Not good: Highlights Purchase applications for home mortgages fell a seasonally adjusted 1 percent in the May 19 week, but refinancing applications rose 11 percent from the previous week to the highest level since March. The drop in purchase applications follows a 3 percent decrease in the prior week and takes the year-on-year purchase index gain down 6 percentage points to 3 percent. Lower rates during the week gave a big boost to refinancing, and the refinancing share of...

Read More »New home sales, US oil sale, Loan demand, Regulation complaints

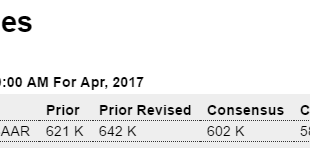

Seems to be slowing in line with the deceleration in mortgage lending previously discussed: Highlights In a mixed report that confirms a reputation for unusual volatility, new home sales swung 11.4 percent lower in April to a much lower-than-expected annualized rate of 569,000. The offset is a 40,000 upward revision to March and February, now at 642,000 and 607,000. Averages are essential to evaluate this report and here the news is clearly good, at a 3-month average of...

Read More »Credit check, Euro area current account

Going from bad to worse, so the way things are going seems the contribution to year over year GDP growth in q2 from credit expansion will be less than it was in q1: Never yet seen a current account surplus like this and a weak currency? (Euro area surplus = rest of world deficit, etc.) And the pressure has been building for over 3 years now as fear drivenportfolio selling, worked to keep the currency down:

Read More »Mortgage apps, Headlines

New applications seem to be modestly increasing even as bank lending for real estate has been flat and decelerating: Hard to say which is worse for markets- if Trump remains as President or if he is removed:

Read More »Housing starts, Industrial production, Fed wage tracker

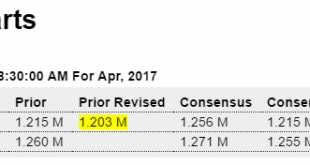

No surprise here, after seeing what mortgage lending has been doing: Highlights A topping out from lower-than-indicated expansion highs is the news from the April housing starts report where levels, though still healthy, are disappointing. Starts fell 2.6 percent to a 1.172 million annualized rate that is well below Econoday’s low estimate for 1.215 million. Downward revisions are a factor in the report, totaling 27,000 in the prior two months. The strength in the report is...

Read More »NY state mfg survey, Housing index, Lending, White House headline

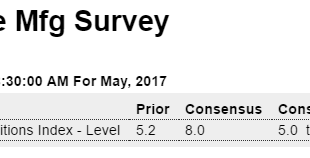

Trumped up expectations reversing? Highlights Activity in the New York manufacturing region is flattening out this month following a run of unusually strong growth. May’s Empire State index came in at a lower-than-expected minus 1.0 with new orders also moving into the negative column to minus 4.4. Unfilled orders, which were very strong in April and March, also moved below zero to minus 3.7. But the strength in prior orders is keeping production up, at a very solid plus...

Read More »Retail sales, Business inventories and sales, Inflation

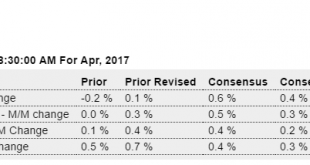

A bit weaker than expected, prior month revisions about a wash. Highlights Retail sales did recover in April but not as much as expected, up 0.4 percent overall and up 0.3 percent excluding autos which both miss Econoday’s consensus estimates by 2 tenths. Core readings are likewise soft, up 0.3 percent ex-auto ex-gas which misses the consensus by 1 tenth and up only 0.2 percent for the control group where a 0.4 percent gain was the call. Vehicle sales rose 0.7 percent in...

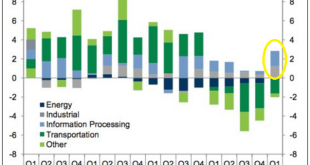

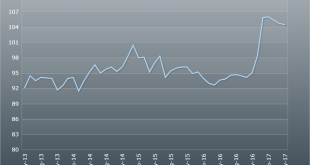

Read More »Energy capex, LA port activity, Fed portfolio

Energy capex collapsed first, followed by non energy capex about a year later. Question now is whether the Q1 non energy capex recovery continues into Q2. I suspect not. In any case the contribution to growth from energy capex is no longer negative but not all that much as a % of GDP: Tells me we still are experience an obvious lack of aggregate demand. We haven’t even gotten back prior highs and growth of these components has slowed dramatically from where it was before...

Read More »Reserve allocation, Pump priming, GDP forecasts

You can see how central bank reserve shifting worked to lower the euro vs the dollar. Yes, we need a larger deficit, both short and long term, given current institutional structure that gives powerful incentives to not spend income. Not that the current proposals to do that are my first choice as to specific taxes to cut and expenditures to increase. Nor would I call it pump priming, but instead I’d call it removing fiscal restrictions: Trump: Debt and deficits will rise,...

Read More »NFIB index, Redbook retail sales, Jolts, Wholesale trade, MMT Article, NY Fed Consumer expectations

Trumped up expectations fading only slowly, as confirmed by stocks, etc: A glimmer of hope seems to have faded: HighlightsThere’s plenty of help-wanted signs but still too few qualified applicants. Job openings in March totaled 5.743 million, up from a revised 5.682 million in February and well ahead of hirings which totaled 5.260 million. Professional & business services, where employers often turn to first when they can’t fill staff themselves, shows a strong rise...

Read More » Mosler Economics

Mosler Economics