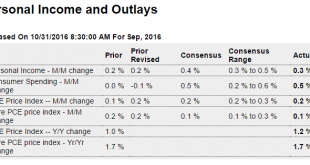

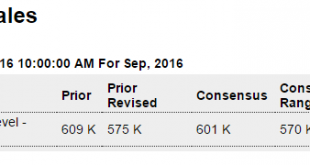

Personal income a bit below expectations, spending met expectations but last month revised down a bit. And the GDP report already had consumer spending way down and less than expected and we already know auto sales are falling behind last year’s totals: Highlights Personal income rose a solid but slightly lower-than-expected 0.3 percent in September with the wages & salaries component, which weakened in August, also at plus 0.3 percent. Consumer spending was especially...

Read More »Consumer sentiment, GDP comments and charts

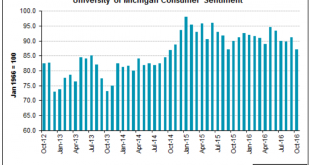

Doesn’t look like ‘improvement’ the way I see it? Looks like others are seeing it my way as well this time: Sorry, but the economy’s growth spurt isn’t going to last By Jeff Cox Oct 28 (CNBC) — Excluding “transitory” effects, the actual growth rate would have been closer to the 1.5 percent rate of the past four quarters. Still decelerating since the collapse of oil capex (and the presumed windfall for the consumer…): This is a relatively new series. so don’t know if it...

Read More »Gasoline demand, Durable goods shipments, Pending home sales, Soybean exports

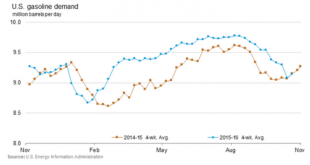

Miles driven had been rising. Fuel efficiency is part of this decline but probably more to it: From yesterday’s durable goods report. GDP is about shipments: As per the chart, this series is not doing well: A surge in soybean exports likely helped to shrink the trade deficit in the third quarter. As a result, economists expect that trade contributed a full percentage point to GDP growth in the third quarter after adding a mere 0.18 percentage point in the April-June...

Read More »Durable goods orders, Philly Fed state coincident index, Labor force additions

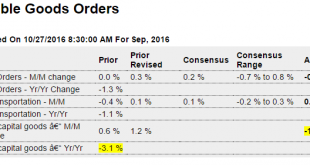

This should have been doing better by now, indicating that, in general, unspent income is still not being sufficiently offset by deficit spending, public or private: Highlights Flat is the takeaway from the September durable goods report where orders slipped 0.1 percent, a lower-than-expected result offset however by an upward revision to August which now stands at plus 0.3 percent. A 45 percent monthly downswing for defense aircraft is a special factor in the September...

Read More »US balance of trade, New home sales, PMI health care premiums, ECB statement, German consumer morale

A bit fewer than expected and prior month revised down bringing it more in line with permits: A nice uptick here, but as per the chart too soon to say the downtrend has reversed. And notice, again, how employment is faltering as has been the case in most of the surveys: Highlights Markit Economics’ U.S. samples are reporting a sharp upturn in business this month, first with Monday’s manufacturing report and now with the service flash where the headline index is up nearly 3...

Read More »Auto sales forecast, Euro area manufacturing and composite PMI, Redbook retail sales, Consumer confidence, Richmond Fed

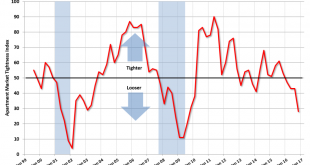

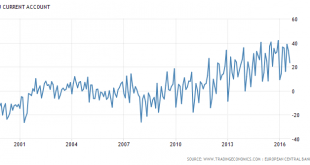

Still negative: Should hold up as long as the euro stays relatively weak due to portfolio selling, which has been all but continuous for the last couple of years or so. At some point ‘fundamentals’ including relative prices and the current account surplus ‘drain the swamp’ and take over: Back down again: Back down: Still negative:

Read More »Apartment market survey, Terni presentation

mosler-presentation-terni-2016-10-21

Read More »Presidential poll, Euro area current account, Saudi output, Russian nukes

Clinton Vs. Trump: IBD/TIPP Presidential Election Tracking Poll (IBD/TIPP) The IBD/TIPP poll — a collaboration between Investor’s Business Daily (IBD) and TechnoMetrica Market Intelligence (TIPP) — has been the most accurate poll in recent presidential elections (About IBD/TIPP Poll). The latest results for the IBD/TIPP Presidential Election Tracking Poll will be released each morning by 6 a.m. ET. Trump Leads Clinton By 1 Point Going Into Debate (IBD/TIPP) Donald Trump has...

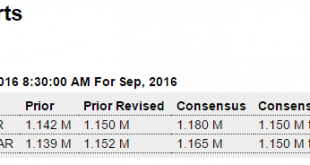

Read More »Housing starts, Mortgate purchase apps, Sales managers index, Garbage carloads, Cass freight index

Starts very weak, but permits up. It’s about permits, so we’ll see if they level off or continue to rise: Highlights Starts are mixed but permits are up in what is a deceptively solid housing starts & permits report. Starts plunged what looks like a shocking 9.0 percent in September, to a 1.047 million annualized rate. But the drop is tied entirely to the volatile multi-family component where starts fell a massive 38 percent in the month to a 264,000 rate. The more...

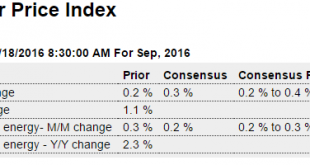

Read More »CPI, Redbook retail sales, Consumer spending comments, Voter turnout comments

Fed continues to fail to achieve it’s 2% target: No sign here of housing growth picking up from where it’s been: Highlights The new home sector picked up steam in the third quarter and looks to end the second half with strength. The housing market index held on to the bulk of its 6-point surge in September, coming in at 63 for October in only a 2 point slip. Home builders are very optimistic about future sales, the leading component of the report which is at 72 and up 1...

Read More » Mosler Economics

Mosler Economics