Seems revenues continue to fall indicating the two years of deceleration of growth may have already gone below 0, and with unemployment claims a lot harder to get that source of transfer payments seems to have been reduced, reducing what otherwise would have been that much counter cyclical deficit spending: US Budget Gap Doubles in December The US government reported a $28 billion budget deficit in December, a 94.4% increase from a $14.4 billion gap a year earlier and...

Read More »Discount rate, Fed payment to Treasury, German trade balance, Trump communications

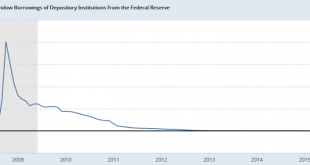

Note that there was little or no demand from member banks to borrow from the regional reserve banks, yet they decided the rate needed to be higher…;) All but one bank requested to raise an interest rate the U.S. central bank places on its loans to commercial banks for the month of December, according to Federal Reserve Board discount rate minutes released on Tuesday. The Federal Reserve Bank of Minneapolis asked to leave the discount rate unchanged, according to Fed minutes....

Read More »Small business index, Redbook retail sales, Jolts, Consumer credit, Retail sales forecast

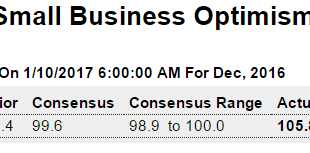

Still Trumped up expectations: Highlights The small business optimism index soared 7.4 points in December to 105.8, the highest reading since December 2004. The outsized increase far exceeds expectations and follows a robust 3.5-point rise in November. NFIB said business owners who expect better economic conditions accounted for about half of the overall increase, with a net 50 percent of respondents expecting that the economy will improve, a 38 point leap up from November....

Read More »Labor market conditions index

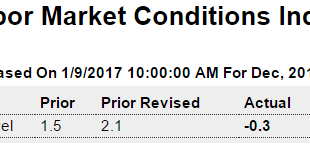

From the Fed’s research: Highlights The economy may be at full employment but it’s not helping the labor market conditions index which remains flat. For the first negative score since May, December’s index comes in at minus 0.3. Based on this report, there may be more slack than suspected and less risk perhaps of wage inflation. Considered experimental, the labor market conditions index, published by the Federal Reserve, is a composite of 19 separate indicators. ...

Read More »Payrolls, Factory orders, Foreign trade, Retailers, Boston rents

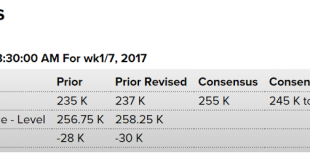

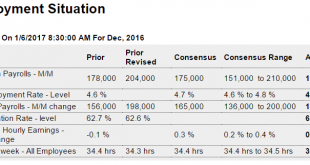

The year over year chart continues its 2 year deceleration unabated. No telling where it ends but the end will coincide with increased deficit spending, private or public: Highlights Job growth may be the new economic policy but wage inflation may be the risk. Nonfarm payrolls rose a lower-than-expected 156,000 in December but, in an offset, revisions added a net 19,000 to the two prior months (November now at 204,000 and October at 135,000). But the big story is another...

Read More »ADP, ISM non manufacturing

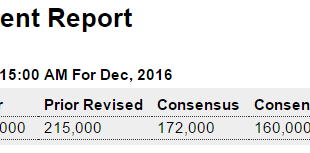

While surveys remain Trumped up, at least so far when it comes to actual numbers the deceleration continues, and can’t reverse without a commensurate increase in deficit spending, public or private: Highlights ADP is pointing to a softer-than-expected employment report on Friday. ADP’s estimate for private payrolls is 153,000, a still respectable level of growth but noticeably below the Econoday consensus for 172,000. Private payroll growth in Friday’s December employment...

Read More »Car sales, NYC real estate

Car sales better than expected, but the annual rate of growth has slowed and 2016 was up less than .5% vs 2015 year. So if vehicles added less than the year before, something else has to add more than it did the year before, or the annual GDP growth slowed: Sales for 2016 hit a new annual record. Sales in 2016 were at 17.465 million, up from the previous record of 17.396 million set last year.Read more at http://www.calculatedriskblog.com/#A7zlBSb83MtA17vJ.99 Manhattan’s...

Read More »Mtg purchase apps, Redbook Retail sales, Restaurant sales

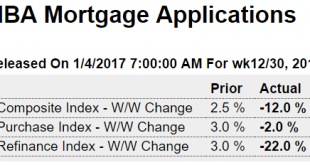

Purchase apps now down year over year, and less than half of what they used to be pre crisis: Highlights Purchase applications for home mortgages fell 2.0 percent on a seasonally adjusted basis in the December 30 week compared to the level 2 weeks earlier, which was the last prior reading due to the Christmas holiday. The refinance index was down a much sharper 22 percent compared to two weeks ago, as higher interest rates continue to deter refinancing by homeowners to a...

Read More »Construction spending, Manufacturing surveys, China

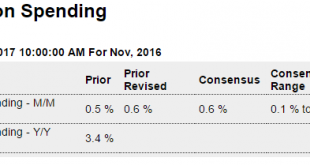

A bit of a bump up going into year end. Could be about expiring tax breaks as has happened in prior years: Highlights Construction had been lagging through most of 2016 but, like the factory sector, appears to have picked up steam going into year-end. Spending rose 0.9 percent in November which just tops Econoday’s high estimate and is the best reading since June. Residential spending rose 1.0 percent in the month on top of October’s 1.6 percent gain. The gain here is...

Read More »Credit check, Publication

The now two year deceleration continues: First time published in a ‘mainstream’ economics journal: Dear Prof. Silipo & Prof. Mosler, I am happy to inform you that the Board of Editors of the Journal of Policy Models, upon recommendation from 4 referees, has approved the publication of your study: Maximizing Price Stability in a Monetary Economy Regards, Sabah CavalloEditorial AssistantJournal of Policy Models www.econmodels.com ...

Read More » Mosler Economics

Mosler Economics