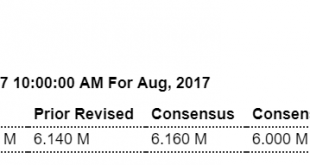

I read this as weakening demand and employers unwilling to pay up to hire, and maybe even posting openings to replace existing workers at lower wages: Highlights Job openings held steady at a very abundant 6.082 million in August while hirings remained far behind, at 5.430 million. In an early indication of full employment, the gap between openings and hiring first opened up about 2-1/2 years ago signaling that employers are either not willing to offer high enough pay to...

Read More »Small business survey, Commercial construction index, Buybacks comments

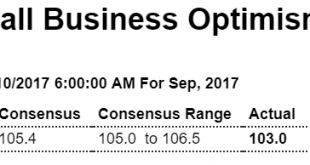

Trumped up expectations continue to unwind, though still above pre election levels, and note the details: Highlights The small business optimism fell 2.3 points in September to 103.0, led by a sharp drop in sales expectations, not only in states affected by hurricanes in Texas and Florida, but across the country. The surprising drop put the index at the lowest level of the year after hovering just below the 12 year high set in January, and came in not only below the...

Read More »Credit check

Appears to be leveling off at much lower rates of growth than last year, as reflected by weaker than expected data releases and revisions:

Read More »Employment, Consumer credit, Social security comment, Corporate debt, Party affiliation

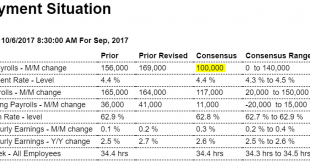

Year over year growth has been decelerating for all practical purposes in a straight line, as per the chart. And the downward revisions in prior months are further evidence of the weakness which began with the collapse in oil capex at the end of 2014. And wage growth increased at least partially because the jobs lost were largely those of lower income workers. Also, at this point with low levels of deficit spending, both public and private, the economy is more likely to be...

Read More »Factory orders, Corp spending, Equity comment

You can see from the longer term charts not much to write home about here: Highlights Increasing strength in capital goods is the good news in today’s factory orders report where a headline 1.2 percent gain is 2 tenths above Econoday’s consensus. The split between the report’s two main components shows a 2.0 percent gain for durable goods, which is a 3 tenths upgrade from last week’s advance report, and a 0.4 percent gain for non-durable goods which is the fresh data in...

Read More »Vehicle sales, Trump comments, Greek comments

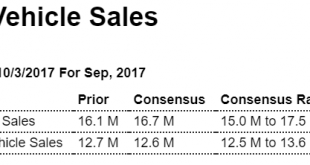

Nice spike after the hurricane lull: Highlights In the strongest monthly sales performance in 12 years, unit vehicle sales shot up to a hurricane-fueled 18.6 million annualized rate in September vs a hurricane-depressed 16.1 million rate in August. September’s rate points squarely at replacement demand following Hurricane Harvey’s flooding of Houston just as the weak August rate pointed to the initial negative effects of the hurricane. Today’s results point to a substantial...

Read More »Trade, Jobless claims, Kelton NYT op ed

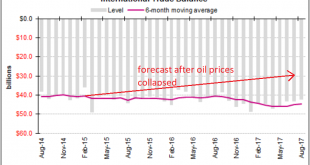

Late in 2014, when oil prices collapsed along with oil capital expenditures, it was widely proclaimed to be an unambiguous positive for the US economy. This included a forecast for a lower trade deficit due to lower oil prices. However, I suggested that, to the contrary, the trade gap might, if anything, widen. The way I saw it, the savings to the US consumer, which was largely ‘small money’ of a few dollars per week, would likely go towards the purchase of imports, while...

Read More »PR note, ADP, Holiday sales, Euro area sales taxes, Erdogan on rates, Tillerson comment, PR bonds

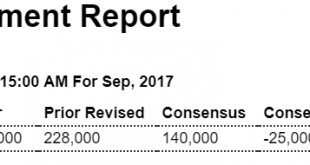

Just noticed this. PR has had over 500,000 move to the states for economic reasons: For many Puerto Rico residents, it’s time to leave the island Note: Puerto Rico is not included in the national employment report. FYI: Highlights Hurricanes didn’t scramble ADP’s sample too much in September with their private payroll estimate at 135,000 which is very close to Econoday’s consensus for 140,000. The result is down sharply from August but is still constructive and consistent...

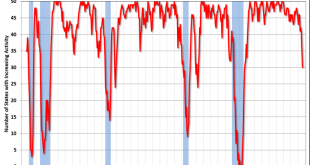

Read More »State Index, Construction spending, PMI and ISM

More data that shows we may already be in recession, and in line with the deceleration in bank lending: Large downward revision to last month was larger than this month’s gain: Highlights The construction spending report is often volatile and today’s results are an example. The headline is up a solid 0.5 percent in August but July’s decline, initially at 0.6 percent, has been downgraded sharply to minus 1.2 percent. Spending on residential construction rose 0.4 percent but...

Read More »Credit check, Expectations vs spending, Inflation, Comments on Fed policy

You may be hearing about ‘spike’ in lending last week, so I’ll try to give you some perspective using commercial and industrial lending charts before just showing year over year changes: In this 10 year chart you can see how the growth in lending suddenly slowed back in November 2016. You can also see that last week’s spike up is something that’s happened many times and looks like ‘normal volatility’ and, at least so far, not an indication of something unusual happening...

Read More » Mosler Economics

Mosler Economics