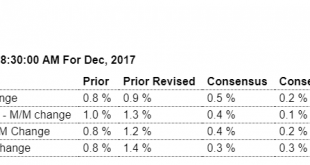

Highlights It was a very good holiday shopping season but perhaps not a great one. Retail sales rose a solid 0.4 percent in December which is just shy of Econoday’s consensus though November is revised 1 tenth higher to what is a standout gain of 0.9 percent. Core readings show similar strength with all pointing to a solid consumer contribution to fourth-quarter GDP. Nonstore retailers, a component which e-commerce dominates, did in fact have a great season. Sales here rose...

Read More »Jobless claims, Producer prices, Savings rate chart

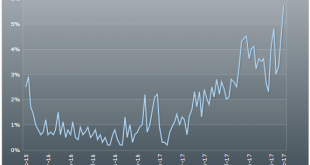

Yes, they have been made very hard to get, and now economists are getting concerned that they are moving higher: Highlights In what might be an early sign of loosening in the labor market, initial jobless claims rose 11,000 in the January 6 week to a higher-than-expected 261,000. The gain is widespread and not centered in Puerto Rico where claims, at 1,778, are down about 500 in the latest week and back to pre-hurricane levels. Only one state, Maine, was estimated in the...

Read More »Consumer Credit, Small business index, JOLTS, Rig counts

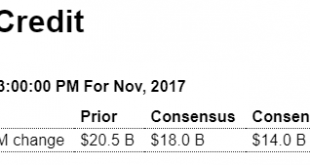

Things are starting to add up better with this jump in consumer borrowing. With real disposable personal income growth near 0, and spending growing at just over 2.5% through November, it’s now looking like consumers ‘dipped into savings’ by running up their credit card balances which tends to be followed by reductions in spending: Highlights Consumers were heating up their credit cards in November as revolving credit, up $11.2 billion in the month, made a sizable...

Read More »Bank loans and macro analysis

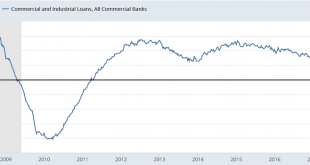

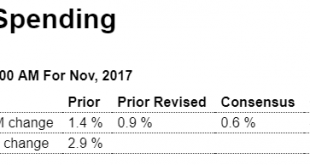

Bank lending began to decelerate after oil related capital spending collapsed late in 2014, and then collapsed further about the time of the presidential election: Note the consumer ‘dipping into savings’ some to sustain consumption via borrowing into year end as personal income flattened: Real disposable personal income flattened and consumer spending slowed but not as much as income, and was instead supported by consumers ‘dipping into savings’: This is now...

Read More »Employment, International trade

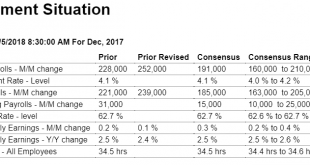

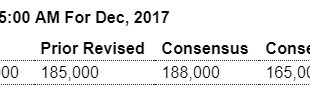

Weaker than expected, with the prior two months revised downward by a net 9,000 jobs. In any case employment growth continues its multi-year deceleration that began with the collapse of oil capex: Highlights Hiring cooled though employment levels are very high and there’s also a hint of wage inflation in December’s employment report. Nonfarm payrolls rose 148,000 which is lower than expected but still favorable and enough to absorb new entrants into the jobs market....

Read More »ADP, Light vehicle sales, Wolf quote

This is ADP’s forecast of tomorrow’s employment number. We’ll see tomorrow how well accurate they were: A bit higher than expected but down for 2017 vs 2016 (negative growth): Highlights Unit vehicle sales proved solid in December, at a 17.9 million annualized rate vs 17.5 million in November. Outside of October and September, which were driven by hurricane-replacement demand, December’s results are among the very best of the last two years. The results, which easily top...

Read More »Construction spending, Saudi Pricing, NY real estate

Prior month revised down, keeping the chart looking very weak for this ‘hard data’ release: Looks like the Saudis mean to keep a bit of upward pressure on prices. Perhaps to offset the weak $US,in which case the higher oil prices work to further weaken the $US: Saudis Seen Keeping Feb. Asia Arab Light Oil Price Unchanged M/m By Serene Cheong and Sharon Cho (Bloomberg) — State-run Saudi Aramco may keep Arab Light crude official selling price unchanged m/m for Feb. sales to...

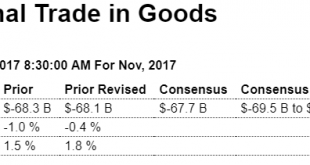

Read More »Trade, Philly Fed Index, small business hiring

Worse than expected: Highlights Net exports look to be holding back fourth-quarter GDP following a second month of deep deficit in cross-border goods trade, at $69.7 billion in November following a revised $68.1 billion deficit in October. The monthly average for the third-quarter was much lower, at $63.8 billion. But there is very good news in the report and that’s exports which rose a very strong 3.0 percent in November in to $133.7 billion, led by strong improvement in...

Read More »Redbook same store sales, Consumer confidence, Pending home sales

Same store sales doing a lot better than last year: Confidence remains high: Housing, however, still seems to be going nowhere: Highlights The pending home sales index has been flat and has not been in line with the strength of final sales of existing homes. This may limit the impact of today’s report where the November index managed only a 0.2 percent gain to a 109.5 level that is still below last year’s levels. In contrast, existing home sales, at a 5.810 million...

Read More »Durable goods orders, Personal income and spending, Bank lending, New home sales, Consumer sentiment

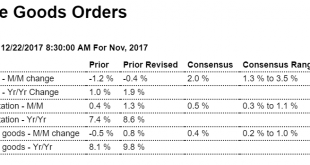

As previously discussed, durable goods and manufacturing, after dipping in 2015 with collapse of oil capex, resumed modest growth from the lower levels which continues: Highlights A jump in aircraft skewed durable goods orders 1.3 percent higher in November which however is well below Econoday’s consensus for 2.0 percent and no better than the low estimate. Orders for civilian aircraft, which have been solid this year, rose 31 percent and reflect Boeing’s success at...

Read More » Mosler Economics

Mosler Economics