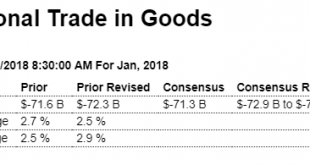

More signs of a slowdown as exports fall, which means less gdp, and consumer imports down, meaning personal spending was lower than expected, as discussed might be the case previously due to lower personal income growth: Highlights Exports came back sharply in January to feed an oversized $74.4 billion goods deficit in January, in what starts off another quarter of trouble for net exports and GDP. Exports fell 2.2 percent in the month with capital goods and industrial...

Read More »New home sales, Core inflation chart, Trump testimony

Large drop from already historically depressed levels reverses year end spike, and inline with depressed mortgage applications: Highlights Sales of new homes slowed but not all the data in January’s new home sales report are negative. New home sales came in at a much lower-than-expected 593,000 annualized rate in January though, in offsets, the two prior months are revised a net 25,000 higher. And badly needed supply moved into the market, up a monthly 2.4 percent to 301,000...

Read More »Mtg purchase apps, Existing home sales, Euro current account, Bank lending, Cycle chart

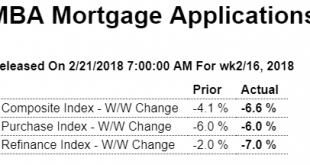

Deteriorating rapidly now? Not good: This is, fundamentally, seriously strong euro stuff: No improvement here as, most recently, growth has gone to 0:

Read More »Mtg purchase apps, CPI, Retail sales

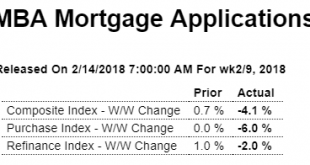

Still depressed and going nowhere: Highlights Amid rising interest rates, purchase applications for home mortgages fell by a seasonally adjusted 6.0 percent in the February 9 week. Unadjusted, the year-on-year gain in the volume of purchase applications fell 4.0 percentage points to 4.0 percent. Applications for refinancing fell just 2.0 percent in the week, putting the refinancing share of mortgage applications up 0.1 percentage points to 46.5 percent. Mortgages rates rose...

Read More »Unemployment benefits, Debt/GDP, Same store sales

Unemployment benefits are harder to get, as previously discussed: The Next Recession Is Gonna Really Suck As a result, the rate at which unemployed Americans receive layoff compensation overall has fallen from about 36 percent in 2007 to about 28 percent in 2017, according to data from The Department of Labor. Wayne Vroman, an associate with the Urban Institute, said a big reason for the decline is that states are finding ways to kick unemployed people off benefits after...

Read More »Spending bill, Rail traffic, Rig count, Saudi pricing

This alone could add maybe 2% to nominal GDP.How much real output it adds is another question, of course: Trump signs massive spending deal into law and ends year’s second government shutdown Self-professed fiscal hawks in the House also opposed the bill. The nonpartisan Congressional Budget Office estimated Thursday that it would cost about $320 billion. Most of that would come in the first year.The deal includes: A $165 billion increase in military spending; A $131 billion...

Read More »Spending bill, Rail traffic, Bank loans

This alone could add maybe 2% to nominal GDP. How much real output it adds is another question, of course: Trump signs massive spending deal into law and ends year’s second government shutdown Self-professed fiscal hawks in the House also opposed the bill. The nonpartisan Congressional Budget Office estimated Thursday that it would cost about $320 billion. Most of that would come in the first year.The deal includes: A $165 billion increase in military spending; A $131...

Read More »Consumer credit, Mania comment, Fed on rates and inflation

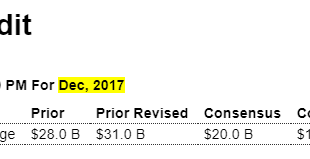

It’s been decelerating all year with a year end move up that’s likely to be reversed as personal income growth continues to be very low: Highlights Consumer borrowing increased in December, up $18.4 billion vs an upwardly revised $31.0 billion in November which is the largest monthly increase since a break in the series 7 years ago. Revolving credit, a component that tracks credit-card debt, rose a sizable $5.1 billion following a November spike of $11.0 billion. On an...

Read More »Mtg apps, Jolts, Trade

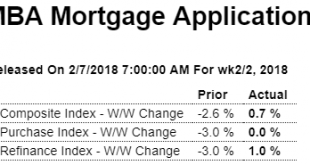

Still going nowhere: Highlights The volume of purchase applications for home mortgages remained unchanged on a seasonally adjusted basis in the February 2 week, while refinancing applications rose 1.0 percent from the previous week despite the headwind of rising interest rates. Unadjusted, purchase applications increased 7 percent from the previous week, though the year-on-year gain shed 2.0 percentage points to 8 percent. The refinancing share of mortgage activity fell 1.4...

Read More »US service sector surveys

Seems the two US service sector surveys are a bit at odds with each other:

Read More » Mosler Economics

Mosler Economics