts, Wholesale trade, Turkey

Bankruptcy-related job losses invoke grim reminders of Great Recession In the first seven months of the year, U.S.-based companies announced 42,937 job cuts due to bankruptcy, up 40% from the same period last year and nearly 20% higher than all bankruptcy-related job losses last year, a report released Tuesday concluded. Despite record-low unemployment, bankruptcy filings have not claimed this many jobs since the Great Recession.“It is the highest seven-month total since...

Read More »Germany, Argentina, Rate cuts

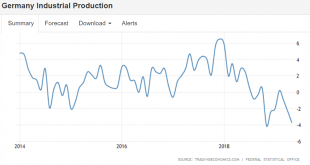

Deep into global industrial contraction: Not that rate cuts are expansionary, of course, but that they think they are. As the barber quipped, ‘no matter how much I cut off, it’s still too short’ : Central Banks Across Asia Cut Interest Rates The Reserve Bank of India cut its benchmark repo rate for a fourth straight meeting by a deeper-than-expected 35bps to 5.4%; the Reserve Bank of New Zealand slashed its official cash rate/OCR by a larger-than-expected 50bps to a fresh...

Read More »JOLTS, Exports, Lumber prices, Trump comments

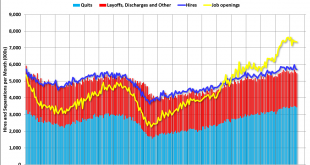

Openings have rolled over and hires gone flat. Neither are population adjusted so it’s worse than it looks here: New export orders now below 2016 collapse: All these statements are entirely false, of course, but interesting how the ’45 year’ statement repeats- seems somehow he’s ‘connecting’ it to him being the 45th President? [embedded content]

Read More »ISM, Canada

US service sector continues its rapid deceleration: Seems about the same everywhere- imports and exports both down: Canada’s trade surplus decreased to CAD 0.14 billion in June 2019 from a downwardly revised CAD 0.56 billion in the previous month and against market expectations of a CAD 0.3 billion gap. It was the third trade surplus since December 2016, as exports were down 5.1 percent, while imports fell at a softer 4.3 percent, both due in part to significant decreases...

Read More »Employment, Factory orders, Trade, Construction

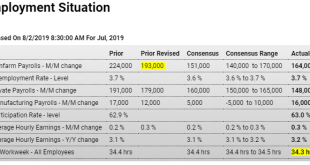

Deceleration continues- see chart: Highlights How far along the rate-cut path will the Fed go? Maybe a bit further given a middling employment report where an important detail is pointing to big trouble for the next industrial production report. First the headlines as nonfarm payroll rose 164,000 which is actually 13,000 above Econoday’s consensus for 151,000. But much of the strength came for a second month from government payrolls which, reflecting the heavy government...

Read More »Headlines, Euro area, China, Freight, GDP

Contraction:

Read More »ADP, Chicago PMI, Buy backs, Domestic product sales

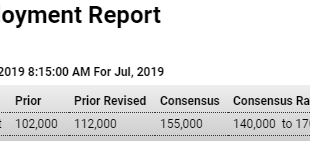

Rolling over: Highlights ADP estimates that private payroll growth in Friday’s employment report for July will rise 156,000. Econoday’s consensus for this estimate was 155,000 and forecasters see actual private payrolls coming in at 160,000 in Friday’s report vs 191,000 in June. Highlights In the lowest reading in 4-1/2 years, the Chicago PMI fell 5.3 points in July to 44.4. New orders sank deeper into contraction with employment falling into contraction for the first...

Read More »Personal income and consumption, Home prices, Pending home sales, Oil capex, Euro area

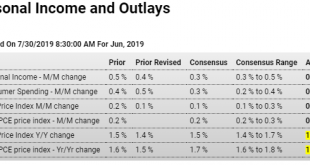

Income and consumption is growing at lower but moderate pace, but has been decelerating since the tariffs started to bite and global trade began its collapse: Highlights The month-to-month breakdown of consumer spending shows slowing in what will offer support for those on the FOMC who want to cut interest rates this week. Despite the strength of June retail sales, total consumer spending in the month rose only 0.3 percent following gains of 0.5 percent in May and 0.6...

Read More »GDI, Productivity, China pmi, Dallas Fed

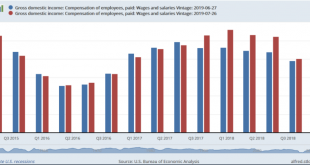

Gross domestic income was just revised higher. The blue bars are the previously reported levels and the red bars are the revised levels. This further meant that the savings rate unspent income) was higher as previously discussed. And an increasing savings rate generally reflects a deceleration in borrowing: Lack of aggregate demand- desires to not spend income not being sufficiently ‘offset’ by’ private or public sector net (deficit) spending: I see deceleration in both,...

Read More » Mosler Economics

Mosler Economics