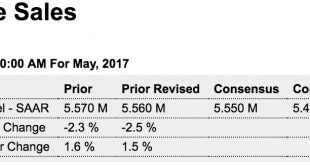

Going nowhere, and with mortgage lending decelerating not much hope this will add to growth vs last year: Highlights Housing has been sliding which adds importance to May’s very solid 1.1 percent rebound in existing home sales to a higher-than-expected 5.620 million annualized rate. Today’s report is mostly solid throughout and includes gains for single-family homes, up 1.0 percent to a 4.980 million rate, and also condos, up 1.6 percent to a 640,000 rate. The sales gains...

Read More »Credit check

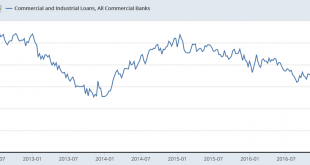

More problematic by the week. Note the absolute level of c and I loans has been flat to negative since October: Annual rate of growth remains sub 2%: This is consistent with the weakening housing releases: This is consistent with weakening consumer spending: This is consistent with weakening vehicle sales: Corporate bonds are not picking up the slack- quite the opposite:

Read More »Housing starts, consumer sentiment, credit growth article

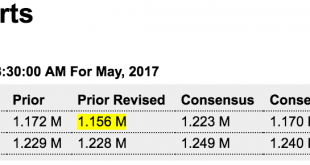

Down and prior month revised down and permits way down as well. All in line with the previously discussed deceleration in bank real estate lending that began just after the elections in November: Highlights The bad economic news keeps building, this time in the housing sector. Housing starts fell an unexpected 5.5 percent in May to a far lower-than-expected annualized rate of 1.092 million with permits likewise very weak, down 4.9 percent to a 1.168 million rate. All...

Read More »Fed surveys, Industrial production, Housing market index, Fed’s gdp forecasts

These spiked up with the Presidential election and are only slowly coming back down: Muddling through at just over a 2% annual rate, but q2 looking weaker than q1: Highlights Forget about all the strength in the low sample-sized regional reports. Government data are not pointing to strength at all as manufacturing readings in the May industrial production report are a matter of concern. Industrial production could manage no better than an unchanged reading in May while the...

Read More »State Taxes and Spending

States tend to be pro cyclical. As tax collections slow, so does spending:

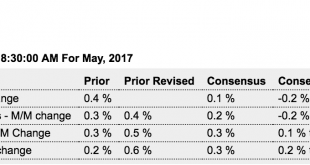

Read More »Retail sales, CPI, business inventories

Highlights Consumer spending was unusually weak in the first quarter and doesn’t look to be improving this quarter. Retail sales fell 0.3 percent in May vs Econoday’s consensus for a 0.1 percent gain. Weakness riddles the report including a 1.0 percent drop for department stores, a 0.2 percent decline for autos, and a 0.1 percent dip for restaurants. Two readings that echo price contraction in this morning’s consumer price report are gasoline stations, down 2.4 percent, and...

Read More »NFIB small business index, household spending expectations, restaurant performance index, Trump news

Trumped up expectations coming off only slowly. Actual business conditions havenot yet responded: Not much optimism here: Trumped up expectations reversed more quickly here: Indicates active selling of US equities and buying of euro equities. This could be part of the process of portfolio managers selling $US to buy euro, reversing shifting in the other direction for the last several years as portfolios shifted out of euro due to political fears and fears of ‘money...

Read More »Credit check, Fed comment

The collapse continues. With total bank credit just over $12.5 trillion, it’s about $500 billion less than it would have been had last year’s loan growth continued. If this lower rate of loan growth continues, and isn’t replaced by some other channel that facilitates agents spending more than their incomes, the implication is that GDP could be a full 2% less than last year, as a substantial portion of bank lending finances purchases of real goods and services:...

Read More »Business Inventories and Sales, Capex, Consumer Credit

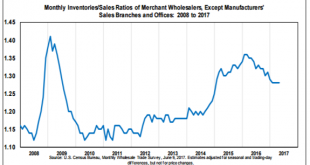

Inventory to sales ratio coming down but remains elevated: Capital expenditures have come back some since the shale bust, but remain depressed: The year over year deceleration continues as also reflected in consumer spending:

Read More »JOLTS, Q1 Mortgage Report

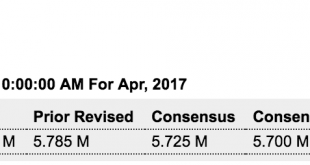

Maybe the reasoning openings are so much higher than hires is because openings are for jobs that pay less than current employees are earning, in the hopes the company can replace them? ;) Highlights Job openings are nearly 1 million ahead of hirings in a widening spread pointing to skill scarcity in the labor market. Job openings totaled 6.044 million in April which is well outside Econoday’s high estimate for 5.765 million and up from a revised 5.785 million in the prior...

Read More » Mosler Economics

Mosler Economics