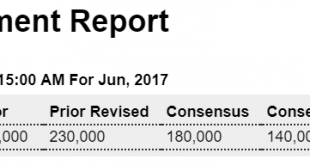

Lower than expected and last month revised lower: Highlights ADP sees June private payrolls rising 158,000 which misses Econoday’s ADP consensus of 180,000. Econoday’s consensus for actual private payrolls in Friday’s employment report is 164,000 which isn’t likely to shift following ADP’s results. Estimates this year from ADP have been hit and miss with a wild upside miss in May. Decent number for this survey but still reflects trumped up expectations: Highlights ISM’s...

Read More »Factory orders, Small business hires, Redbook retail sales

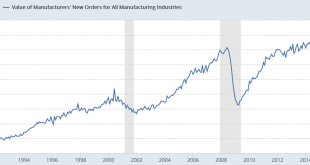

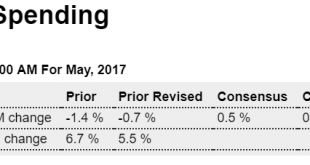

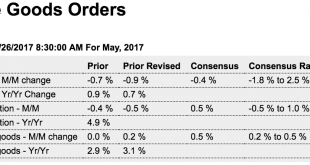

Weaker q2 vs q1, and muddling along at about 3% year over year as previously discussed: Highlights Forecasters thought factory orders would get a lift from nondurables but they didn’t as total orders fell 0.8 percent in May vs Econoday’s consensus for minus 0.5 percent. Nondurable orders, held down by weakness in petroleum and coal, also fell 0.8 percent as did durable orders where last week’s advance data showed a 1.1 percent decline. But there are positives in today’s...

Read More »Manufacturing charts, IG loan issuance

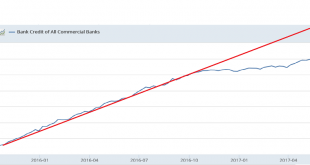

Nothing here looking encouraging: Inventories remain elevated: Credit decelerating here as well:

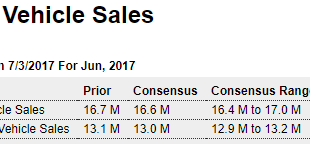

Read More »Motor vehicle sales, Holiday spending

Also decelerating in line with deceleration of bank auto lending. One by one the data releases seem to be confirming the last 6 month’s rapid deceleration of bank lending: Highlights The consumer remains disengaged based on vehicle sales where weakness extended into June, at a 16.5 million annualized rate vs what were modest expectations for 16.6 million and against 16.7 million in May. North American-made sales edged up to 13.1 million from 13.0 million though the gain is...

Read More »Construction spending, Manufacturing

As per the chart, decelerating in line with the deceleration in real estate related bank lending: Highlights Spring 2017 was not the greatest for the nation’s housing sector where data have been mixed at best. Permits have been down and spending data are flat to down with construction spending unchanged in May which hits the very lowest estimate in Econoday’s consensus range. And the weakness is in residential spending, down 0.6 percent overall and including declines for...

Read More »The Center of the Universe 2017-07-02 18:48:15

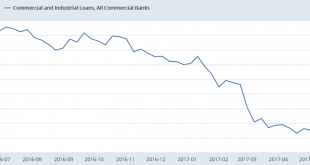

First, let’s look at total bank credit. On this chart you can see that the cumulative growth of bank credit is more than $400 billion less than it would have been if it hadn’t slowed down. That is, last year’s economy was supported by that much more growth of bank credit than this year’s economy as the annual rate of growth has slowed from over 8% to about 4%: We’ve most recently had a few weeks of increase. A hopeful sign but the annual growth rate is still way down from...

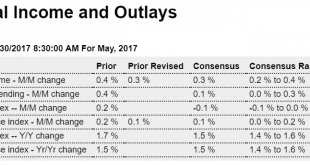

Read More »ECB research report, Personal income and outlays, Chicago pmi, Consumer sentiment

Looks to me like this opens the door to fiscal relaxation!!! “In an economy with its own fiat currency, the monetary authority and the fiscal authority can ensure that public debt denominated in the national fiat currency is non-defaultable, i.e. maturing government bonds are convertible into currency at par. With this arrangement in place, fiscal policy can focus on business cycle stabilisation when monetary policy hits the lower bound constraint. However, the fiscal...

Read More »Durable goods orders, Chicago Fed, Dallas Fed, commercial real estate

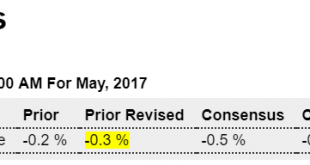

Worse than expected and prior month revised lower, but otherwise muddling through at modest rates of annual growth: Highlights Aircraft had been the strength but is now the weakness for durable goods which, pulled down by a second straight downswing for commercial aircraft, fell 1.1 percent in May. When excluding transportation, a reading that excludes aircraft, orders actually rose, but not very much at only 0.1 percent which falls 4 tenths shy of Econoday’s consensus. An...

Read More »Credit Check

The credit collapse continues:

Read More »PMI’s, New Home Sales, State Coincident Index, Corporate Profits

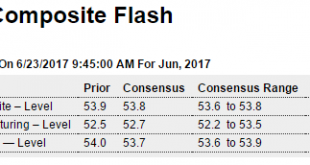

Trumped up expectations continue to revert: Highlights The economy is solid, at least the service sector, but on the whole is losing momentum, based on Markit’s flash data for June. The composite PMI slowed to 53.0 vs Econoday’s consensus for 53.8 with services also at 53.0 and manufacturing at 52.1, both short of expectations. Services offer the best news with new orders and employment solid and optimism on the outlook particularly positive. In a special sign of strength,...

Read More » Mosler Economics

Mosler Economics