NEP’s Bill Black on The Real News Network discussing how the Trump administration is using small business as an excuse for wholesale assault on regulation. You can view with a transcript here. [embedded content]

Read More »Trumped up expectations, Chicago PMI, Consumer sentiment, Redbook retail sales, Executive orders, GDP comment, Trump comments, Income and spending chart

Trumped up expectations vs ‘hard data’: Highlights January was a flat month for the Chicago PMI which could manage only 50.3, virtually at the breakeven 50.0 level that indications no change from the prior month. New orders have now joined backlog orders in contraction in what is a negative combination for future production and employment. Current production eased but is still solid though employment is clearly weakening, in contraction for a 3rd straight month. One special...

Read More »Protectionist trends

from Maria Alejandra Madi Throughout 2016, many countries around the world keep on competing for market share in high-wage, innovation-based industries. Indeed, these countries have turned to “innovation mercantilism” by imposing protectionist policies to expand domestic production and exports of high-tech goods and services. In this setting, innovation mercantilist policies are being oriented to high-value tech sectors such as life sciences, renewable energy, computers and electronics,...

Read More »Open thread Jan. 31, 2017

[unable to retrieve full-text content]

Read More »The “Imperative Mandate” — Recall: An Annotated Bibliography

Recall of elected officials is both the essence of Populism, the “imperative mandate” and consistent with good business principles. “You’re fired!, the voters’ version of “The Apprentice”: An analysis of local recall elections in California.” Rachel Weinstein, Southern California Interdisciplinary Law Journal, Vol , 15. 2005-2006. The title of this 2005 article contains the delicious irony of referencing Resident Dump’s reality T.V. show, “The Apprentice.” As the...

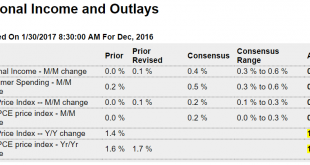

Read More »Personal income and spending, Pending home sales, Dallas manufacturing

Just skip to the chart: Highlights Personal income rose a moderate 0.3 percent in December with the wages & salaries component posting a slightly better gain at 0.4 percent. The savings rate, however, fell in the month, down 2 tenths to 5.4 percent which helped to fund a strong 0.5 percent gain in consumer spending. December’s spending was centered in a 1.4 percent rise for durable goods, boosted specifically by autos, but included a 0.4 percent gain for services and a...

Read More »Angry Bear 2017-01-30 00:34:48

To cite myself: Tags: lawsuits, mixed nuts Comments (2) | Digg Facebook Twitter |...

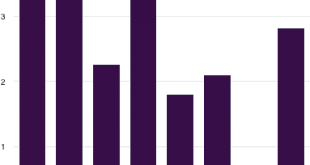

Read More »Economy Base Level

from Peter Radford We are, no doubt, about to be barraged by a torrent of alternative facts concerning the economy and economic growth under our new leader. So let’s get a few facts on the table in order to set a base level for future reference. Let’s start with growth during the past six presidencies: So, no, Obama was not the disaster Trump and the Republicans are trying to paint him as. The economy during Obama’s term outperformed that of his predecessor. This includes the enormous...

Read More »Beyond Trump and free trade

from David Ruccio Now that President Trump has begun carrying out his campaign pledges to undo America’s trade ties, formally withdrawing the United States from the Trans-Pacific Partnership and announcing he will start to renegotiate the North American Free Trade Agreement, it’s time to analyze what this means. As it turns out, I’d already started to do this before the election, with a series of posts (e.g., here, here, here, and here) on Trump and the mounting criticism of the trade...

Read More »The Trump cabinet: strangest show on Earth

from Dean Baker As we start the Trump presidency, events just keep getting more bizarre. At his first and last press conference as president-elect, Donald Trump boasted about his divestment plan in which he was “sort of, kind of” turning over the management of his business enterprises to his two adult sons. He displayed a table full of documents that were supposed to indicate the extent of his divestment, but the documents were not made available for the press to examine. Furthermore, in...

Read More » Heterodox

Heterodox