Big miss here. As previously discussed, it’s a case of lenders raising rates due to Fed fears when demand is low, further reducing demand: Highlights Consistently volatile is the well deserved reputation of the new home sales report. December sales of single-family homes plunged 10.4 percent in the month to a far lower-than-expected annualized rate of only 536,000. In a small offset, the prior two months have been revised upward by a combined 14,000 (to 598,000 for November...

Read More »Auto sales, Deficit news, Budget news, Germany news, Japan news

Looks like a weak start for 2017: From WardsAuto: Forecast: January Forecast Calls for Low Sales, High Inventory The U.S. automotive industry is expected to a have a slow start in the new year, with January light-vehicle sales down 4.4% from like-2016. … The resulting seasonally adjusted annual rate is 17.0 million units, well below the 18.3 million in the previous month and 17.4 million year-ago.…December inventory was 9.2% above same-month 2015, the biggest year-over-year...

Read More »Mtg purchase apps, Consumer debt comments

Note the trend: Don Schlagenhauf, chief economist for the St. Louis Fed’s Center for Household Financial Stability, and Lowell Ricketts, the Center’s senior analyst, analyzed consumer credit data and found that a decline in housing-related debt offset growth in other types of consumer debt during the third quarter. “The latest data suggest that overall growth may have stalled, despite robust student and auto loan borrowing,” Schlagenhauf and Ricketts wrote. ...

Read More »Redbook retail sales, PMI Markit manufacturing, Richmond Fed Manufacturing Index, Existing home sales, Trump budget director, CIA on Trump, Mnuchin on $, Euro area surveys

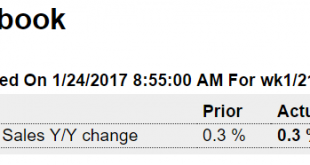

Still back to the lower, pre mini spike levels. Industrial production was up due to elevated utility bills, which might explain why retail sales are low: Highlights Same-store sales growth continued the glacial pace of the prior week and was up just 0.3 percent year-on-year in the January 21 week, a sharp deacceleration from the 2-percent plus growth seen in the final weeks of December. Versus December, month-to-date January sales were down 3.5 percent, more than twice the...

Read More »Rental tightness, Trump comments

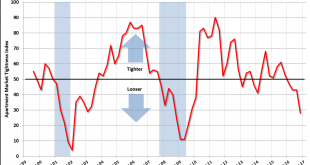

From the National Multifamily Housing Council (NMHC): Apartment Markets Soften in the January NMHC Quarterly Survey — Apartment markets continued to retreat in the January National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. All four indexes of Market Tightness (25), Sales Volume (25), Equity Financing (33) and Debt Financing (14) remained below the breakeven level of 50 for the second quarter in a row. “Weaker conditions are evident...

Read More »Euro area current account, Trump comments

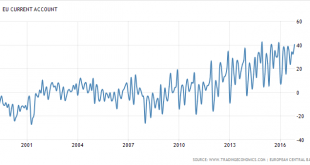

This is very ‘strong euro’ stuff, as in the longer term trade flows do rule: Euro Area Current Account Surplus At Nearly 1-Year High Eurozone current account surplus rose to EUR 40.5 billion in November of 2016 from a EUR 30.9 billion surplus a year earlier and reaching the highest since December of 2015. Considering the first eleven months of the year, the current account surplus rose by EUR 38.4 billion to EUR 355.8 billion; the goods surplus increased to EUR 372.6 billion...

Read More »Housing starts, Chicago Fed, Trump cuts

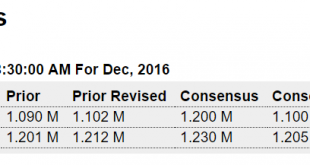

As previously discussed, no homes are built without prior permits, which are going nowhere: Highlights Housing starts extended their wild ride of volatility in December, up 11.3 percent in the month to a 1.226 million annualized rate which beats the Econoday consensus for 1.200 million. But the rise is confined to multi-unit starts which jumped 57 percent to a 431,000 rate, a contrast to the 4.0 percent decline to 795,000 for single-family starts. Permits, which are subject...

Read More »Mtg apps, Redbook retail sales, Industrial production, Housing market index, CPI, Euro zone and US sectoral balances

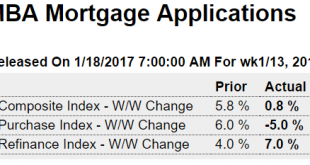

Back down again, in spite of Trumped up expectations, and going nowhere: Highlights Purchase applications for home mortgages fell a seasonally adjusted 5.0 percent in the January 13 week, while applications for refinancing rose 7 percent. Unadjusted, the purchase index increased 25 percent compared to the previous week, however, taking the year-on-year comparison up 17 percentage points from the prior week to minus 1 percent, a strong recovery but still sharply below the...

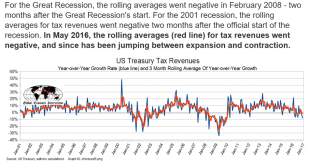

Read More »Euro zone trade, Tax receipts, Trump comments

Strong euro stuff! Eurozone Trade Surplus Widens Ahead Of ExpectationsThe Eurozone trade surplus rose to €25.9 billion in November 2016 from €22.9 billion in the same month of the previous year, above market consensus of €22 billion. Exports increased 6 percent while imports went up at a slower 5 percent. Considering the first eleven months of the year, the trade surplus increased to €248.2 billion, compared with €214.3 billion in the same period of 2015. Weak US economy...

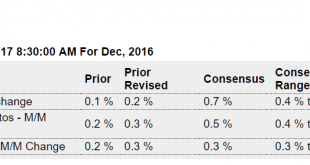

Read More »Retail sales, Business inventories, Consumer sentiment, China exports, German GDP

Less than expected and held up by vehicle sales which were about flat for the year and are unlikely to be any better than that in 2017, and therefore not contributing anything to growth: Highlights Outside of cars, consumers weren’t in much of a spending mood this holiday season. Retail sales did post a very solid gain in December, up 0.6 percent, but without autos the gain falls to only 0.2 percent. And exclude gasoline as well, which isn’t really a common holiday gift, and...

Read More » Mosler Economics

Mosler Economics