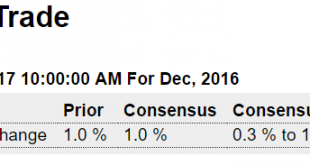

Highlights Inventories have been on the climb raising the risk of unwanted overhang. But overhang isn’t the story of the December wholesale trade report where a large 1.0 percent build is far outmatched by a 2.6 percent surge in sales. The results pull the stock-to-sales ratio down sharply to 1.29 from 1.31. Wholesale auto inventories rose 2.0 percent in December, a month that proved very strong for retail auto sales and was also very strong for wholesale sales where autos...

Read More »Mortgage purchase apps, Tax reform, Trump comments

Purchase applications seemed to have, at best, leveled off a what remains very depressed levels: Revenue neutral won’t do the trick, and since the tax cuts are likely to be lower multiple than any spending cuts it could slow things down: Taxpayers should expect to see revenue-neutral tax reform as early as this summer, Republican Sen. Rob Portman told CNBC on Wednesday. “We need to do it. It’s urgent. It’s one way we know we can give the economy a shot in the arm,” the Ohio...

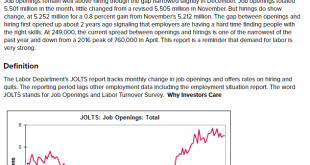

Read More »Jolts, Consumer credit, Trade, Brexit poll

Still looks to me like it’s already rolled over: Less than expected indicating spending likely to be less than expected as well: Highlights Growth in consumer credit slowed in December, to $14.2 billion vs an upward revised $25.2 billion in November. Revolving credit showed less life in December than prior months, rising only $2.4 billion vs November’s $11.8 billion. Weakness here helps explain the general weakness in core shopping during December. Nonrevolving credit,...

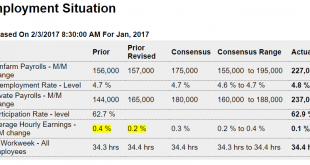

Read More »Nonfarm Payrolls, Factory orders, ISM non manufacturing, Conway comments

Better than expected. Lots of seasonality to January numbers. For example, warm weather that adds a few construction jobs gets magnified, and due to light temporary help hiring during the holiday season there were fewer workers to layoff in January, giving a boost to temporary help type measures. Meanwhile, however, the deceleration trend in the year over year chart continues, and wage growth remains subdued and last month’s downward revision indicated prior concerns were...

Read More »Ryan timeline, Trump remarks

It will be a while before even the discussions begin: House Speaker Paul Ryan said Thursday that Republican lawmakers will try to push through tax reform and infrastructure bills — two key policies for investors — in the spring after focusing on health care. “It’s just the way the budget works that we won’t be able to get the ability to write our tax reform bill until our spring budget passes, and then we write that through the summer,” Ryan said on “Fox and Friends.” He...

Read More »Chain store sales, Saudi output and pricing, Publication notice

More weak hard data: Highlights Chain stores are reporting mostly lower sales rates in January than December, in line with Redbook data and hinting at possible trouble for the ex-auto ex-gas reading of the January retail sales report. Looking at the total retail sales report, unit auto sales proved very soft compared to December (data released yesterday) though gasoline stations likely got a January lift from a moderate increase in prices. Yet gasoline makes up only a small...

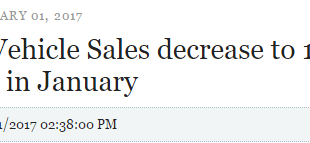

Read More »Vehicle sales, Mtg purchase applications, Construction spending, ADP private payrolls, ISM manufacturing, PMI manufacturing

Same story- survey expectations elevated while hard data continues to soften: Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.47 million SAAR in January. That is up about 2% from January 2016, and down 4.5% from the 18.29 million annual sales rate last month.Read more at http://www.calculatedriskblog.com/#qWEO2cMQ2CSiDhiS.99 Highlights Construction spending fell 0.2 percent in December but details show welcome gains for housing. Spending on...

Read More »Trumped up expectations, Chicago PMI, Consumer sentiment, Redbook retail sales, Executive orders, GDP comment, Trump comments, Income and spending chart

Trumped up expectations vs ‘hard data’: Highlights January was a flat month for the Chicago PMI which could manage only 50.3, virtually at the breakeven 50.0 level that indications no change from the prior month. New orders have now joined backlog orders in contraction in what is a negative combination for future production and employment. Current production eased but is still solid though employment is clearly weakening, in contraction for a 3rd straight month. One special...

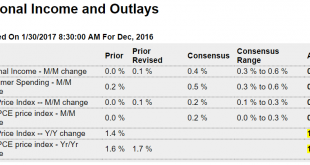

Read More »Personal income and spending, Pending home sales, Dallas manufacturing

Just skip to the chart: Highlights Personal income rose a moderate 0.3 percent in December with the wages & salaries component posting a slightly better gain at 0.4 percent. The savings rate, however, fell in the month, down 2 tenths to 5.4 percent which helped to fund a strong 0.5 percent gain in consumer spending. December’s spending was centered in a 1.4 percent rise for durable goods, boosted specifically by autos, but included a 0.4 percent gain for services and a...

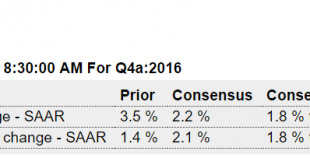

Read More »GDP, Durable goods, Consumer sentiment, Luxury home sales, Trump comments

And without the undesired inventory build due to lower sales, it would have only been up .9% for q4, and .25% lower year over year. Personal Consumption (which includes health insurance premiums) has gone from +q2;s 4.3 to q3’s +3.0 to q4’s +2.5 and we’ve kicked off the new year with a big drop in vehicle sales and a big drop in housing starts, etc: Highlights A perhaps unwanted build in inventories drove up fourth-quarter GDP which, however, could only manage 1.9 percent...

Read More » Mosler Economics

Mosler Economics