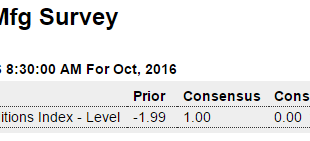

Well below expectations and further contraction: Highlights The first indication on October’s factory conditions is negative. The Empire State index is below zero for a third month in a row, at minus 6.80 vs similar readings in September and August. And the details are almost entirely negative with new orders at minus 5.60 for a second sub-zero score in a row. Shipments are at minus 0.60 with employment in reverse for a fourth straight month, at minus 4.70. Unfilled orders...

Read More »Retail sales, Atlanta Fed, Consumer sentiment, Business inventories, Unemployment claims, Freight transportation services

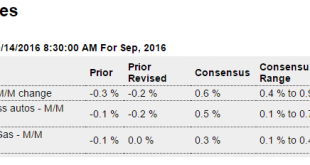

All numbers as expected. Notice the use of the word ‘solid’ for all the reports? And no one talking about year over year, which eliminates much of the seasonal factors and month to month volatility. Nor do they mention that these numbers are not adjusted for inflation, which pushes the year over year numbers down to stall speed. See charts below: Highlights Retail sales proved solid in September hitting the Econoday consensus across the board: total up 0.6 percent, ex-auto...

Read More »JOLTS, Mall closings

So does the fed somehow see this as ‘improvement’ and ‘solid’? More likely to me that the Fed gets criticized for waiting too long to cut. Not that it would matter, of course… Highlights In downbeat indications on the labor market, job openings fell a sharp 7.3 percent in August to 5.443 million at the same time that hiring, instead of rising, slowed by 0.9 percent to 5.210 million. The openings number is the lowest since December last year while the hiring number is more...

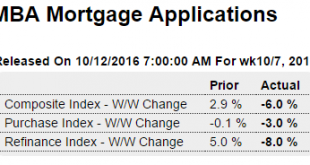

Read More »Mtg purchase apps, Small business indicator, Payouts and cash flow

Another bad one: It’s that other problems have become more important for these small businesses as conditions continue to deteriorate:

Read More »Fed labor market conditions index, NFIB chart, Oil comment

No one seems to know how much weight the Fed gives to this index: Highlights The labor market conditions index came in at minus 2.2 in September, extending its soft trend this cycle. Definition The Labor Market Conditions Index is an experimental indicator compiled by the Federal Reserve to track labor market activity. It is a broad composite with 19 components. Just my imagination that this has been decelerating since the drop in oil capex? My oil related comments: Any kind...

Read More »NFIB small business index, Hotel occupancy, Redbook retail sales

Went down when consensus expectations were for an increase: Note that it peaked and then fell when oil capex collapsed: The NFIB Index of Small Business Optimism dipped 0.03 points in September for the second consecutive month. Increased inventories fell seven points while hard-to-fill job openings plunged six points landing at 24 percent. Six of the 10 indices dropped, washing away the rise in expected business conditions. Interesting way of saying its going to be down from...

Read More »Consumer credit, Commercial Real Estate index

Nice move up vs last month but doesn’t move the year over year needle, and this series has a history of spikes up that are immediately reversed: A bit lower but too soon to suggest the modest uptrend is reversing:

Read More »Jobs, Wholesalers sales and inventories, Atlanta Fed GDP forecast

Less than expected, July/August total revised down, earnings gain less than expected. Yes, unemployment was up because the labor force increased, but arguably it was functionally that large in the months before, etc, which means, functionally, unemployment had been that much higher all along, etc. etc. and all to my suspicions that the drop in the participation rate might be close to entirely cyclical, meaning the ‘slack’ might be equiv. to a headline unemployment rate well...

Read More »Jobless claims, Chain Store Sales, Fed comment, truck orders, Saudi pricing

This low, and not adjusted for population- tell me it’s not because they are much harder to get, thanks! Initial Jobless Claims Near Four Decade Low -5k to 249k in latest weekly survey. In the week ending October 1, the advance figure for seasonally adjusted initial claims was 249k, a decrease of 5k from the previous week’s unrevised level of 254k. The 4-week moving average was 253,500, a decrease of 2,500 from the previous week’s unrevised average of 256k. This is the...

Read More »Rents, GDP per capita, Bacon prices, Atlanta Fed

Some Big U.S. Cities See Apartment Rents Fall for First Time in Years By Laura Kusisto Oct 4 (WSJ) — Rents in San Francisco declined 3%, while they fell about 1% in New York and edged lower in Houston and San Jose, Calif., the first drops in those markets since 2010, according to apartment tracker MPF Research. Across the U.S., rent growth was 4.1% on average. According to a report by Axiometrics Inc., growth in the U.S., slowed to 3% in the third quarter from 5.2% in the...

Read More » Mosler Economics

Mosler Economics