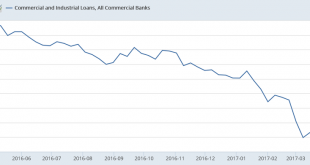

Not a pretty sight:

Read More »Employment, NY Fed q2 GDP forecast, Consumer credit

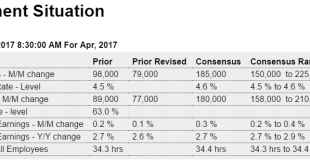

Highlights The labor train is back on the tracks as nonfarm payrolls reversed the prior month’s weakness and came in on the high side of expectations, up 211,000 in April vs a revised 79,000 in March for the third 200,000 plus reading so far this year. Payroll gains are centered in business services, in what points to capacity constraints among employers, and also government which added 17,000 to April’s total. Strength in the labor market continues to pull down the...

Read More »Factory orders, Trade, Chain store sales

Highlights Factory orders, like much of the economy, fizzled in March, up only 0.2 percent and skewed higher for a third month in a row by aircraft. The split between the report’s two main components shows a 0.5 percent dip for nondurable goods — the new data in today’s report where weakness is tied to petroleum and coal — and a 0.9 percent rise for durable orders which is 2 tenths higher than last week’s advance report for this component. The gain for durables looks...

Read More »Small business borrowing, Tesla

U.S. small business borrowing stalls in March By Ann Saphir May 1 (Reuters) — Borrowing by small U.S. firms stalled in March, as business owners remained cautious about investing amid policy uncertainty, data released on Monday showed. The Thomson Reuters/PayNet Small Business Lending Index for March registered 134, down 1 percent from last March. The index was up 4 percent from February, which had four fewer working days. Doesn’t seem to scale very well… ;) Tesla said net...

Read More »Vehicle sales, Share buybacks, Gasoline demand

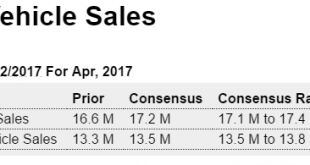

Low and worse than expected, and inline with the deceleration in bank auto lending, as previously discussed, which doesn’t bode well for other sales measures tied to credit expansion: Highlights The earliest hint on whether consumer spending bounced back in April is positive. Unit vehicle sales rose from March’s very soft 16.6 million annualized rate to 16.9 million which however is below expectations for 17.2 million. Sales to consumers and sales to businesses are not...

Read More »Personal income and outlays, Construction spending, ISM and Markit manufacturing surveys

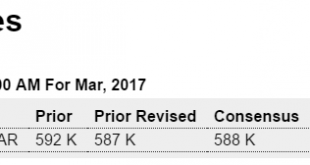

Last month revised lower and low and below expectations this month. Again, in line with decelerating credit data which means persistent weakness in GDP: Highlights Based on the consumer and based on inflation, FOMC members won’t be feeling much pressure to raise rates at least not any time soon. Consumer spending was unchanged in March, even weaker than Econoday’s 0.1 percent consensus. More startling is the weakest showing in 16-1/2 years for core PCE prices which fell 0.1...

Read More »GDP, Repatriation, Credit check

A very low initial print, with inventories down as expected as was consumption growth. And the investment data that did grow strongly is volatile and subject to reversal which would limit q2 growth as well. Expectations have come off some but remain trumped up, even as the hard data shows ongoing weakness. And note how q2 forecasts are now starting up where q1 forecasts were this time 3 months ago: Highlights The weakest showing since the last recession for consumer...

Read More »Mortgage purchase index, Saudi pricing

You can see from the chart that growth of mortgage applications for home purchases has been near 0 for quite a while, and remains historically depressed. The lines zigging downward are Saudi initiatives to lower prices, and as price setter they will necessarily prevail for as long as they have excess capacity:

Read More »New home sales, PMI’s, Vehicle sales, Lumber tariffs

New home sales better than expected, but remember it’s about permits, as no home is built without one: Note how weak this is vs past cycles: Annualized rate of total sales keeps working its way lower from last year’s peak of about an 18.5 million pace, which also coincides with the deceleration in auto lending: From WardsAuto: U.S. Forecast: Mild Sales, Growing Inventory The report puts the seasonally adjusted annual rate of sales for the month at 17.1 million units, well...

Read More »Credit check

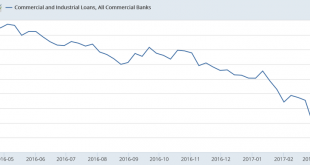

See any reason not to panic?;)

Read More » Mosler Economics

Mosler Economics