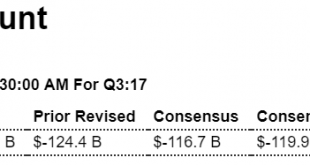

Another hurricane influenced number. Without the receipts from foreign insurance companies looks like it would have been about the same as last month: Highlights Hurricane receipts from foreign insurance companies for losses resulting from hurricanes Harvey, Irma, and Maria shaved $24.9 billion from the nation’s current account deficit to a much lower-than-expected $100.6 billion in the third quarter. But the quarter also benefited from a $6.2 billion narrowing in the goods...

Read More »Industrial production, Empire state manufacturing, Retail sales, PMI, Port traffic

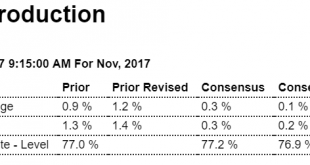

Boring: Highlights A rise for mining offsets a dip for utilities making a modest 0.2 percent gain for manufacturing the story for November’s industrial economy. This report’s manufacturing component has been the only uneven indicator on the factory sector all year which limits the surprise of November’s results. Forecasters weren’t calling for much strength in the first place with Econoday’s consensus at only 0.3 percent for manufacturing. Vehicle production, after a run of...

Read More »Small business optimism survey, Private sector credit

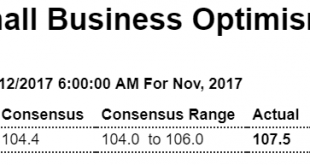

Expectations all the more trumped up with the new tax bill, but the details show actual conditions aren’t doing so well: HighlightsOptimism among small business owners is surging, according to the National Federation of Independent Business (NFIB), whose Small Business Optimism Index rose 3.7 points in November to 107.5, the highest level since November 2004. The monthly jump in small business sentiment beat analysts’ forecasts with 8 out of the 10 components of the index...

Read More »Credit check

Something happened about the time of the Presidential election that caused a sudden deceleration of bank lending, which had already been decelerating since the collapse of oil capex. And still no signs of a recovery here, as consumers seem to be instead dipping into savings to sustain consumption as personal income growth decelerates as well:

Read More »Employment, Consumer sentiment, Inventories

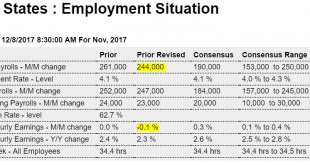

Higher than expected but last month revised lower, so seems best to wait a month (and sometimes more) for the revisions before passing judgement. And the wage data, if anything, is that of a very low demand economy with lots of excess capacity: Highlights Overheating may not be the description of the labor market but heating up definitely is. Nonfarm payrolls rose a stronger-than-expected 228,000 in November led by outsized gains for manufacturing at 31,000, construction...

Read More »Disruptions

Disruptive headlines: Trump announces U.S. will recognize Jerusalem as Israel’s capital Trump: Government shutdown ‘could happen’ Saturday Mania in progress:

Read More »ADP, Mtg purchase apps, Capital spending report, Oil prices

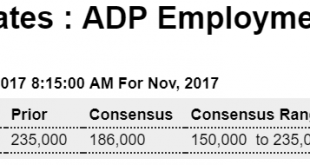

Winding down from post hurricane levels, however keep in mind this is a forecast of Friday’s number, not report of actual private payrolls: Highlights A pre-hurricane total of 190,000 is ADP’s call for November private payroll growth which would follow a hurricane-related upswing of 252,000 in October and 15,000 downswing in September. This fits with Econoday’s consensus for Friday’s November report where private payrolls are expected to rise 184,000. Demand for labor has...

Read More »Trade, Redbook retail sales, PMI services, ISM services

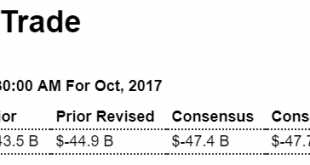

As previously discussed, the US bill for oil imports went up: Highlights Fourth-quarter net exports get off to a weak start as October’s trade deficit, at $48.7 billion, comes in much deeper than expected and well beyond September’s revised $44.9 billion. Exports, at $195.9 billion in the month, failed to improve in the while imports, at $244.6 billion, rose a steep 1.6 percent. Price effects for oil, up more than $2 to $47.26 per barrel, are to blame for much of the rise in...

Read More »Factory orders, Cash bonuses, Oil prices

As the chart shows, year over year growth has gone to near 0 since the election, and the hurricane replacement effect has since dissipated: Highlights A big upward revision to core capital goods highlights today’s factory orders report which closes the book on what was a mixed October for manufacturing. The month’s 0.1 percent decline, which is better than expected and actually hits Econoday’s high estimate, reflects a 33 percent downswing for commercial aircraft orders that...

Read More »Construction spending, Rig count, Fed US leading index, Flynn news

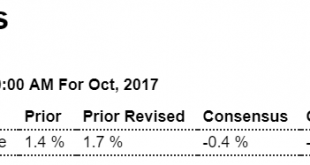

Up a bit this month but as per the chart it’s bumping along at recession type levels: Highlights It’s not housing that drove construction spending up a very sharp 1.4 percent in October but non-residential activity which had been lagging in this report. Spending on private non-residential construction jumped 0.9 percent in the month with strength centered in office construction and transportation construction. Despite the improvement, year-on-year spending on the...

Read More » Mosler Economics

Mosler Economics