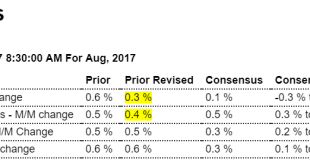

July Personal income revised down to .3 and August only .2 further confirms income growth- the driver of consumption- has slowed down in line with the deceleration in bank lending, and the same seems to be the case with spending, with weak price indicators further confirming the same weak demand narrative. And the very low savings rate tells me there’s a lot more weakness to come: Highlights The next Federal Reserve rate hike may not be in December after all, based on an...

Read More »GDP revision, Inventories, Corporate profits, Trump fundraiser

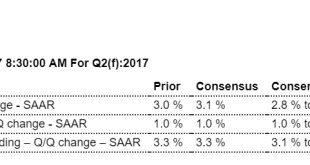

Revised higher due to inventory building- not good- and weak prices also tend to indicate low demand. And note how q3 gdp estimates have been coming down as well: HighlightsSecond-quarter GDP proved strong, at an as-expected 3.1 percent annualized rate for the third estimate driven by consumer spending at a 3.3 percent rate. Nonresidential fixed investment, at a 6.7 percent rate, was also a strong contributor and offsetting a 7.3 percent decline for residential investment....

Read More »New home sales, Pending home sales, Durable goods orders, Children

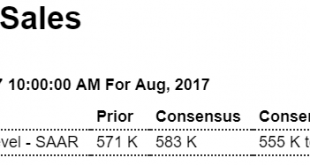

Heading south in line with the deceleration of mortgage lending: Highlights Weakness in the South pulled down new home sales in August as it did in last week’s existing home sales report. New home sales fell sharply in the month to a 560,000 annualized rate vs an upward revised rate of 580,000 in July and a downward revised 614,000 in June (revisions total a net minus 7,000). Sales in the South, which is by far the largest region for housing, fell 4.7 percent in the month...

Read More »Vehicle sales, Homebuyer affordability, Bank loans, FX reserves, Growth index, Rail traffic

Looking like an uptick here, some of it weather related? From WardsAuto: Forecast: SAAR Expected to Surpass 17 Million in September A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 17.5 million-unit seasonally adjusted annual rate in September, following August’s 16.0 million SAAR and ending a 6-month streak of sub-17 million figures. In same-month 2016, the SAAR reached 17.6 million. Preliminary assumptions pointed to October, rather than September, as...

Read More »Chicago Fed, Small business optimism, NY Fed comments

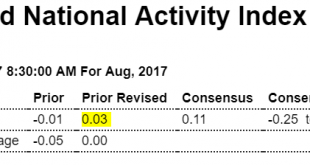

Note the shift: From NY Fed’s Dudley. I added a chart after several of his statements so you can seewhat he sees as support for his statements. Looks a lot to me like he’s trying to manage expectations? “The fundamentals supporting continued expansion are generally quite favorable. Low unemployment, sturdy job gains, and rising wages—even at a pace below previous expansions— are lifting personal income. Household wealth has been boosted by rising home and equity...

Read More »Retail sales, Industrial production, Euro area trade, Rail week

The story is the weakness is weather related, as was the cpi increase, though not the downward revision for the prior month. (I suppose getting control of the weather would be a useful policy tool for the Fed to hit its targets?) The economy is to some degree path dependent, which in this case means that a slowdown in sales = a slowdown in income which can reduce future sales even after the weather issues clear up, especially given the declining growth rate real disposable...

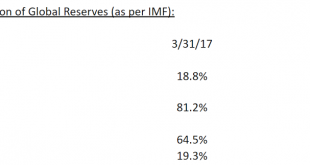

Read More »Euro reserves, Small business survey, Municipal revenues

Trumped up expectations continue even as earnings deteriorate: As U.S. Economy Improves, Cities May Be Headed for Another Downturn Cities may be facing a new period of economic stress — even as the national economy continues to improve. According to a National League of Cities (NLC) report released on Tuesday, municipal finance officers are expecting minimal growth this year — less than 1 percent — after dealing with slower revenue growth last year. If that happens, NLC...

Read More »JOLTS, Redbook sales, Rig count, Credit check, NK comment, PMC jersey

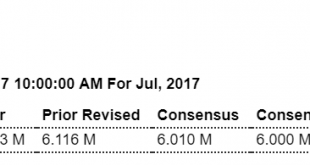

Openings higher than hires tells me employers don’t want to pay up, which is also suggested by low wage growth: Highlights In the latest indications of strong, tight conditions in the labor market, job openings rose to a higher-than-expected 6.170 million in July for a 0.9 percent increase from June. Hirings also rose, up 1.3 percent to 5.501 million which, however, is 669,000 below openings. Openings have been far ahead of hirings for the past several years to indicate that...

Read More »Factory orders, Euro charts, Oil prices

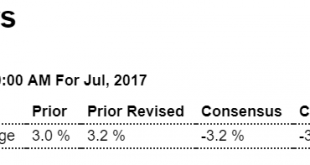

Manufacturing continues to muddle through: Highlights There’s really only good news in the July factory orders report where the headline, at minus 3.3 percent, reflects a slowing in what were strong prior gains for aircraft orders. The best news is a 6 tenths upward revision to core capital goods orders (nondefense ex-air) to a 1.0 percent gain and a 2 tenths upward revision to core shipments, now at 1.2 percent. These numbers point to accelerating strength for...

Read More »Misc. charts, Cryptocoin hedge funds, Bank loans

Interesting charts: Over 50 hedge funds attracting investors who want to go long bitcoin and the rest. Helps explain why the prices are going up even as there is no intrinsic or conversion value whatsoever, which, presuming that to be the case, also means that at some point the mania ends and the price goes all the way back to 0: Hedge funds are cashing in on bitcoin mania — there are now 50 dedicated to cryptocurrencies Digital currencies, such as Bitcoin, are powered...

Read More » Mosler Economics

Mosler Economics