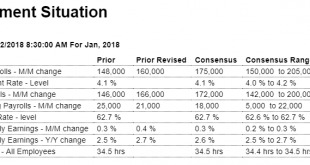

Note how the year over year growth rate continues it’s 3 year decline, and is in ‘stall speed’ with no sign of reversal. And last I heard a .1 change in the work week hours is equal to about 100,000 jobs, so the .2 drop last month offsets the 200,000 new jobs: Highlights A very solid employment report for January, one however tinged with a hint of weakness, is led by a 200,000 gain in nonfarm payrolls. This is 25,000 above Econoday’s consensus and near the high estimate....

Read More »Vehicle sales, Construction spending, GDP comments, Comments on tax cuts, Comments on fed policy

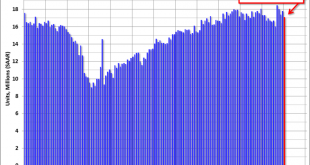

Even lower than expected as weakness continues: U.S. Light Vehicle Sales decline to 17.1 million annual rate in January By Bill McBride Feb 1, (calculated Risk) — Based on a preliminary estimate from AutoData, light vehicle sales were at a 17.1 million SAAR in January. That is down 1.2% from January 2017, and down 3.8% from last month. Once again, prior month revised down, and current month higher than expected. In any case as the chart shows, construction growth remains...

Read More »ADP employment forecast, Pending home sales, Income and spending

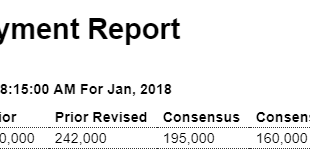

This is now a forecast for Friday’s payroll number, and note from the chart that it’s been diverging all year. Seems there’s some kind of error in their forecasting methodology? Highlights ADP sees a very strong employment report coming out on Friday, estimating a 234,000 rise in private payrolls. ADP has been running above actual government data which is reflected in the difference in Econoday’s consensus calls for each, at 195,000 for today’s ADP report and 172,000 for...

Read More »Spending and savings, Apartment market tightness, Vehicle sales

Seems to me this divergence has been stretched to the limit: And this chart from Daniele Della Bona shows how dipping into savings via borrowing adds to interest expense that further reduces savings when other personal income is lagging: And this shows the gap: And from a different angle: And this was also part of the consumer’s year end credit card binge that contributed to GDP? And would that be consumption or investment? ;) From WardsAuto: U.S. Forecast: January Sets...

Read More »Personal income and outlays, GDP, PMI’s, Philly Fed index, Bank loans, Rail traffic

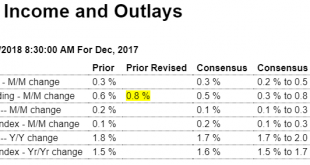

Pretty much in line with expectations, but last month’s spending increase means what I think was an unsustainably low savings rate is now even lower. Highlights Personal income rose 0.4 percent in December with wages and salaries up a solid 0.5 percent. Spending also rose 0.4 percent in December with November revised 2 tenths higher to a very strong 0.8 percent gain. Giving a boost to spending but hinting at trouble for the consumer is a 1 tenth dip in the savings rate to a...

Read More »New home sales

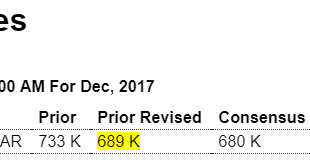

Much lower than expected, and last month’s number, which was touted as the turning point for housing, was revised lower as well. And note from the chart we’re still below the levels of the 1970’s when the population was about 40% lower: Highlights The headline 9.3 percent decline in new home sales for December masks what is actually a solid new home sales report. December’s 625,000 annualized rate is the fourth best of the expansion and follows November’s revised 689,000...

Read More »Existing home sales, PMI services, Coal mining jobs

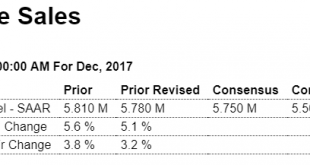

Less than expected and last month’s number revised a bit lower, so still no contribution to growth for the year: Highlights Lack of supply pulled down existing home sales in December and may very well pull down sales in January as well. Existing home sales fell 3.6 percent in December to an annualized rate of 5.570 million which is near the low end of Econoday’s consensus. But November, despite a small downward revision to a 5.780 million rate, remains by far the best month...

Read More »Housing starts, Apple repatriation

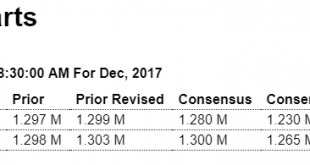

Starts were quite a bit lower than expected while permits held steady: From the Census Bureau: Permits, Starts and Completions Housing Starts:Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,192,000. This is 8.2 percent below the revised November estimate of 1,299,000 and is 6.0 percent below the December 2016 rate of 1,268,000. Single-family housing starts in December were at a rate of 836,000; this is 11.8 percent below the revised...

Read More »Housing index, Industrial production, Redbook same store sales, Healthcare comments

Up more than expected this month, but last month revised down, inline with a recent pattern of reporting a better than expected number that subsequently gets revised down to where it no longer looks so good: The year end blip up, funded by out sized credit card advances, may have reversed: Highlights Same store sales were up 2.6 percent year-on-year in the January 13 week, continuing the deceleration seen in the prior two weeks to fall to the smallest year-on-year weekly...

Read More »Bank lending review, $US, Dementia signs

I’m using monthly totals this week to take some of the ‘noise’ out of the weekly numbers surrounding year end: Pretty clear here there’s been almost no loan growth over the last year or so: The growth rate of real estate lending also shifted around election time: Consumer credit, however, expanded into year and as consumers borrowed to sustain spending as income growth fell short: Large trade deficit: Large trade surplus: clinical dementia: “Problems these experts say...

Read More » Mosler Economics

Mosler Economics