The year over year change not looking so good: Highlights Purchase applications for home mortgages were down just 0.1 percent from the prior week in the September 30 week, but the comparison with the year ago week plunged sharply into deeply negative territory at minus 14 percent. Refinancing applications were up 5.0 percent from the prior week, however, as more mortgage holders seized the opportunity to refinance with lower interest rates. The refinancing share of mortgage...

Read More »Vehicle sales, Manhattan apartment sales, ISM NY, Redbook retail sales

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.65 million SAAR in September. That is down about 2% from September 2015, and up 4.3% from the 16.92 million annual sales rate last month. Read more at http://www.calculatedriskblog.com/#ycdZ4cVpGQLvjHoI.99 Manhattan apartment sales plunge 19 percent By Robert Frank ISM New York Report On Business September 2016 ISM New York 49.6 in September. New York City business activity largely held...

Read More »Construction spending, PMI Manufacturing, ISM manufacturing, Atlanta Fed

Worse than expected, prior month revised lower, and year over year now in contraction as the downtrend continues. Watch for further downward q3 GDP revisions: Highlights Multi-family units are just about the only strength in what is a weak construction spending report for August, down 0.7 percent on the month with July revised 3 tenths lower and into the negative column at minus 0.3 percent. Construction spending on new single-family homes fell 0.9 percent for the third...

Read More »Restaurant Performance Index, Bank loans

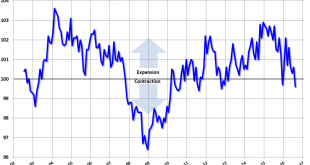

Big move down into contraction as the trend continues:This downtrend is intact as well: Flattened out as oil capex collapsed, and well below levels of prior cycl:

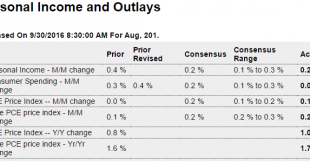

Read More »Personal income and spending, ISM Chicago, Consumer sentiment, Atlanta Fed GDP forecast

The consumer isn’t ‘coming back’ until after deficit spending, public or private, increases to offset unspent income, and ‘putting money into savings’ (below) is better described as ‘increasing borrowing less’. Also, consumption spending includes health care premiums and utility bills, and when they go up it tends to later take away from spending on other things: Highlights August was a soft month for the consumer, both for income and especially for spending. Income rose only...

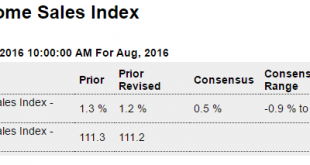

Read More »Pending home sales, Auto sales, Wholesale trade

Still on the downward glide path since the collapse in oil capex: Highlights Existing home sales, in sharp contrast to new home sales, haven’t been able to build any strength this year and today’s pending home sales report points to outright weakness in the coming months. The pending index fell a very steep 2.4 percent in August with 3 of 4 regions positing monthly declines. The exception is the Northeast which rose 1.3 percent in the month and is the only region in the plus...

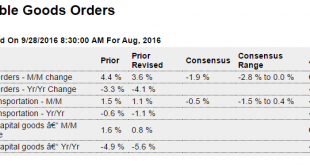

Read More »Durable goods orders, Trucking tonnage index

Continues in contraction year over year, and revisions likely to cause further downward GDP revisions: Highlights The headline, at a monthly zero percent, is flat and so are the indications from the bulk of the August durable goods report. Excluding transportation, orders slipped 0.4 percent. This reading excludes a 22 percent downswing in civilian aircraft orders that is offset in part, however, by a solid 0.7 percent gain for vehicle orders. Readings on core capital goods...

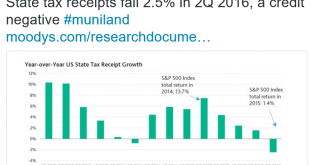

Read More »State tax receipts, Redbook retail sales, Case-Shiller house prices, PMI services, Richmond Fed manufacturing, consumer confidence

This too has followed the shale boom/bust cycle and is headed lower: No recovery here: This looks back over the last three months and seems to be decelerating from already modest levels: Up a bit but still low: The flash Markit US Services PMI came in at 51.9 in September of 2016 from 51 in August, reaching the highest figure in five months and above market expectations of 51.1. Activity picked up for the first time in three months due to ongoing new business growth while...

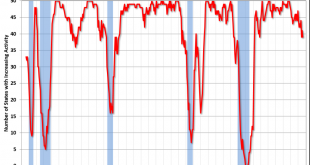

Read More »Rail traffic, Philly Fed state index, NY Fed nowcast

Rail Week Ending 17 September 2016: Data Looks Better This Week Week 37 of 2016 shows same week total rail traffic (from same week one year ago) contracted according to the Association of American Railroads (AAR) traffic data. However, the data was an improvement over last week. Not looking so good: This one’s coming down as well: September 23, 2016: Highlights The FRBNY Staff Nowcast stands at 2.3% and 1.2% for 2016:Q3 and 2016:Q4, respectively. Negative news since the...

Read More »Eurozone Composite PMI, US Manufacturing PMI

Also down and a bit lower than expected: United States Manufacturing PMI The flash Markit manufacturing PMI for the United States declined to 51.4 in September of 2016 from 52 in August and below market expectations of 51.9. New business growth eased further, output slowed and export orders fell for the first time in four months while payrolls increased.

Read More » Mosler Economics

Mosler Economics