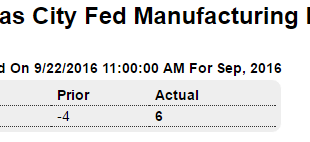

Better, apart from employment and prices, which happen to be the Fed’s mandate. So interesting that the KC Fed President wants to hike rates: Highlights Just about every month the Kansas City manufacturing index is in the negative column, but not in September which comes in at plus 6 for the second positive reading this year and the best reading since December 2014. New orders are sharply higher, at plus 12 vs August’s minus 7 with backlogs holding steady. Production and...

Read More »Fed comments, Chicago Fed, Existing home sales

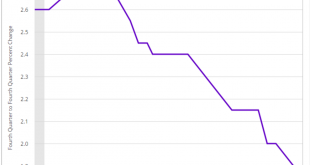

So growth and employment prospects are lower than those of their prior meeting, when they didn’t raise rates. And their forecasts continue to decelerate: Fed Trims Interest-Rate, Growth Forecasts By Michael S. Derby Sept 21 (WSJ) — Federal Reserve officials cut their growth forecast for this year to 1.8%, from 2.0% in June, and held steady their view for next year at 2.0%. Notably, they lowered their long-run view on the economy’s growth rate to 1.8% from 2%. In their...

Read More »Mtg purchase applications, Architectural billings index

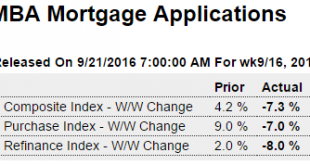

So much for last week’s glimmer of hope: Back down to recession levels:

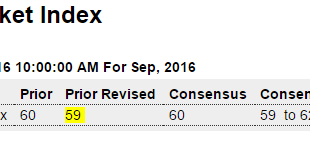

Read More »Housing market index, Redbook retail sales, Housing starts

Up a bit, but until permits increase not much chance of home building increasing: Been going from bad to worse: Highlights Redbook’s sample is not pointing to any September improvement for core retail sales. Year-on-year same-store sales rose only 0.2 percent in the September 17 week, about in line with August and noticeably lower than July — two months when the government’s ex-auto ex-gas reading posted 0.1 percent monthly declines. Rates in this report don’t always match...

Read More »Long Beach container counts, Ship building orders

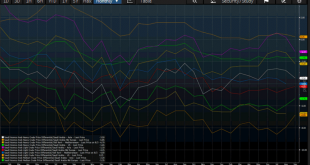

Notice the change of course after oil capital expenditures collapsed: http://www.marinelog.com/index.php?option=com_k2&view=item&id=23076:bimco-shipbuilding-orders-at-20-year-low&Itemid=231

Read More »Retail Sales, Industrial production, Inventories, Empire survey, Phili Fed survey, Atlanta Fed

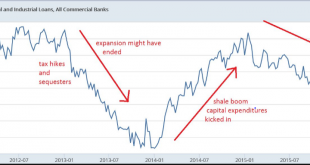

The slow motion train wreck that began in late 2014 with the collapse of oil capex continues unabated, with no sign of reversal that I can detect, and the annual rate of growth is consistent with prior recessions: Highlights After spending heavily in the second quarter, the consumer has stepped back so far in the third quarter. Retail sales, after inching up a revised 0.1 percent in July, fell 0.3 percent in August and do not just reflect expected weakness in auto sales....

Read More »NFIB charts, Govt receipts, Mtg purchase apps

Mortgage applications up nicely this week for a change. Always hoping for the best! ;)

Read More »Saudi pricing, Redbook retail sales, Small business index

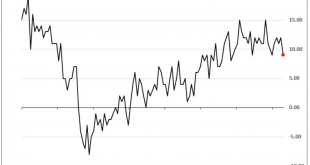

So I count 3 or 4 increases and 3 or 4 decreases, so hard to say overall policy has changed, which is to keep the price just low enough to keep global investment to a minimum? Still very bad: This index went up with the shale boom and now down since the bust pulled the rug out from under oil capital expenditure:

Read More »Bank loans, Profits, Heavy truck sales

Decline in Profits Slows By Stephen Grocer Sept 12 (WSJ) — Analysts expect S&P 500 companies to report that revenue grew by 2.6% in the third quarter from the year-earlier period, according to FactSet. That would end a six-quarter period of sales contraction. Importantly, sales estimates for S&P 500 companies improved slightly since the third quarter began and companies began reporting second-quarter earnings. On June 30, analysts expected revenue to increase 2.5%,...

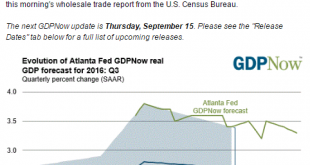

Read More »Atlanta Fed and GDP commentary

As previously discussed, this ‘nowcast’ is working its way lower as more data is released, much like it did last quarter. Still to come are weaker retail sales due to weakening car sales, weaker residential investment due to weakening housing permits, more inventory reductions due to weaker sales, and generally weaker consumption as employment growth continues to decelerate. And I also suspect the trade deficit to resume it’s climb as exports continue to weaken and the...

Read More » Mosler Economics

Mosler Economics