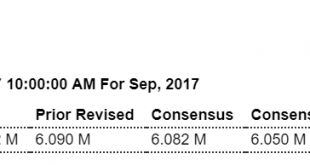

Note that hires and quits have stopped growing, and historically both lead job openings, in yet another indication that this cycle has reversed: Highlights September job openings edged up slightly to a very abundant 6.093 million from a revised 6.090 million in August. Over the month, hires and separations were also little changed at 5.3 million and 5.2 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2...

Read More »Credit check with macro comments

Bank credit growth continues to decelerate, to where historically, after revisions, the economy would already be in recession. Housing and vehicles look like they are already reporting negative growth, and personal income growth has decelerated to about 0% growth, with personal spending holding positive only because people are dipping into savings, which historically has always been followed by a reduction in spending: Less borrowing to spend translates into less...

Read More »Private payrolls, Construction spending, Vehicle sales, Saudi output and pricing, Trump news headlines

2 month average is 167,500: Highlights ADP is calling for a limited snap back in the October employment report. ADP sees private payrolls rising 235,000 which is just on the high side of ADP’s usual estimates. Actual private payrolls fell 40,000 in September, pulled down by hurricane dislocations. Today’s results may, only on the margin, pull down expectations for Friday’s private payrolls where the consensus is currently 320,000. Service sector employment growth began...

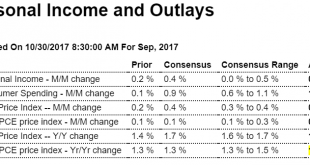

Read More »Personal income and spending, GDP, Trump meeting, North Korea tests

Personal income growth continues to be depressed, which tends to keep spending down as well over time, though this month it had a nice one time increase due to the hurricanes, and the drop in the personal savings rate tells me it’s entirely unsustainable. Also the low inflation readings also support the notion of a general lack of aggregate demand: Highlights Core inflation remains lifeless in an unwanted highlight of an otherwise solid income and spending report. Personal...

Read More »Credit Check

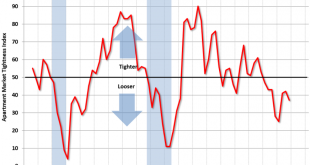

Still getting worse:

Read More »New home sales, Durable goods orders, Vehicle sales

Nice uptick, but subject to revision and at best indicating continued very modest growth well below the last cycle with a population that’s maybe 10% higher than it was 10 years ago: Highlights Volatility tied to low sample sizes is what the new home sales report is known for, proving its reputation again as September surged 18.9 percent to a 667,000 annualized rate. This is the largest percentage gain in nearly 28 years and is the highest level of the economic cycle, since...

Read More »Apartments index, JOLTS chart, Rig count chart

Yet another chart that looks like we might already be in recession: Hires quits were the leading indicators in the last cycle: Rig count peaked a few months ago:

Read More »Existing home sales, Oil rig count

Now down year over year, and in line with the deceleration in bank mortgage lending: Highlights Existing home sales posted their first gain in four months, rising 0.7 percent in September to a 5.390 million annualized rate that is near Econoday’s top forecast. Hurricane effects are hard to gauge with the National Association of Realtors reporting that sales in Florida were down substantially though sales in Houston have already recovered. The sales gain came at a price...

Read More »Fed surveys

These surveys are the ‘soft data’ that’s looking good. They all gapped higher around election time and have remained elevated. In fact it looks like there’s already been a recession followed by a recovery: Unfortunately the ‘hard data’ isn’t looking so good:

Read More »Housing starts, Spending, Trump comments, Car comment

Continuing evidence that the slowdown in bank lending is reflecting slowdowns in the macro economy: Highlights Single-family permits continue to rise in what, however, is the main positive in an otherwise weaker-than-expected housing starts and permits report. Looking first at headline totals, starts fell 4.7 percent in September to a 1.127 million annualized rate which is well under Econoday’s low estimate. Permits fell 4.5 percent to a 1.215 million rate that is above the...

Read More » Mosler Economics

Mosler Economics